South Korea’s Jeju Island, a self-governing tourist hotspot, will reportedly trial NFT tourist cards in a bid to attract the country’s younger generation.

Cryptocurrency Financial News

South Korea’s Jeju Island, a self-governing tourist hotspot, will reportedly trial NFT tourist cards in a bid to attract the country’s younger generation.

December was the fifth-strongest month for NFTs in 2024, with sales volumes reaching $877 million.

The newly launched PENGU token has stolen the spotlight after becoming the largest Solana-based memecoin by market capitalization. The token’s rally has gathered massive interest from large-scale investors, who have heavily invested in the token over the last few days.

On December 17, the Pudgy Penguins Non-Fungible Token (NFT) project launched its official token, PENGU, on the Solana Blockchain. The token has moved through the ranks, flipping other Solana-based tokens and gathering massive attention in nine days.

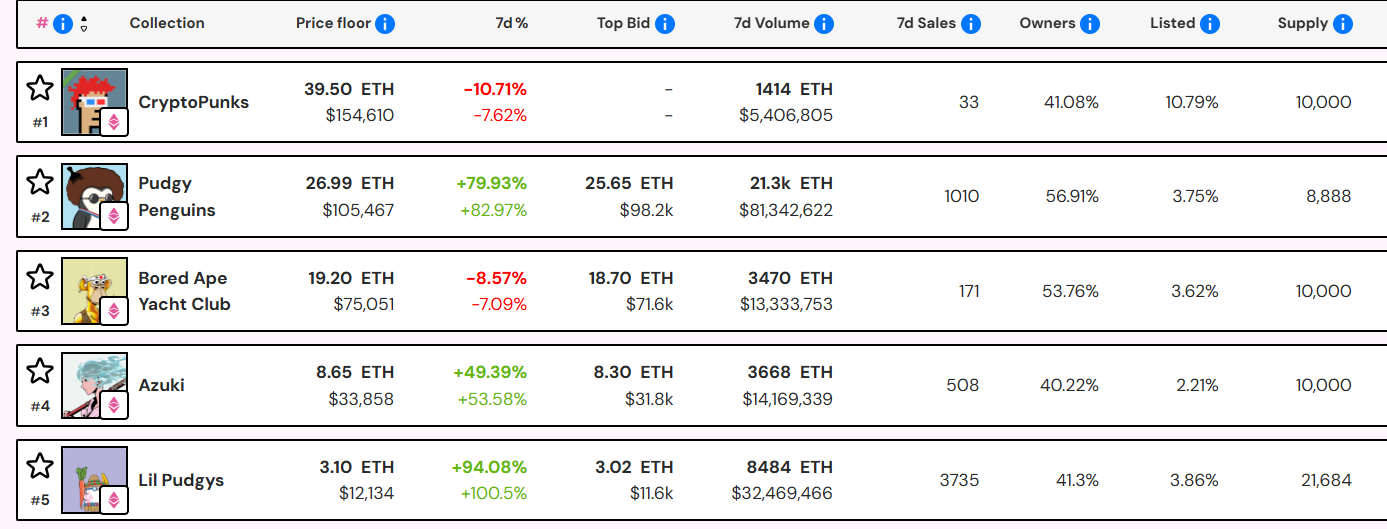

Pudgy Penguins, one of the largest NFT collections, consists of 8,888 unique cartoons of cute penguins and has a market capitalization of 205,757 ETH. In anticipation of the token launch, the project surged as the second-largest NFT collection, only falling behind CryptoPunks.

Since its launch three years ago, the project has seen its community significantly grow and “cemented itself in the hearts and minds of everyday people and culture,” according to the project’s team. Additionally, it is expected to contribute to the project’s governance despite not having a specific use case announced yet.

As such, the newly launched cryptocurrency aims to “expand its community and further widen the reach” of the project by allowing old and new users “to align” themselves with the penguins.

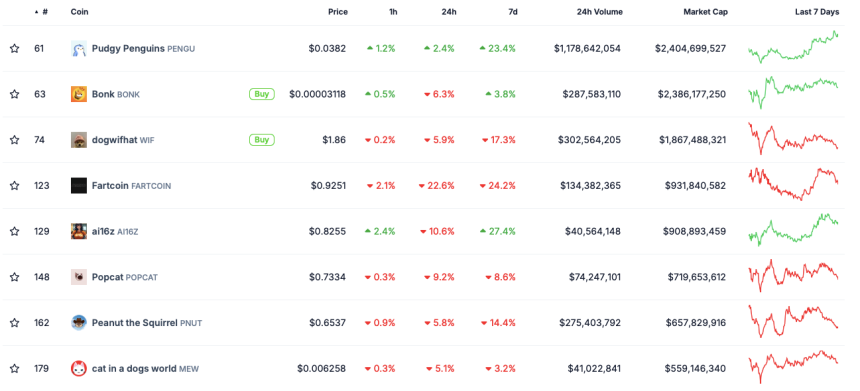

According to CoinGecko data, the Solana-based memecoin debuted with a 500% surge to a market capitalization of $3.5 billion but registered massive volatility in the following days.

Just hours after launching, PENGU’s price retraced over 50% before descending to a $1.4 billion market cap on December 20. The token hovered between the $0.025-$0.037 range over a few days, stabilizing around the range’s upper zone on Christmas Eve.

Amid the market’s momentary Christmas Day gains, the token broke above this range and climbed to the $0.042 mark on Thursday morning, hitting a $2.6 billion market cap. During this 18% rally, the token flipped dogwifhat (WIF) and BONK to become the largest Solana memecoin by market cap, currently holding its position as the sector’s leader.

PENGU became the fourth largest memecoin by this metric, just behind Dogecoin, Shiba Inu, and PEPE. Additionally, in the last 24 hours, the token has seen a 25% increase in market activity, with a daily trading volume of $1.92 billion.

According to on-chain data analysis firm Lookonchain, Crypto whales have also noticed PENGU’s rally, with several large-scale investors filling their bags over the past week.

On December 24, a whale that had received an airdrop of 116.7 million PENGU, worth $3.52 million, increased its holding with a $1 million purchase. According to the post, the wallet spent 5,250 SOL to buy an additional 34.42 million PENGU, holding a total of 151.12 million PENGU, valued at $5.08 million.

Similarly, another whale exchanged 500,000 ai16z, another trending Solana-based memecoin, today for PENGU. In the past eight days, this investor has spent $2.47 million to buy 79.9 million PENGU, having unrealized profits of around $835,000.

As of this writing, PENGU is trading at $0.038, a 4.8% increase in the daily timeframe.

Two 23-year-olds, Gabriel Hay and Gavin Mayo, allegedly abandoned projects after providing misleading information on project roadmaps.

NFT projects encountered numerous setbacks in 2024, but many remain hopeful that the asset class will stage a comeback.

The Pudgy Penguins NFT collection is keeping Web3 hopes afloat in a sea of dead NFT projects and a generally muted collectibles market.

The <a href="https://www.coindesk.com/learn/what-are-nfts-and-how-do-they-work/ " target="_blank">non-fungible token</a> set became the world’s second <a href="https://nftpricefloor.com/?temp=7d" target="_blank">most-valued</a> NFTs on Wednesday, with the minimum — or floor — price for any of the 8,888 comic penguins topping $100,000 and flipping the collections' value above its comic monkey forerunner, the Bored Apes Yacht Club.

That means buying a single NFT now costs more than a bitcoin, which currently trades at just over $100,000.

The floor price has jumped 76% in the past seven days to over 26 ether (ETH), or just above $105,000. Bored Apes and CryptoPunks — the most valued NFTs — both fell 12% in the same period.

Demand for the NFTs surged after a CoinDesk exclusive on Pudgy Penguin’s plans to <a href="https://www.coindesk.com/markets/2024/12/05/top-nft-brand-pudgy-penguins-to-release-pengu-token" target="_blank">release a PENGU token on the Solana blockchain</a> later this month. The token allocation strategy includes a substantial share for existing NFT holders, which may have incentivized current owners to hold or increase their investments, driving up demand.

Nearly a quarter — 23.5% — of the 88 billion PENGU tokens will be reserved for owners of the project's NFT collections such as Pudgy Penguins, Lil Pudgys and Pudgy Rods. A further 22% will be available to the Solana and Ethereum communities, and 12% will be set aside to provide liquidity on decentralized exchanges.

In the NFT market, the floor price is the cheapest cost of an NFT within a specific collection. It is fixed by the NFT's owner based on market forces such as demand or rarity of traits in the collection. The floor remains in place until a lower one is set.

This is different from the general token or stock market, where demand and supply automatically change prices every second, instead of a single holder deciding the minimum price for an asset.

Pudgy Penguins came into existence in 2021. Each penguin is hand-drawn and features distinctive traits such as backgrounds, body, face, head and skin.

The collection has successfully expanded its presence beyond just digital collectibles into physical products and mainstream branding.

Parent company Igloo last year introduced Pudgy Toys, a toy line based on the digital art collection. It has since sold more than $10 million in collectible igloos and plushies through major retailers including Walmart, Target, Amazon and Walgreens.

The French gaming company developed the title in partnership with the Arbitrum Foundation.

A heavyweight from the once-hot NFT era is now getting into the cryptocurrency issuance game.

Pudgy Penguins launched three years ago as a set of 8,888 NFTs depicting colorful and comical birds.

Now, the team behind the project tells CoinDesk that they will release a token called PENGU this year on the Solana blockchain.

Nearly a quarter — 23.5% — of the 88 billion PENGU tokens will be reserved for owners of the project's NFT collections like Pudgy Penguins, Lil Pudgys, Pudgy Rods and more. A further 22.02% will be available to the Solana and Ethereum communities, while 12.32% are set aside to provide liquidity on decentralized exchanges.

"With $PENGU, the millions of Pudgy Penguin fans and the hundreds of millions of people who see and share the Pudgy Penguin every day now get the opportunity to align themselves with the character and become a part of The Huddle," the team shared in a statement.

Pudgy is among the rare collections that managed to stay culturally relevant in the otherwise dreadful NFT business following the price crash from the 2021-2022 bull market. Many NFTs lacked real utility beyond being a digital brag. It was also difficult to fully realize gains after price bumps — as market liquidity was often inadequate to fill orders.

The pivot comes as fun tokens and memecoins, unlike NFTs, have taken off and flourished in the last two years. Liquidity, relative cheapness, virality and ease-of-use are key reasons why people have flocked to these latest hot asset classes — even though fun tokens and memecoins fundamentally represent the same idea as NFT collections did: belonging to a passionate community.

Official Pudgy Penguins channels have over 3 million followers across Instagram, X, TikTok and YouTube, and videos involving the characters have notched 32 billion views on Giphy.

One of the brand's TikTok accounts is focused on spreading good vibes under the "Pudgy Kindness" moniker — popularizing it as a feel-good service in the mainstream, outside of crypto circles.

It goes beyond screens too. Parent company Igloo last year introduced Pudgy Toys, a toy line based on the digital art collection, and has since sold more than $10 million in collectible igloos and plushies that are carried at major retailers, including Walmart, Target, Amazon and Walgreens.

Pudgy Penguins is the third-largest NFT collection by market capitalization — $550 million in total — as of Thursday, <a href="https://www.coingecko.com/en/nft" target="_blank">data shows</a>, trailing only CryptoPunks and Bored Apes Yacht Club. The collection came to life in 2021, and each penguin is hand-drawn and features various distinct traits such as backgrounds, body, face, head and skin.

Unyted we (meta) stand

Many of the fancy metaverse projects take loooong to build and often require developers and budgets just to stay alive. In fact, one of my favorite ones had the whole company collapse around it in the build phase. I absolutely love what we’ve built with Superworld, for example, and what we’re about to release with Asvoria. Both of these require heavy machinery and rotation to come to life—and to be maintained.

Enter Unyted and my newest spatial Web3 space, which allows me to deliver fluent, up-to-date presentations on what’s happening now while also providing an overview of my entire career. I built it mostly by myself, with some guidance and glitch-fixing help from the team—special thanks to Tijana, Saskia, and Florian. I can update it in minutes to include a new project, presentation, or missing link. It’s freeing and necessary.

https://www.newsbtc.com/wp-content/uploads/2024/11/unyted.mp4

Unyted is at the forefront of spatial computing, offering innovative solutions that empower users to create, own, and monetize immersive 3D virtual environments. Their platform is designed to facilitate seamless transitions into the metaverse, providing tools for education, collaboration, and personalized digital experiences.

Link to join the metaverse

Link to join the X spaces.

Join us for a session with Ador, Bitcoin LIVE and others tomorrow 20.00 CET

Starting Thursday, we’ll kick things off with a joint presentation with Ador, and from there, we’ll host regular spaces that people can join visually. X is great for connecting with people, but for an artist, a lot is still missing from the full experience. Let’s see if we can bring these two innovations together in a sensible way.

Watch the Tijana introduction to Unyted as well as my keynote held some time ago regarding web3, metaverse and creativity.

Watch the Tijana introduction to Unyted as well as my keynote held some time ago regarding web3, metaverse and creativity.

Delivering the Metaverse

They’re just starting out, and sure, sure there are a few glitches, but I’ve already given a couple of presentations that feel like a real departure from the world of Zoom. Nothing is ever perfect and getting going and constantly working on it is what keeps the thing alive.

It’s a step closer to delivering something of real value in the metaverse. People showed up to my first keynote in the space done together, they asked questions and then some were left to wonder around the space to explore it on their own. Promises kept. Those matter, after the last run.

I’ve been friends with Florian Krueger since the early blockchain days in London back in 2018, and we’ve collaborated on several projects. He remains one of my favorite people in the crypto space—always looking out for his people and tirelessly fighting for the ethical side of it. I was happy to hear he was starting a new venture and that I could also be a part of.

If you prefer the (virtual) city life?

Key Features of Unyted:

In many ways what is important about the metaverse is our ability to pre-visualise the world we would like to live in, and then walk toward that direction.

Founded in 2022 by Gaby K. Slezák and Florian Krueger, Unyted envisions a decentralized, independent metaverse where users have equal access to a secure three-dimensional internet. Their mission is to empower individuals to shape their digital futures, fostering a community where creativity and collaboration thrive.

For those seeking to explore the metaverse, Unyted offers consulting services to guide organizations through VR, AR, blockchain, Web3, and Web4 technologies. Their seasoned team provides strategy insights and design expertise to craft unique digital experiences aligned with organizational visions.

Unyted stands as a visionary force in the evolving digital landscape, pioneering innovation while prioritizing user ownership, open collaboration, data protection, and sustainability.

Ador aka BitSavage will join us for the Monday talk in which we also dwell deeper into DAF – the Department of Artistic Freedom

Asvoria coming up soon!

I’ll soon travel to Bulgaria to film some content in the Asvoria linked Hotel Satoshi Nakamoto, as well as guide the team on advances in our shiny updated metaverse space.

I’ll soon travel to Bulgaria to film some content in the Asvoria linked Hotel Satoshi Nakamoto, as well as guide the team on advances in our shiny updated metaverse space.

The art cars are also gearing up for their auction in Dubai in January, but more on that later.

See you Dec 5th 20.00 CET:

Link to join the metaverse

Link to join the X spaces.

Much to build,

VESA

Crypto Artist, Speaker, Consultant, Writer

All links to physical, NFTs, and more below

The new offering will be available across all Crypto.com card tiers with up to 8% rewards on spending.

Fan tokens change the game for sports engagement and outperform NFTs.

NFTs had a monthly sales volume of over $562 million in November, surpassing October’s record of $356 million.

South Beach Bound

This year BitBasel will takeover the entire Sagamore Hotel in Miami South Beach for the entire week. The last show I was a part of with BitBasel was still held in the Miami Bitcoin Center in 2019, so returning to exhibit with these pioneers is precious. I had also no idea just how predictive my keynote back then was going to be about what is going to be shown now. It’s groundhog day with bananas and a repetition of Dante’s circles of hell, while trying to help humanity out of inverse mode. A worthy fight. Legends only

As crazy as this journey has been since the early days, needing to repeat some fundamentals time and time again, while the ETH scene erodes further, luckily there are people who see what I do and support the perspective to be a part of it all. Much gratitude for Lecks and Scarlett for including me in the 2024 show.

Back to the Future

Notice what is on screen during my lecture about all things decentralised in 2019 at BitBasel

Back then, I was commenting a lot on how the world is on fire, how we need to fix the monetary system, the origin story of creativity, how AI will replace most low-end lawyers, accountants, etc., within five years, and how the banana fuckery of the art world couldn’t possibly sink any lower. Man, was I wrong—again—on that one. It seems the art world has found new ways to hit rock bottom in the Web3 space. At least then, SuperRare was still just taking off with hope. My naive self still believed back then that blockchain was going to bring more transparency to the art world. LOL.

Anyhoo, both the divine touch and the banana were featured in my slides during the presentation, and now they will be part of the 2024 BitBasel as a combined artwork. The piece comments on how the West has lost its way and explores what we can do to revitalize it. The reverse of the great inverse is the avant-garde, and I keep being here for it. Eventually, this will be seen by everyone and recognized as self-evident. In the meanwhile, I gotta double up as an artist as well as a culture critic. It’s a weird position but someone’s gotta do it.

I’m Potency

I’m Potency will be on show, infamous now from the precious SuperRare debacle.

I’m Potency will be on show, infamous now from the precious SuperRare debacle.

The NFT comes with a physical canvas print, painted over with acrylics, which launches an AR animation.

I wrote an article here called “Proof of censorship” recently on the substance.

Here is the longer original tweet as my “submission” for the competition.

Price 6 ETH

See if the scanning works via the Artivive app!

See if the scanning works via the Artivive app!

https://www.newsbtc.com/wp-content/uploads/2024/11/BitBaselRam.mp4

The second piece on show is the live version NFT of the BitRam artwork re-imagining the animal lore of Bitcoin a bit. BTC keeps trucking along, breaking new number heights, but most importantly fighting to have an alternate space marked safe from the fiat inflation machine.

The animation original piece comes with a 2/3 physical, hand finished canvas art piece that launches into an AR version via the Artivive app.

Price: 9 ETH

BitRam physical re-paint (sold 1/3) on show in Switzerland at the Swiss Web3 Conf earlier in 2024 during Art Basel. 2/3 is now available and married together with the 1/1 animation NFT on sale at BitBasel.

Renaissance 360

Lecks also asked me to get some metaverse material on a screen, which I was happy about. The compilation video of some of the best made thus far through Asvoria (launching soon), Superworld and Cornerstone Land will be presented as part of a larger metaverse reel.

Why are we not allowed to ask, in art, the most basic of questions. Why can’t we be inspired by excellence, beauty, harmony and the spirit? Time after time, we just revel in this mud like pigs with no future. At least the pigs derive some nutrients and skin care from their play, whilst we just reduce ourselves to animals with no instincts.

Program schedule and links:

BitBasel Miami Art Week 2024, scheduled from December 3 to December 8 at the Sagamore Hotel South Beach, offers a dynamic fusion of art and technology. This week-long event features a diverse lineup of activities, including exhibitions, panel discussions, and immersive experiences.

Event Highlights:

Throughout the week, attendees can explore “The Gallery,” a curated space showcasing cutting-edge creative expressions in fine art, digital masterpieces, and space-bound art.

For more details and ticket information, visit the official BitBasel website.

Proof of Effort

T(r)opical from 2017 was the first Miami specific work I ever made. The 2/3 re-paint is still available now priced at 1 BTC. I kept the idea I had that some of the early works will keep the thread to the 1 BTC price, when bought from me. Of course, I needed start making others without it, as about 10k remains the constant “fuck you money” that people in the scene use for art. These piece are historic though, so if you want in on that action, I solute you! I saved it here as the last thing, so it’s only through proof of collector effort, that you even get to them.

Also, forever respect for Moe Levin, the founder of the North American Bitcoin Conference, for giving me my first ever spot to showcase my art in January 2018. Cool to have a fren also in Joel from the Bad Crypto Podcast, who is lurking there in the background  The 1/50 signed print was given to Moe as a gift.

The 1/50 signed print was given to Moe as a gift.

At 100k, the 6×3 foot re-paints are still cheap to what some of the earliest holistic works will eventually cost, once the dust settles a bit.

VESA

Crypto Artist, Speaker, Consultant, Writer

All links to physical, NFTs, and more below

Starting Nov. 27, Kraken’s NFT marketplace will transition to withdrawal-only mode.

November has already surpassed October’s total volume, continuing strong market momentum for NFTs.

A BBC probe uncovered alleged links between Logan Paul and undisclosed cryptocurrency wallet trades, sparking new controversy.

Doodles was a hit on OpenSeas and is making its way as a media franchise with product partnership and a new film.

The lawyer for two OpenSea users who accused the platform of selling them securities told Cointelegraph they “had no choice but to dismiss the pending case.”

NFTs have started to recover as monthly sales volumes surged by 18% and total transactions shot up to 7.2 million.

Web3 Liberation from Postmodernism’s Stranglehold: The Art Renaissance

By VESA

Postmodernism isn’t just an art issue—it’s everywhere. This single, pervasive philosophy has seeped into big tech, corporations, legislation, media, and nearly every major institution, often strangling genuine creativity, diversity of thought, and depth. For comparison, there are around 200 other philosophies, 4,300 religions, the male perspective, homemaker moms, the working class, the diminishing middle class, the scientific paradigm, and much more that are left out of gallery circles simply because they don’t fit the dominant narrative, which paradoxically claims to be the one that’s repressed. It’s really a luxury belief for the modern aristocracy—a tool for control—and the Marxist roots always emerge when pressure is applied.

Postmodernism’s defining trait is deconstruction, pulling apart concepts and ideals without ever offering a cohesive path forward. It’s a circular maze that keeps doubling back on itself, producing increasingly bizarre conclusions to solve the very problems it creates. Real solutions lie in expanding the field of view beyond this single frame, embracing a diversity of philosophies, religions, and perspectives that have grounded humanity for millennia. The real power of Web3 lies in its ability to do just that: to break art and culture out of this one-note narrative, empowering creators and thinkers alike to explore beyond the limits imposed by postmodernism.

This is what we missed in the first run of NFT’s importing the same postmodern experts from the realm we were trying to break free from. That and some better tech solutions for sustainable art, as some of the falling platforms have showed.

We first had a true avant-garde scene, which was then quickly eroded by the millions upon millions showered on end-stage postmodern expressions, championed by people who either (a) didn’t realize how tired it all was or (b) were heavily financially and ideologically incentivized to support it.

Funny, not funny

Funny, not funny

It turns out that holding contempt for ideas and their significance means that, time and again, the working class ends up being ruled by them. While I understand why this is amusing to some, I see how many are now disillusioned, as the humanities have been overtaken by a single, monolithic ideology. Similarly, the U.S. intelligentsia’s “flyover states” disdain is now facing a reckoning with the MAGA hat in a very different way after 40 years of indulging in postmodern ideas and scorn. The underbelly of the speech in A Bug’s Life is surfacing, too.

You can’t only summarise postmodernism to be woke and Marxist, but you aren’t far off. In case you want to hear the foundations, Steven Hicks has a brilliant analysis and summary of it. You might have to spend 3hrs to save your life & community to get it, so it’s not that long, really

Part I – Philosophy foundations

Part II – Relevance now

For five long decades, postmodernism has held art in a chokehold, enforcing its narrow, often cynical, view of reality. Art became a reflection of society’s fragmentation, alienation, and obsession with irony—what I call the “postmodern monolithic rule.” While postmodernism initially sought to challenge established norms, it has since become the new establishment, dictating an increasingly restrictive narrative. The art world under postmodernism has marginalised genuine exploration, profound beauty, and universal human truths.

This is where Web3 steps in, not just as a technological shift but as a liberation front for artistic expression. That was the point. Not just monetising what ever, but to actually set culture free. Web3 allows artists to break out from the centralised grip of traditional galleries and critics, unleashing a decentralized platform where new ideas can flourish – however this means the scene has to support that, instead of the next duck tape banana or drooling ape AI pic.

Through NFTs and blockchain, creators can finally bypass the gatekeepers, reaching audiences directly and letting their art speak unfiltered. It’s the anti-postmodern era we’ve been waiting for—one that values authenticity, courage, and depth over calculated irony and shallow critique. The freedom to explore and create in as vast a way as the internet has already guided us to be for the past twenty years.

What is the Garden of Earthly Delights by Hieronymus Bosch. From paradise to hell, the lesson path is clear in the end stage. These aren’t just imaginative nightmares. They’re warnings about human nature — and what a world without religion is like. Feel familiar a bit? The twet link will explain it further.

Outside the restrictive frame of postmodernism lies a rich expanse of artistic traditions and narratives that we’ve been missing out on. Imagine a return to the timeless pursuits of beauty, harmony, and spirituality, merged with the advancements of digital technology. Art that celebrates connection, transcendence, and human potential. Web3 offers the tools to bring these visions to life, and artists are now free to explore themes of mythology, futurism, abstraction, and even divinity—all without needing to conform to a single ideology. This isn’t just art for art’s sake; it’s art for humanity’s sake, and it’s been a long time coming.

Authenticity as an Artist: From Cave Paintings to the Metaverse

Art isn’t a recent trend—it’s a core aspect of the human journey that dates back to our ancestors painting on cave walls. In today’s world, however, many artists find themselves constrained by expectations to follow specific trends, often losing their authenticity along the way. True artistry isn’t about following popular movements or creating what’s fashionable. It’s about tapping into a lineage of creativity that spans thousands of years, one that includes everything from the first tribal carvings to the masterworks of the Renaissance, all the way to the digital landscapes of the metaverse.

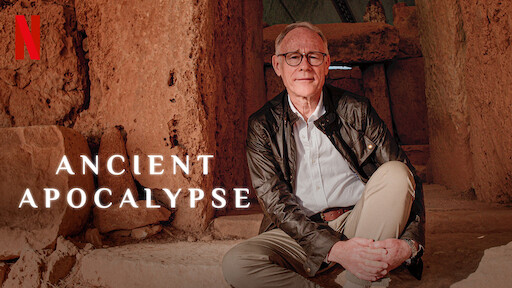

Why did Graham Hancock’s Ancient Apocalypse suddenly get attacked as racist, with Hancock himself labeled a white supremacist, despite his thirty-year marriage to a woman of color and his long-standing praise of ancient cultures worldwide throughout his journalistic career? You guessed it—postmodernism, as the series collapses the narrative. I’ll write more on that later.

Why did Graham Hancock’s Ancient Apocalypse suddenly get attacked as racist, with Hancock himself labeled a white supremacist, despite his thirty-year marriage to a woman of color and his long-standing praise of ancient cultures worldwide throughout his journalistic career? You guessed it—postmodernism, as the series collapses the narrative. I’ll write more on that later.

Inside the art world, for the most part, you might hear of Mayan culture and traditions, but not the parts that contradict postmodern ideas.

Inside the art world, for the most part, you might hear of Mayan culture and traditions, but not the parts that contradict postmodern ideas.

Being an authentic artist means immersing yourself in this vast ocean of history and expression, drawing inspiration from the past and future alike. The beauty of Web3 is that it allows artists to travel across these realms without restriction. The blockchain and NFTs don’t just democratize art; they create a space where we can explore new forms of expression while staying grounded in the wisdom of our creative ancestors. The metaverse, for instance, offers the opportunity to merge the digital with the timeless, creating interactive experiences that honor the depth and spirituality of older art forms while pushing the boundaries of what’s possible.

When you explore the richness of art history, you find yourself standing on the shoulders of giants. Authentic art doesn’t mimic or simply react—it builds bridges. It’s about discovering your voice in this vast chorus and using every tool available, whether it’s oil on canvas, sculpture, or VR. Web3 and the metaverse make this journey even more exhilarating, providing artists with a canvas as expansive as their imaginations. True artists dig deep, break molds, and remind us that art is not bound by time or technology but by a timeless quest for truth.

Imagine the uproar, the fuss and emotional outbursts if there was to be a grand unveiling of an openly conservative gallery?

Imagine the uproar, the fuss and emotional outbursts if there was to be a grand unveiling of an openly conservative gallery?

The Heretical Idea: Curate Your Own Galleries Outside the Establishment

Here’s a heretical idea for cultural curators and artists: Forget trying to break into the art world if you don’t feel represented. Start your own galleries, curate your own shows, and let Web3 be your platform for sharing art on your own terms. It’s cheap to start an online gallery.

Web3 has made this entirely possible. With decentralized platforms, artists can sidestep traditional gatekeepers, reach global audiences, and create communities that appreciate and support their work. Curating your own gallery isn’t just an act of defiance; it’s a celebration of creative freedom. Imagine artists coming together to form collectives that highlight unique styles, new voices, and daring themes that the conventional art world might consider “too much.” With NFTs and blockchain, you have the tools to bring these exhibitions to life without relying on anyone else’s approval.

Curating your own gallery in the Web3 space doesn’t just disrupt the old system; it builds a new one based on collaboration, innovation, and authenticity. This is where real artistic diversity can thrive, unbound by the constraints of a single ideology. Artists can create galleries that reflect their own vision, themes, and messages—whether that’s surrealism, futurism, spiritual exploration, or socio-political commentary. The freedom to shape your own narrative is the most powerful tool artists have, and Web3 is the key to unlocking it. It’s time to stop waiting for permission and start creating spaces that embody the true spirit of art: raw, fearless, and unfiltered.

TDR

Notice that all these artists and collectors below are doing this poll by not making their views public. I’ve been standing up for this, in the free speech spirit, since I came in from 2017, and was put in the web3 Western culture jail for it (mostly) since. Here is an earlier article to prove it.

so, have your postmodernism, it’s fine, I’m not trying to take your voice away from you, but actually deliver on the inclusion promise so everyone can come to play. The virtual is for everyone, not just one dominant ideology that leaves out most of the world.

As for the cover image, I have my reservations about Trump, even if there’s a potential Web3 landslide against the pro-censorship camp led by figures like Kamala. My concerns are less pronounced with Elon Musk, Ron Paul, RFK, Tulsi Gabbard, and increasingly JD Vance after listening to him on Rogan. While most visual artists sat this one out—even in Web3—the comedians have shifted the landscape, outpacing us 6-0 in terms of relevance.

The thing is, even if Trump is guilty of a lot, he and his team of “X-men mutants” have become voices for Bitcoin, free speech, opposition to big pharma, and perhaps even psychedelics, squirrels, and the like. For the first time in my life, a political campaign is actually addressing ideas that interest me. Of course, as I am not a US citizen, you don’t have to worry about my vote even if you absolutely hate everything I just wrote. None the less, this election will greatly influence my life, and it is addressed in the web3 citizen of the world spirit.

Let that sink in,

VESA

Crypto Artist, Speaker, Consultant, Writer

All links to physical, NFTs, and more below