Optimism (OP) is a Layer 2 network that solves Ethereum’s scalability issues, bringing low fees and faster transactions to users. Scalability and low gas fees have always been Ethereum’s major problems. This is because, amid the trilemma of crypto, where security, decentralization, and scalability are not equal, Ethereum chose more security than decentralization and more decentralization than scalability to focus on. This is the reason Ethereum has a lot of layer 2s to help solve the scalability difficulties.

Over the years, people have had to spend huge amounts of ETH gas to perform a transaction, but no one really cared at the time because the value of ETH was small. For example, spending 0.001 ETH when ETH was worth $300 means that you were spending $0.03 on gas fees, which was cheap.

This was also at a time when the network was less congested, but over time, the value of ETH increased from $300 to over $2,000. In a more congested period, users have found it could cost upwards of $80 in gas fees to approve a transaction on the Ethereum chain.

OP network is one of the Layer 2 fixes for ETH

What better way to solve this issue than to introduce the Ethereum Layer 2s, which will give you almost the same properties as Ethereum but is expected to be better in what Ethereum is lacking. Ethereum is lacking in the scalability aspect, some of the layer 2s are helping to fill the void while some are not. One layer 2 Ethereum chain that is helping to feel the void is the Optmism chain.

Ethereum is great, but imagine not wanting to transact on the chain because you feel the gas fee is too expensive. It’s like spending $50 on a delivery fee to buy a $10 item. Although Ethereum boasts of strong security, some people still detest the expensive gas fee and decide to build on other chains.

Optimism (OP) Network Benefits: Cheap gas fees and lightning-fast transaction speed

Optimism is an Ethereum rollup that is known for cheap gas fees and lightning-fast transaction speed. Using the chain to transact will make you appreciate it so much and will make you want to transact on the chain regularly.

If you were used to paying $10 on gas fees on the ETH network, you would appreciate the Optimism network more, as you would spend less than $0.01 on gas fees. The Optimism Network is one of the most successful Ethereum layer 2 chains, with a very successful airdrop of its native token called Optimism (OP), which can be traded on centralized exchanges.

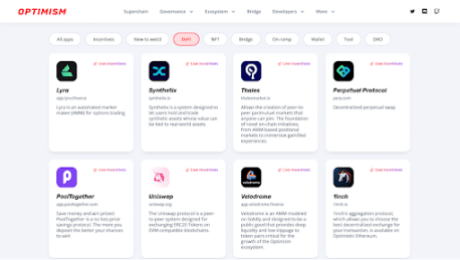

Important things to know about the Optimism Ecosystem:

Let’s explore the Optimism ecosystem to help you know how to navigate and use the decentralized applications (DApps) on the network, which keeps you safe from falling for fake sites and phishing links.

The optimism mainnet chain uses optimism ETH, opETH, for gas fees. Tokens on the chain are sometimes represented as opX, where X represents the token. For instance, if you have Bitcoin on the Optimism chain, it is represented as opBTC, so Ethereum on the Optimism chain is opETH.

How to Buy, Sell, and Trade Tokens on the Optimism Chain or Network:

To buy any token on the optimism chain, you need optimism ETH; you can get OPETH in two ways: through the centralized or the decentralized way. Let’s talk about the centralised way first because it doesn’t require much effort.

If you have a Binance account, Bybit, Kucoin, or HTX, and you have some USDT, you can trade the USDT for ETH. Then, withdraw the ETH on the Optimism network to your EVM wallet like Metamask.

Decentralized Way To Buy Optimism (OP)

To get opETH the decentralised way, you would need to know what wallets to use. Optimism network supports varieties of EVM wallets. Here are some EVM wallets that are compatible with Optimism network; we have Metamask, which’s the universal EVM wallet, Trustwallet, Coinbase Web 3 wallet, Rainbow wallet, Brave wallet, Taho wallet, OKX Web 3.0 wallet, Rabby Wallet, Zerion wallet, and lots more. Check here for the full list of Optimism ecosystem wallets.

How to Bridge to Optimism Network:

You should have your compatible EVM wallet and your ETH in wallet ready, the next step is to bridge your ETH. There are different ways to bridge your ETH. You can use native ETH or other layer 2 ETH, and you can get native ETH from centralized exchanges or through P2P from your local crypto vendor.

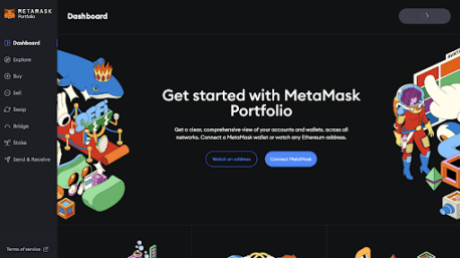

You can also get native ETH by buying directly from Metamask like this:

Go to Metamask portfolio and connect your Metamask wallet or whatever EVM wallet you have. Choose your location, and select a payment method. After that, you can select the coin you want to do, this method gives you a variety of coins on different chains.

You can select ETH on the optimism chain and easily get the ETH on the optimism chain, this way it’s easier for you to get ETH on the optimism chain or any other chain without using any centralized crypto platform. The downside to this is the spread; you can spend $100 only to end up getting $75 worth of ETH, and the rest will be used for charges.

However, if you already have native ETH or ETH on Arbitrum or any other layer 2 chains, you can bridge in two ways.

Bridging using the Optimism native bridge: With this, you can bridge from the available ETH networks to the Optimism network. This bridge primarily supports bridging from native ETH to optimism but doesn’t primarily support other chains to the optimism chain. So it uses a secondary bridging platform like hop protocol, stargate, and more.

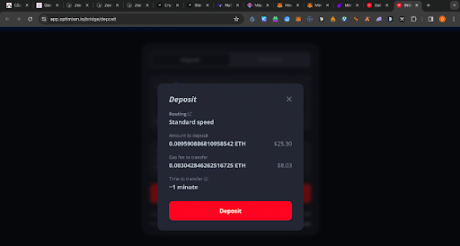

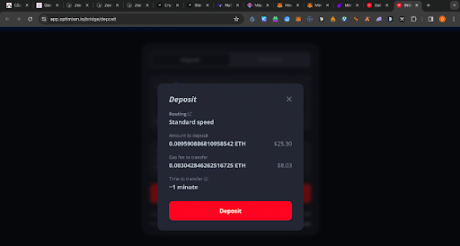

Using the Optimism bridge is pretty easy, but you will have to have native ETH in your wallet. Go to the site, connect your wallet to the site, and review the deposit.

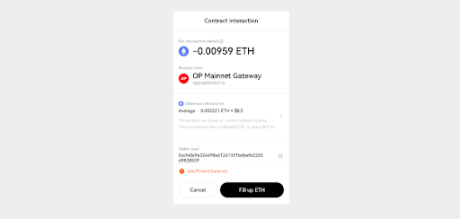

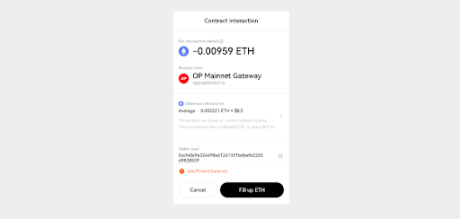

From the review deposit, you will see that you have to pay a gas fee to the optimism chain. This gas fee is for the optimism chain, and after paying that, you still need to pay another gas fee to initiate the transaction, depending on the gas fee congestion at that moment.

For instance, the gas fee congestion states I pay an extra $8.51 because the Ethereum chain has a high gas fee.

So if you do the math, you will notice that we have spent over $16 just to bridge from the Ethereum mainnet to the optimism chain. This is why we need to consider the other bridging option, which is bridging using the secondary bridging platforms.

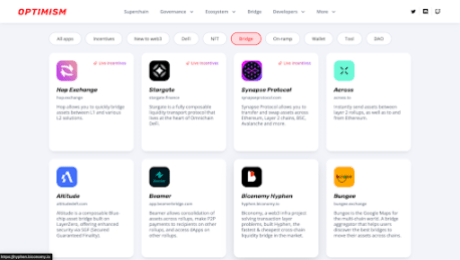

There are varieties of secondary bridging platforms you can use, and each of them has its different bridging fees.

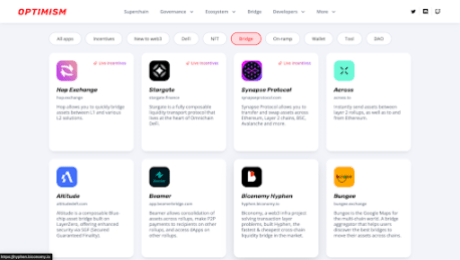

Bridging using the Optimism app bridge: You can access all the secondary bridging platforms on the Optimism app bridge https://www.optimism.io/apps/bridges. Even though most of them are cheaper than the native bridge option, you have to do your research and find the cheapest with the fastest transaction time.

Most of them are pretty easy to use, and some recommendations include Orbiter. finance, Bungee, and Layerswap. Transactions on these platforms are pretty cheap and can support bridging from other chains.

Enter their sites from the Optimism bridging apps, choose any of your choices, connect to your wallet, select what network you want to bridge to the optimism chain, approve, and bridge.

How to Find and Trade Tokens on the Optimism Chain:

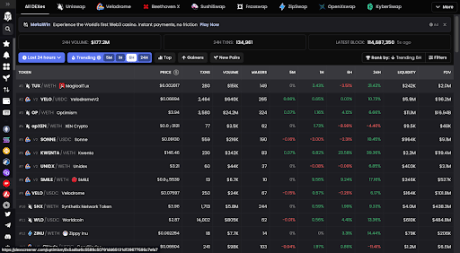

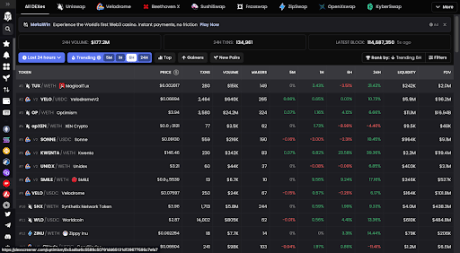

With your optimism ETH in your wallet, let’s trade. To trade on the optimism chain, you need to know what to trade. On the optimism chain, you can only trade tokens on the optimism chain. To find tokens on the Optimism, you will have to use Dexscreener.

Dexscreener is an on-chain tracker used to check most EVM and non-EVM coins and tokens. However, we will be focusing on the optimism chain right now, so navigate to the Optimism chain Dexscreener.

You can see a variety of tokens to trade on the optimism chain. If you have a specific optimism token in mind, you can type the name in the search button. If you don’t know the name of the token but have the smart contract address, you can also input that and the token will be displayed.

From Dexscreener, you can also find the token contract address just by clicking the token name on Dexscreener.

For Instance, click on any token, scroll down and you will see the contract address, just like Smile in the red box.

Now you know how to get token smart contracts, it’s time to trade them. There are different DEXes to trade these tokens, as shown below:

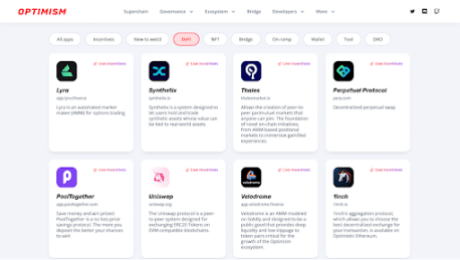

Check the Optimism Defi Section to select which DEX to use. People mostly use the Uniswap DEX, 1INCH DEX, and Sushi Swap.

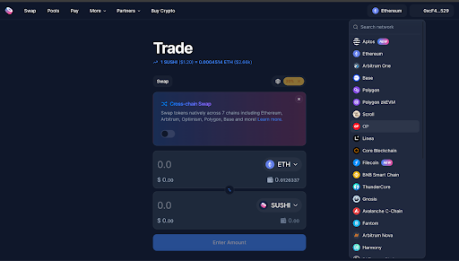

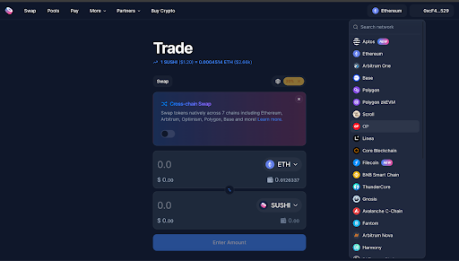

Let’s use SushiSwap to show how to trade optimism tokens on the optimism network. Go to the SushiSwap swap section. Connect your wallet and change the network to the optimism network.

If you want to swap opETH for any optimism token, click on the denominator side, input the contract address of the token, and approve the token. Now you can trade.

Conclusion

The Optimisim network is just like any other decentralized network when it comes to trading and buying these tokens carry their own unique risks. A lot of the tokens on decentralized exchanges are new, and are therefore untested. So when trading these tokens, always risk what you are willing to lose in the event a project does turn out to be a scam or a rug.

There is no need to claim this airdrop. Do not interact with any site asking you to do so.

There is no need to claim this airdrop. Do not interact with any site asking you to do so.

_

_