An analyst has explained how Polygon could see a rally of around 17% if the cryptocurrency’s price breaks above this level.

Parallel Channel May Reveal What Could Be Next For Polygon

In a post on X, analyst Ali has discussed about a parallel channel that Polygon has been consolidating inside during the last few weeks. The “parallel channel” here refers to a technical analysis (TA) pattern that’s drawn using two parallel trendlines.

This pattern’s upper line joins successive tops in the asset while the lower one connects bottoms. While the price is inside the region bounded by these two lines (the “channel”), it’s probable to stay trapped in it, only consolidating sideways.

Naturally, retests of the upper line can likely result in reversals back to the downside, while the lower one may act as a source of support, helping the coin bottom out and regain an uptrend.

There are different types of parallel channels in TA, like the ascending and descending ones, where the channel is slopped upwards or downwards.

In the context of the current topic, though, a parallel channel parallel to the time axis is of interest. This means consolidation inside this channel occurs between the same top and bottom levels.

Like with other consolidation patterns in TA, a break out of the trendlines of the parallel channel can also suggest a continuation of the trend in that direction. More specifically, a surge above the pattern can suggest bullish momentum for the asset, while a drop under the channel may spell a bearish outcome instead.

Now, here is a chart that shows how the parallel channel that Polygon has been consolidating inside has looked like over the past month:

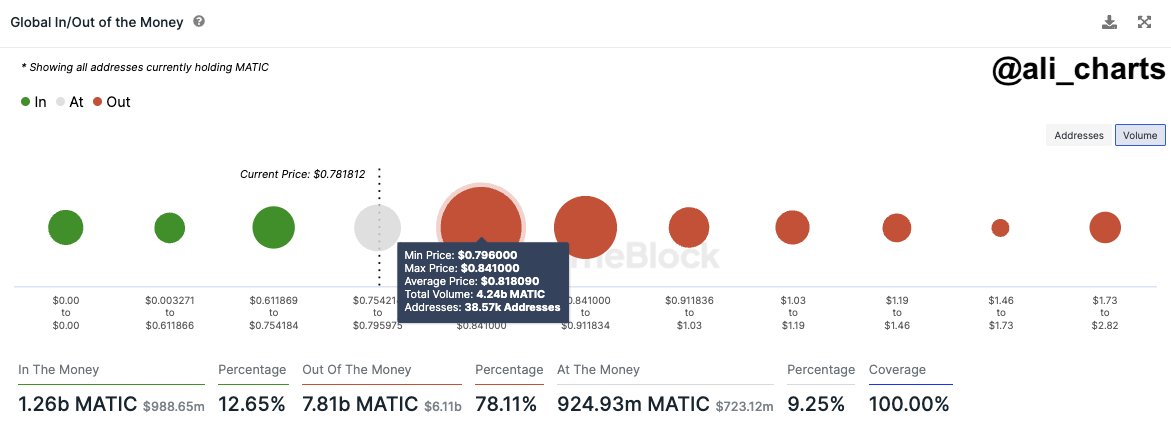

From the above graph, it’s visible that Polygon has been stuck in consolidation inside this parallel channel since the cryptocurrency crash last month.

The asset has made some attempts at the upper level, but so far, all of them have failed, with the coin unable to find any break. MATIC is currently floating near the level, so another retest may be coming up soon.

If the Polygon price surges above the channel this time, it may enjoy some sustained bullish momentum. “A breakout above $0.76 could trigger a 17% surge, pushing $MATIC to $0.88!” notes Ali.

This price target is based on the fact that the crash last month, which threw the asset into this consolidation, occurred starting from around that level. Given this potential retest of the upper line of the channel, it now remains to be seen how the cryptocurrency performs in the coming days.

MATIC Price

Polygon almost touched the $0.76 upper level of the channel yesterday, but the coin has since observed a pullback, and it’s now back down to $0.72.