Data shows that Bitcoin (BTC) Open Interest plummeted during the latest market retrace, but Solana (SOL) and Ethereum (ETH) have been resilient.

Solana & Ethereum Open Interest Has Only Seen A Mild Retrace

According to data from the analytics firm Santiment, Bitcoin has seen its Open Interest plunge after the pullback in its price. The “Open Interest” here refers to a metric that keeps track of the total amount of derivatives positions related to a given asset (in USD) currently open on all exchanges.

When the value of this metric goes up, investors will be opening new positions in the derivatives market right now. As new positions generally suggest a rise of total leverage in the market, the Open Interest registering this trend can lead to more volatility for the cryptocurrency’s price.

On the other hand, the indicator observing a decline implies some investors are either closing up their positions of their own volition or getting forcibly liquidated by their platform. The asset tends to behave more stably once such a decrease goes through.

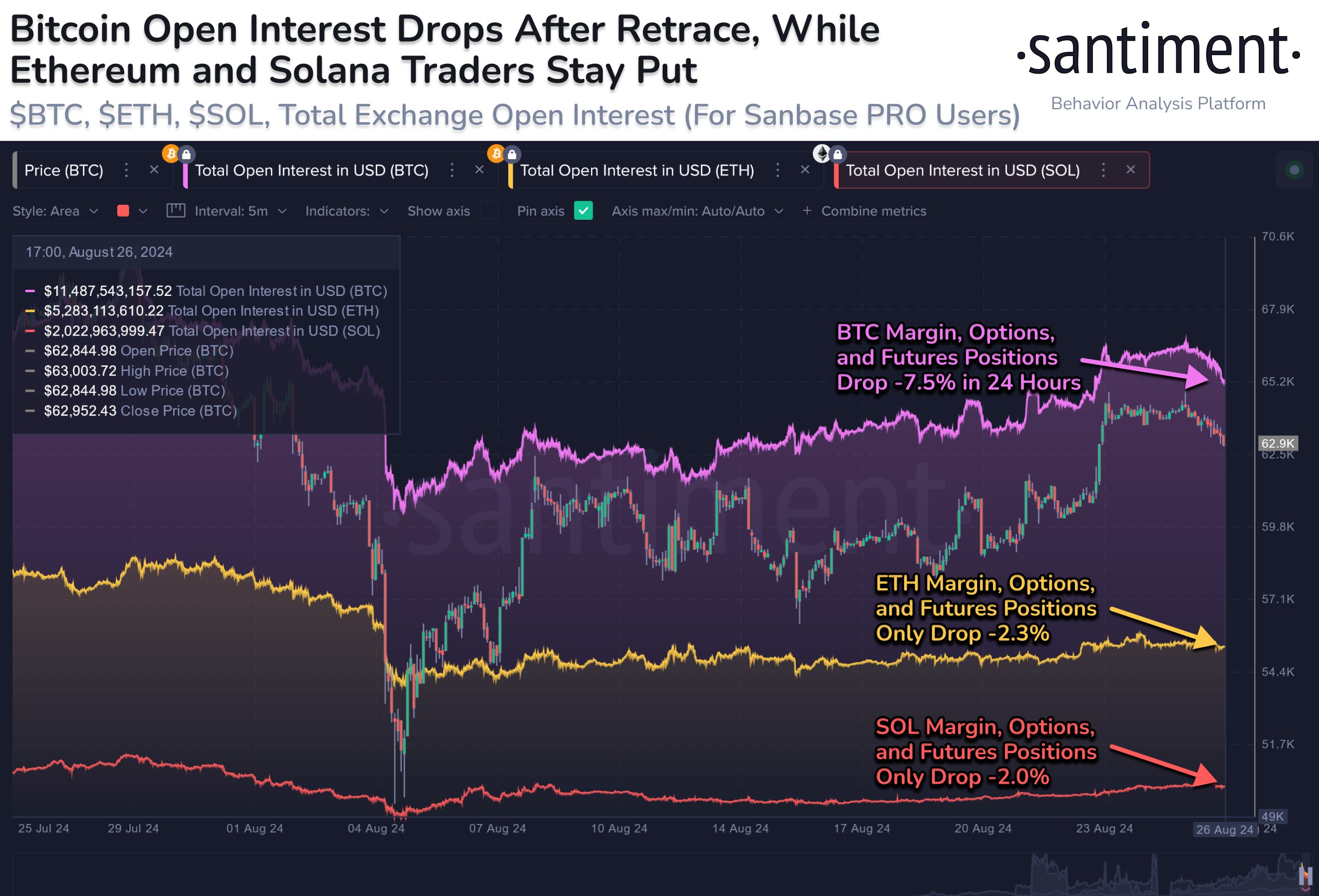

Now, here is a chart that shows the trend in the Open Interest for three top coins in the sector, Bitcoin, Ethereum, and Solana, over the past month:

As displayed in the above graph, the Bitcoin Open Interest has dropped around 7.5% in the past day. The reason behind this plunge will likely be the asset’s retrace to levels under $63,000.

Interestingly, while Ethereum and Solana have registered similar price drawdowns inside this window, the Open Interest is only down around 2% for both of them.

It’s possible that Bitcoin was simply the most leveraged of these assets, so the relatively small price drop was enough to cause significant liquidations. There are also some other possibilities, however.

The investors may be more interested in the altcoins right now, choosing to close down BTC-related positions and opening up more positions related to alts like Solana and Ethereum.

It’s hard to say whether this increased appetite for speculation around Solana and Ethereum relative to Bitcoin is a positive for the market. Still, it does set these coins up to see some action shortly.

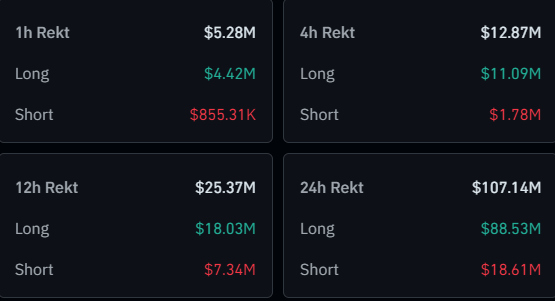

On the topic of liquidations, data from CoinGlass has revealed the exact figures related to the Open Interest flush the cryptocurrency sector has witnessed in the last 24 hours.

The table shows that $107 million in cryptocurrency derivatives contracts have found liquidation during the past day, with over $88 million of these coming from the long contract holders alone.

SOL Price

At the time of writing, Solana is trading around $156, up almost 7% over the past week.