The perpetual futures DEX has set up a foundation and will announce the details of an airdrop next month.

Cryptocurrency Financial News

The perpetual futures DEX has set up a foundation and will announce the details of an airdrop next month.

Despite Ethereum’s inflationary trend, staking and restaking gains momentum, boosting network security and rewards.

Restaking yields are still mostly speculative, according to Mike Silagadze speaking at the Blockchain Futurist Conference.

By acquiring substantially all the assets of the blockchain node operator, the publicly traded Galaxy Digital will increase its role in Ethereum staking, as part of a broader effort to expand in the business of blockchain infrastructure.

Ethereum co-founders Vitalik Buterin and Joseph Lubin reflect on the state of the network a decade after its creation.

Bitcoin and Ethereum users are experiencing exceptionally low fees, but why?

Greenpeace alleges that Wall Street titans such as BlackRock or Vanguard contribute to the environmental harm derived from Bitcoin mining.

MetaMask said that 99% of ETH holders do not have the required 32 ETH to participate in Ethereum staking.

Block times can also be adjusted as desired. The root mainnet shard features an average block time of just two seconds.

Regulatory concerns force Ether ETF issuers to abandon staking plans, sparking conflicting community views and discussions on investor appeal.

El Salvador currently holds 5,750 BTC worth $354 million, accumulated over three years.

The Grayscale Dynamic Income Fund initially includes APT, TIA, CBETH, ATOM, NEAR, OSMO, DOT, SEI and SOL.

The POSA updated its staking principles to say that providers should communicate clearly and should not control the amount of liquidity a user must provide.

The new “staking principles,” published by the Proof of Stake Alliance, aim to ensure consumer protections and promote innovation. Signers include Lido, Coinbase, Rocketpool, Blockdaemon.

Ethereum co-founder Vitalik Buterin previously admitted that centralization is one of Ethereum’s main challenges, which could take 20 years to solve.

One year after the Ethereum Merge, Grayscale has finally taken a decision to abandon all the rights to proof-of-work Ethereum tokens.

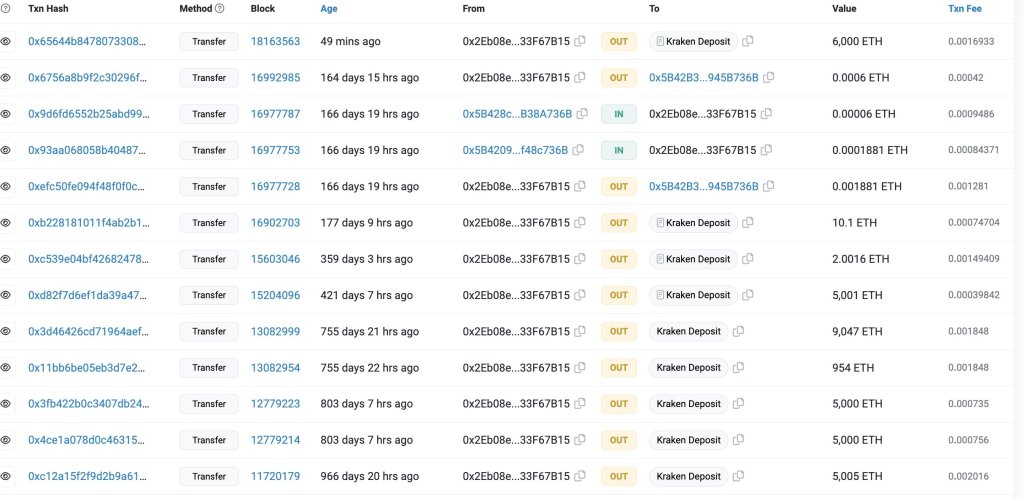

An Ethereum initial coin offering (ICO) participant and one of the earliest supporters of the smart contract platform has moved 6,000 ETH worth $9.96 million to Kraken, a cryptocurrency exchange, recent data from Lookonchain on September 18 reveals.

The unidentified whale received 254,908 ETH when each traded for 40.31 during the crowdfunding in 2014. This amount is currently worth over $466 million at spot rates.

The anonymous nature of public blockchains, including Ethereum, makes it harder to decipher the owner’s identity. Determining whether an entity or an individual controls the address is also more complex.

Whale transfers to a crypto exchange are usually considered bearish since the ramp provides an easier swapping option for token holders to cash out. Typically, crypto whales have the potential to impact the market due to the sheer size of their holdings.

Accordingly, their trading decisions can influence prices, increasing volatility. Therefore, the recent deposit to Kraken may suggest that the whale plans to sell, taking a profit.

On the brighter side, the whale could be moving their coins via an intermediary, in this case, Kraken, before transferring them to other platforms like Rocket Pool or Lido Finance for staking.

In the current proof-of-stake consensus algorithm used by Ethereum, whales can earn annual staking rewards if they lock at least 32 ETH. While the whale can set up a node and stake, liquidity staking providers like Rocket Pool allow users to stake coins and earn staking rewards using their infrastructure.

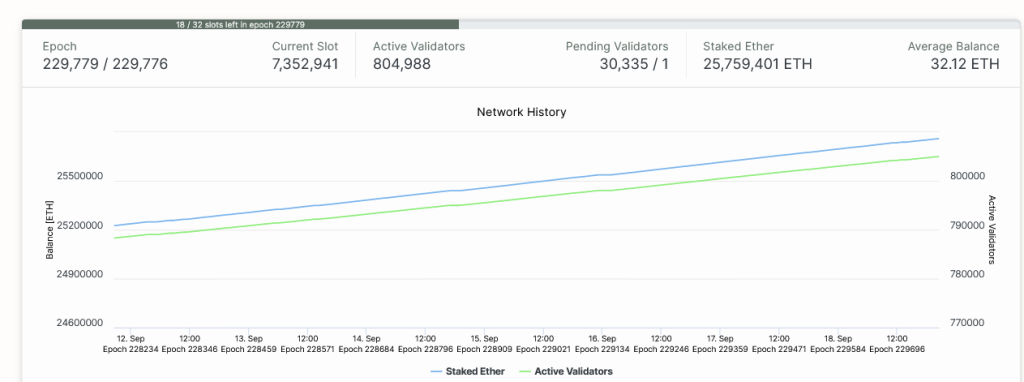

As of September 18, there are over 804,000 validators, that is, users who have locked at least 32 ETH operating an Ethereum full node. Cumulatively, over 25.7 million ETH have been locked.

As of this writing, the transfer on September 18 is amid the broader recovery in the crypto market. Of note, Ethereum (ETH) prices are up roughly 6% from September lows. Overall, supporters are bullish, expecting more growth in the days ahead.

The pump also means bulls have reversed some of the losses of September 11, and the current formation may anchor the next leg up that could propel the coin above $1,750, or August 29 highs, and later peel back sharp losses recorded on August 17.

From the candlestick arrangement in the daily chart, ETH remains under pressure, dropping 23% from 2023 highs of around $2,140.

However, since bears didn’t reverse losses of the June to July leg up, buyers have a chance following the rejection of lower lows from around the 78.6% Fibonacci retracement level of the Q3 2023 trade range. Presently, the September and August 2023 lows remain critical support levels for ETH, with the retest of August 17 lows on September 11 causing concern for optimistic traders.

The debut of the testing system – designed to be twice as big as the main network so developers can simulate massive scaling, comes a year after Ethereum completed its historic “Merge” shift to a “proof-of-stake” model from the original “proof-of-work” setup that Bitcoin uses.

DeFi exploits resulted in losses of over $16 million in August.