Other Web3 infrastructure platforms, such as Circle, are also mulling IPOs.

Cryptocurrency Financial News

Other Web3 infrastructure platforms, such as Circle, are also mulling IPOs.

The financial regulator requested an extension until February 2025 to review “at least 133,582 unique documents” as part of discovery motions with Coinbase.

The SEC has taken action against romance scammers for the first time, charging two allegedly fake crypto exchanges with carrying out fraud.

SEC Commissioner Mark Uyeda wants to update the agency’s S-1 disclosure for cryptocurrency firms. His stance is a positive step toward progress.

The regulator charged the former DeFi protocol and its co-founders for allegedly misleading investors and unregistered broker activity involving its pools.

The U.S. Securities and Exchange Commission settled charges with decentralized finance lending platform Rari Capital and its co-founders.

House of Representatives members brought up FTX, Donald Trump’s token launch, and SEC Chair Gary Gensler at the “Dazed and Confused” digital assets hearing.

While the SEC focuses on investor protection, Pudgy Penguins CEO Luca Schnetzler believes that investors should also hold some form of accountability for their purchases.

The recent XRP price action has sparked a broader bullish sentiment among crypto investors and analysts. The cryptocurrency’s 10% surge in the last week has driven the price above levels not seen in nearly a month, continuing its green performance in most long-term timeframes.

As a result, some market watchers have set their bullish targets for the cryptocurrency, claiming that the multi-year consolidation is coming soon to an end.

XRP’s price suffered a massive drop when the US Securities and Exchange Commission (SEC) filed its lawsuit against Ripple nearly four years ago. The SEC claimed that the company had illegally sold the cryptocurrency as an “unregistered security.”

The crypto crackdown drove investors away from the token as uncertainty about the token’s status and the lawsuit’s resolution grew. However, Ripple’s victory against the SEC has sparked a bullish sentiment among users, reflecting on its recent price action.

Investor and analyst CredibleCrypto deemed that XRP’s trajectory to a new all-time high (ATH) is a matter of “when” and not “if” after the court’s ruling.

The analyst noted that the cryptocurrency has moved between the $0.40-$0.75 price range since March’s highs, only registering a “deviation” from this level in July.

According to the investor, the deviation “forcibly pushed below the range low to trick breakout traders into buying/selling before price moves right back into the range and heads in the opposite direction.”

Following the August ruling, the token has hovered between the $0.55 to $0.64 mid-range level but recently registered another “deviation” during the early September market retrace. This could suggest that XRP’s price is poised to retest the accumulation’s upper level.

To the analyst, the token will retest the $0.75 resistance level before kickstarting its massive bull run. However, he noted that this scenario will likely only play out if Bitcoin (BTC) bounces to the $61,000-$62,000 price zone “relatively soon.”

Credible Crypto also highlighted that XRP displays “The Mother” of all bullish patterns in the longer timeframes. Per the post, the token seemingly exhibits a multi-year bullish pennant pattern that could lead to a breakout.

To the analyst, this “near 7-year compression will be coming to an end soon,” which could result in a “legendary” rally for the cryptocurrency. Moreover, he added that the breakout’s possible targets will surpass the $3.4 mark as it is set to make a new ATH at a “minimum.”

After that goal, the trader stated that investors would be “looking at double digits” for the next targets. Similarly, Crypto Trader Mikybull noted XRP’s bullish pattern, asserting that it displays “one of the most bullish macro charts out there.”

Another analyst also suggested that XRP will be one of the top performers during the upcoming bull run. As October approaches, Charlie.eth considers that a “significant recovery seems likely,” which could lead to the mid-term target of $2.5 before aiming for a long-term target between the $10-$12 mark.

At the time of writing, XRP’s price registers a 4% surge in the last 24 hours, trading at $0.58. The cryptocurrency also saw a 13.6% increase in its daily market activity, reaching a daily trading volume of $1.29 billion.

BlackRock’s iShare Bitcoin Trust (IBIT) registered its first daily net inflow in three weeks, leading to US spot Bitcoin exchange-traded-funds (ETFs) witnessing a combined net inflow of $12.8 million, data from Farside Investors confirms.

BlackRock forayed into the Bitcoin ETF space when the US Securities and Exchange Commission (SEC) approved IBIT in January 2024.

Dubbed the world’s largest asset manager with a total asset-under-management (AUM) of $9 trillion, BlackRock’s entry into the nascent crypto ETF ecosystem was met with much enthusiasm by investors as it not only brought a degree of sophistication but also exhibited institutional approval toward the industry.

Yesterday, the asset manager’s regulated financial product pulled $15.8 million in daily net inflows, a first since August 26, 2024. The net inflow of funds into IBIT was strong enough to push the wider US spot Bitcoin ETF market into green territory, with a combined net inflow of $12.8 million.

IBIT’s three weeks of no net daily inflows consisted of 11 days with zero flows, while two days – August 29, and September 9 – saw net daily outflows to $13.5 million and $9.1 million, respectively.

Looking at the performance of other spot Bitcoin ETFs, Grayscale’s GBTC product witnessed a net daily outflow of $20.8 million. At the same time, Fidelity’s FBTC, Franklin Templeton’s EZBC, and VanEck’s HODL experienced a net daily inflow of $5.1 million, $5 million, and $4.9 million, respectively.

According to data from cryptocurrency ETF tracker SoSoValue, BlackRock’s IBIT reigns supreme among US-based spot Bitcoin ETFs, with an enviable cumulative net inflow of $20.9 billion since the product’s inception early this year. FBTC follows this with $10.1 billion, Ark and 21Shares’ ARKB with $2.6 billion, and Bitwise’s BITB with $2.2 billion.

In contrast, GBTC has witnessed a cumulative net outflow of $20 billion. Analysts blame the product’s exorbitant fee of 1.5% as a major reason for GBTC’s performance to date. For comparison, IBIT has a fee of 0.21%.

While spot Bitcoin ETFs ended the day with a combined net inflow of $12.8 million, spot Ethereum ETFs experienced a combined net outflow of $9.4 million.

Akin to its Bitcoin ETF, Grayscale’s Ethereum ETF (ETHE) witnessed a net daily outflow of $13.8 million, followed by Bitwise’s ETHW with a $2.1 million net outflow. Only Grayscale’s mini Ethereum ETF (ETH) successfully attracted net inflows worth $2.3 million.

Since their approval in May 2024, Ethereum ETFs haven’t performed as well as Bitcoin ETFs when attracting significant inflows.

The tepid performance of Ethereum ETFs is reflected in the digital asset’s price as it continues to underperform against Bitcoin. Ethereum trades at $2,307 at press time, slightly up by 0.6% in the past 24 hours.

The U.S. Securities and Exchange Commission (SEC) has filed suit against three individuals and five companies for allegedly operating pig butchering scams – a type of confidence-enabled investment scam in which fraudsters befriend victims over text-based social media apps, gain their trust and convince them to invest large amounts of money in fictitious crypto platforms before stealing their funds and disappearing.

International accounting firm Prager Metis has agreed to pay $745,000 to settle misconduct allegations from the U.S. Securities and Exchange Commission (SEC) tied to its bungled audit of FTX before its collapse in November 2022.

The regulator alleges that Prager issued two audit reports for FTX between February 2021 and April 2022 that falsely represented auditing standards.

US House lawmakers will hear from a former SEC commissioner and crypto industry leaders at their “Dazed and Confused” digital assets hearing on Sept. 18.

The US custodian’s crypto-native clients include Worldcoin, ZetaChain and LayerZero.

The SEC filed its proposed amended complaint against Binance on Thursday with a greater emphasis on the exchange’s token listing process.

According to a popular pro-crypto attorney and Senate candidate, the SEC’s overreach into the crypto industry has cost retail investors over $15 billion in losses.

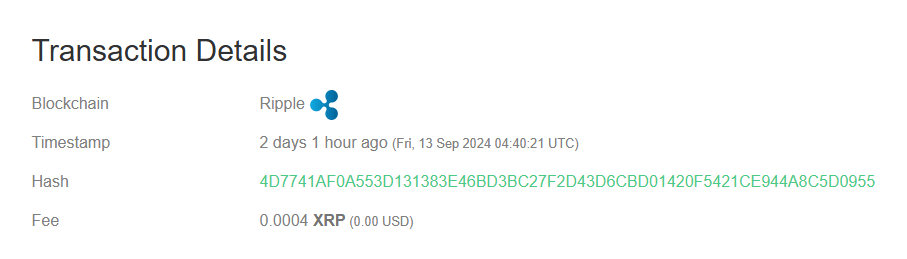

With a huge 150 million XRP transfer to an unknown wallet, Ripple Labs has rocked the crypto scene. Based on on-chain tracker Whale Alert, the transaction—worth more than $85 million—has left many in the crypto community guessing about Ripple’s gameplan.

Ripple has been sending XRP into this wallet before, which begs questions about what the payment behemoth would do going forward.

That is quite timely, considering rumors about an XRP Exchange-Traded Fund (ETF) are rife. The recent announcement by Grayscale XRP Trust increased the possibility of XRP emulating Bitcoin and Ethereum in getting an ETF listing. The fact that Ripple is still in a continuous legal fight with the Securities and Exchange Commission further shrouds this issue in mystery as investors await the next developments.

150,000,000 #XRP (85,383,318 USD) transferred from #Ripple to unknown wallethttps://t.co/uwRDwlk3LS

— Whale Alert (@whale_alert) September 13, 2024

According to Whale Alert data, this mysterious wallet has been receiving XRP from Ripple quite regularly since October 2023. There were some inflows and partial outflows in that account during September also.

The most recent transaction is 12.08 million XRP on September 12. Before that, on September 10, there was an outflow of 40 million XRP from the account. Most interestingly, the wallet also received 200 million XRP in August, therefore increasing its already massive stash.

The regular transfer of XRP into and out of this wallet has resulted in various hypotheses among XRP proponents. While some say the wallet belongs to an institutional investor, others suspect it’s Ripple consolidating money in preparation for a major announcement.

Another often accepted belief is that this wallet might be used for cold storage, a preventive action to protect significant XRP quantities.

Driven by Grayscale’s release of its XRP Trust, the move coincides with growing interest about an XRP ETF. An XRP ETF might materialize in the next eight months, according to industry analysts. Should it occur, Ripple and its native token would reach a significant turning point. But the result of Ripple’s legal fight with the SEC might affect the chronology for such innovations.

Where Ripple has already scored a partial victory in the dispute against the SEC, the latter has its window till 6th October to file its appeal, and so there is still uncertainty. The case is under close observation from the investors as a favorable outcome would pave the way for more institutional investments, which may even push up the XRP price.

The concept of an XRP ETF has helped the market react favorably despite legal impediments. With XRP trading at $0.5612, the price surged by nearly 4% after Grayscale’s statement. This price spurt shows increasing faith in Ripple’s capacity to overcome obstacles amid regulatory pressures.

Positive Sentiment Develops Around XRP

XRP’s price has risen 11% over the past week; trade volumes have surged to $980 million. Its market capitalization, which indicates great interest from institutional and ordinary investors, is getting near $30 billion. Many people are asking if Ripple is preparing for a big action given the recent 150 million XRP transfer adds to the mystery.

Featured image from CPO Magazine, chart from TradingView

Coinbase has emerged as a vocal advocate for the crypto industry in the face of ongoing regulatory crackdowns in the United States.

In May, United States congressional lawmakers voted to repeal Staff Accounting Bulletin-121 in a 228-182 bipartisan vote.