As the dynamic crypto landscape evolves, attention is turning not only to the giants but increasingly to emerging altcoins that show promise and innovation. October is shaping up to be a pivotal month for a select group of these altcoins, with potential frontrunners positioning themselves. Here are our top 4 altcoins for October.

Arbitrum (ARB)

Arbitrum (ARB) is thrust into the limelight as it inaugurates its Short Term Incentive Program (STIP), positioning 50 million ARB to be siphoned into protocols residing within its ecosystem. The maneuver is predictive of a substantial acceleration in liquidity, reminiscent of Optimism’s grant’s influential impact which witnessed the Total Value Locked (TVL) catapulting from $300 million to $1 billion during its grant distribution period, as highlighted by DeFi researcher Thor Hartvigsen.

In total, over 105 applications have already been funneled into the Arbitrum STIP, predominantly from DeFi applications, and notably DEXes which are commandeering the dominant category followed by yield aggregators and lending markets.

At press time, ARB was trading at $0.9295 after the price was rejected at the 38.2% Fibonacci retracement level ($0.9721). A break above this resistance is crucial. In particular, it is important for ARB not to fall below the descending trendline (black) again, which was breached on Sunday.

Solana (SOL)

Hartvigsen emphasized the potential he sees in SOL, noting, “Growing DeFi ecosystem and a very strong/vocal community. Solana has established itself as more than just another L1 as it has significant scaling benefits with product market fit.” This assertion further manifests with projects like Eclipse undertaking ambitious endeavors, specifically, “building an Ethereum L2 with the Solana VM.” Such innovations not only underscore Solana’s rising importance but also demonstrate its practicality and adaptability in the continuously evolving DeFi landscape.

In the last 22 days, the SOL price has increased by almost 40%, and the sentiment around Solana is extremely positive. As the latest CoinShares weekly report shows, SOL has been one of the most popular investments among digital asset funds around the world in recent weeks.

The Solana (SOL) price broke above the 200-day EMA on Sunday and also managed to cross the 38.2% Fibonacci retracement level. Assuming a successful retest, the SOL price could target the $26.63 and $32.35 levels.

Radiant Capital (RDNT)

Radiant Capital’s momentum in the crypto sphere took an intentional pause with the deferral of its Ethereum mainnet deployment from October 3rd to the 15th. Addressing this decision, Radiant Capital cited their unwavering commitment to quality, remarking: “During the final stages of testing for Ethereum mainnet deployment, we’ve identified opportunities for significant gas optimizations. It’s imperative to ensure competitive gas costs to deliver an optimal user experience.”

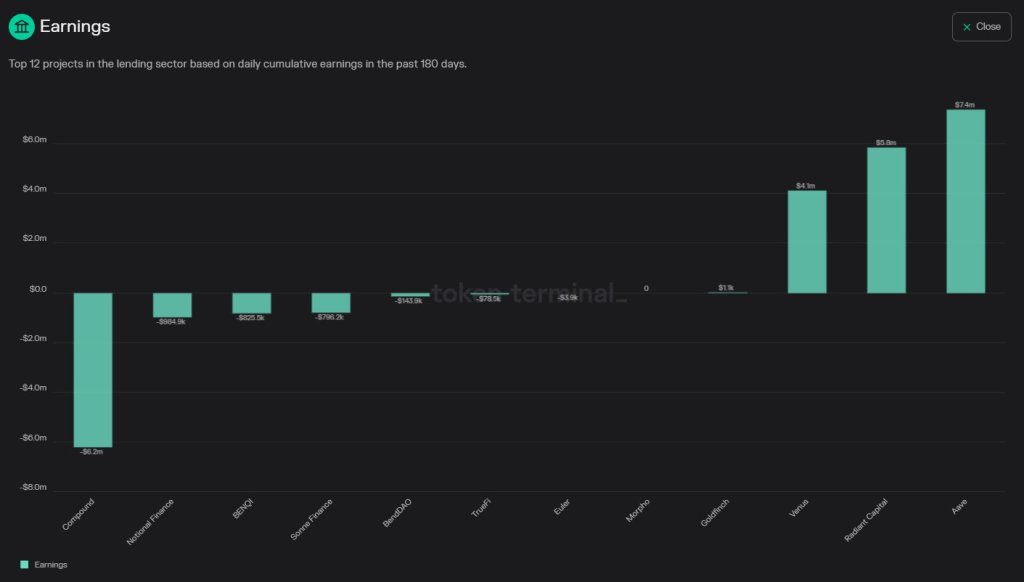

Beyond the temporary shift in launch timelines, the organization’s team remains palpable. Thor Hartvigsen reflected on Radiant Capital’s prowess, stating, “RDNT – Already leading the lending/borrowing market on Arbitrum. Expecting TVL to rise from the cross chain expansion. Expecting TVL to rise from the cross chain expansion. Further: Arbitrum STIP proposal to receive 3.36 million ARB aimed at ecosystem growth.”

RDNT saw a strong drawdown of close to 62% after the all-time high at $0.4956 on April 15. However, after the historical low at $0.1905, RDNT has already shown a strong reaction. Should the price break above the 23.6% Fibonacci retracement level at $0.2625, it could be interpreted as an indication of a breakout from the downtrend.

Maker (MKR)

Maker (MKR) has been generating significant attention in the crypto community, primarily due to its impressive rally in recent weeks. Central to Maker’s rise is its strong financial performance. Hartvigsen illuminates this by noting: “Maker is the largest revenue-generating protocol in DeFi with a current annualized revenue of $193m!” This revenue is primarily driven by interest accrued from DAI minters, with a significant proportion coming from Real World Assets (RWAs).

As he further elaborates, “Currently, 53% of all DAI collateral comes from RWAs such as US t-bills paying out nearly 5% APY. Roughly 63% of the $193m in annualized revenue comes from the RWA collateral.”

But what has precipitated this uptick in MKR’s valuation? Hartvigsen attributes it to two primary factors: “1) More of the collateral as RWA (and high US interest rates) and 2) A growing DAI supply.” He emphasizes the symbiotic relationship between Maker’s revenue and DAI’s market cap, stating that “Maker revenue depends primarily on the total market cap of DAI as the collateral backing this stablecoin is what generates fees.”

On the horizon, MKR’s prospects appear even more promising. Hartvigsen lists several catalysts that could further propel its growth. One notable highlight is the potential impact of DAI’s ongoing expansion: “If the DAI supply can continue to grow, the Maker revenue will continue to grow which most likely will impact the price positively.”

Additionally, forthcoming developments, including “a MKR 1:12000 token split,” a complete rebranding initiative, and the anticipated launch of subDAOs, are set to infuse MKR with enhanced utility and potentially greater demand in the market. As he concludes, these changes will enable “MKR holders to stake MKR to farm these new subDAO tokens which will create additional token utility.”

After the MKR price crossed the 200-day EMA at 1,110 three weeks ago, the odds are good that the rally will continue. A possible target could be the 23.6% Fibonacci retracement level at $1,888.