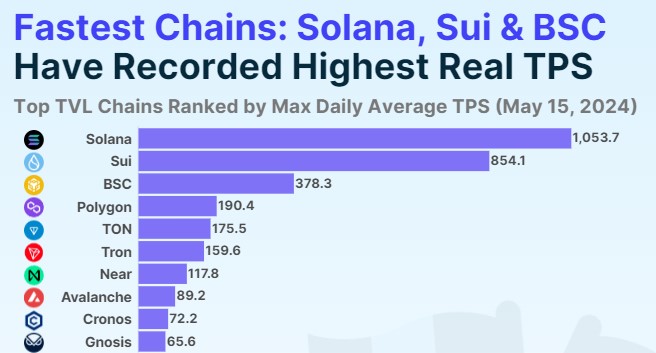

The race to achieve the fastest blockchain transaction processing speeds is heating up, Solana (SOL) is in the spotlight as a new report from crypto data aggregator CoinGecko reveals some surprising findings.

The study analyzes the real-world transaction per second (TPS) performance of a range of large blockchain networks, both Ethereum-based and non-Ethereum (ETH) Virtual Machine (EVM) protocols.

Solana Emerges As The Undisputed Speed Champion

According to the findings, Solana has proven to be the fastest among large blockchains, with its actual daily average transactions per second (TPS) reaching a record high of 1,504 on April 6th, 202. Notably, this figure makes Solana 46 times faster than Ethereum, the second-largest cryptocurrency by market capitalization.

Furthermore, Solana’s TPS is more than 5 times faster than Polygonm (MATIC), which currently holds the highest TPS among Ethereum scaling solutions.

According to CoinGecko, this demonstrates the superior processing power of the non-EVM blockchain and its ability to handle a large influx of transactions, especially during periods of heightened market activity, such as the recent Memecoin mania, specifically within the Solana network.

However, it’s important to note that despite Solana’s performance, the blockchain has only achieved 1.6% of its “theoretical maximum speed” of 65,000 TPS. This suggests that there is still significant room for improvement, and the network’s upcoming upgrades will be closely watched to see how quickly it can record even higher real TPS.

Ethereum Scaling Solutions Lag Behind Non-EVM Blockchains

The second-fastest blockchain in the study is another non-EVM protocol, Sui (SUI), which recorded its highest real TPS of 854 in July 2023 as the on-chain game Sui 8192 gained popularity. Other fast blockchains among the non-EVMs include The Open Network (TON) at 175 TPS and Near Protocol (NEAR) at 118 TPS.

In contrast, the non-EVM blockchains that have recorded relatively lower real processing speeds are Aptos (49 TPS), Starknet (12 TPS), Bitcoin (11 TPS), and Thorchain (2 TPS).

Collectively, the 8 non-EVM large blockchains have an average peak TPS of 284, which is 3.9 times faster than the 17 largest EVM and EVM-compatible blockchains, which have an average of just 74 TPS.

The EVM-compatible blockchain that has achieved the fastest real TPS is BNB Smart Chain (BSC), which recorded 378 TPS on December 7th, 2023, amid the surge in on-chain activity driven by the inscriptions craze. This performance places BSC as the fastest Ethereum-based blockchain, though it still lags behind the top non-EVM protocols.

Similarly, the surge driven by inscriptions allowed Polygon to record 190 TPS on November 16th, 2023, making it the fastest among the largest Ethereum scaling solutions and 8.4 times faster than Ethereum itself. However, the leading non-EVM blockchains still outpacing even Polygon’s impressive speed.

At press time, SOL was trading at $168, up nearly 7% in the last 24 hours and registering an impressive 720% gain year-to-date.

Featured image from DALL-E, chart from TradingView.com