A war for on-chain market dominance may be brewing. The question: What will be the collateral of choice in the decentralized finance (DeFi) economy?

As of press time, DeFi protocols across all ecosystems have locked in almost $126 billion in value, according to DeFiLlama data, inching closer every day to their 2021 high of $175 billion. The majority of those pledged funds take the form of ether (ETH) and derivatives like yield-producing staked ether liquid tokens (stETH) and wrapped eETH (weETH), with wrapped bitcoin (wBTC) and stablecoins as a whole competing for fourth and fifth place.

But the team behind Bitcoin-based DeFi protocol Lombard Finance intends to shake things up with LBTC, a new liquid bitcoin token. The idea, according to Lombard co-founder Jacob Philips, is to dethrone ETH and stETH and install bitcoin as the collateral of choice in the entire on-chain economy.

“On centralized venues, bitcoin is the prime collateral. There’s no question about this. Why is it not the case in DeFi?” Philips told CoinDesk in an interview. “Bitcoin only does one thing well, and it’s being a rock-solid store of value. It is the perfect collateral. There’s no reason that we shouldn’t be building DeFi on top of bitcoin.”

Bitcoin has had a formidable year, surging 124% since January 1 thanks to political tailwinds in the U.S. and the massive success of its almost year-old spot exchange-traded funds. Ether, for its part, has underperformed significantly by “only” rising 48% in the same period of time, despite being four times smaller in terms of market capitalization. With demand for bitcoin increasing by the day — and ever-increasing chatter about a potential U.S. strategic bitcoin reserve under the incoming Trump administration — it isn’t crazy to think the asset could play a bigger role on-chain.

That, in turn, could transform the way DeFi as a whole operates.

“Bitcoin is going to be the next big source of liquidity for every DeFi protocol, on every chain. It’s just a massive influx of net new capital,” Philips said. Noting that bitcoin has a market cap close to $1.9 trillion, he said: “Even if we only get a fraction of that, it would still put a ton of new activity into the ecosystem and make DeFi more efficient — maybe even get to the point where DeFi protocols, through passive liquidity, rival the liquidity on centralized exchanges.”

Bitcoin with a yield?

A big difference between bitcoin and ether is that you can lock in the latter asset on the Ethereum network — a process called staking — to help secure the blockchain, and earn interest, paid in ETH. At press time, staked ether offers a 3.19% yield annually, according to CoinDesk’s composite ether staking rate (CESR) index.

The Bitcoin network doesn’t offer such capabilities, but Lombard aims to provide a yield-bearing bitcoin token through Babylon, a protocol designed to let users stake bitcoin in order to secure other blockchains.

It goes like this: Users give Lombard some bitcoin, Lombard stakes these coins through Babylon, then it mints one LBTC token for each BTC staked. These LBTC tokens follow the ERC-20 standard, meaning they can be used across Ethereum and all of its protocols.

That interest rate on LBTC will be paid by the blockchains secured through Babylon, or so the theory goes. Nine different projects — Corn, BOB, Cosmos Hub, Nubit, Fiamma, Manta, LayerEdge, Chakra and Pell — have started or completed integration to Babylon’s blockchain development environment, or devnet, so far, Coleman Maher, growth lead at Babylon, told CoinDesk. These integrations should go live next year, after Babylon’s own layer 1 goes live.

Babylon isn’t giving out any staking rewards right now, but that hasn’t prevented the protocol from accumulating $5.4 billion in value, making it the 10th biggest protocol by value locked across all of DeFi, according to DeFiLlama. So why are people so eager to lock up their bitcoin on Babylon? Possibly because it’s running a points program, meaning that early depositors could eventually receive an airdrop. The Babylon team did not comment on whether a token would ever be issued.

Fierce competition

Out of the $6 billion staked on Babylon, over $1.4 billion was plugged through Lombard to create LBTC tokens. In the absence of Babylon-issued staking rewards, these tokens aren’t providing any yield yet.

“Users aren’t choosing to hold ether or bitcoin based on staking yield alone,” Philips said. “There are much broader reasons why they’re choosing one or the other,” such as the potential U.S. bitcoin reserve and regulators’ views towards the two assets. “And the yield is a little bit of a cherry on top.”

It’s important to note that DeFi users already can use bitcoin as collateral (although without any yield) thanks to wrapped bitcoin. At press time, wBTC’s market capitalization stood at $12.9 billion. That’s only 22% away from its 2021 all-time-high, despite concerns that wBTC’s issuer, crypto custody and trading firm BitGo, is sharing custody of the underlying bitcoin with BiT Global, an entity partially owned by TRON founder Justin Sun. Sun has been accused of fraud and market manipulation in the U.S.

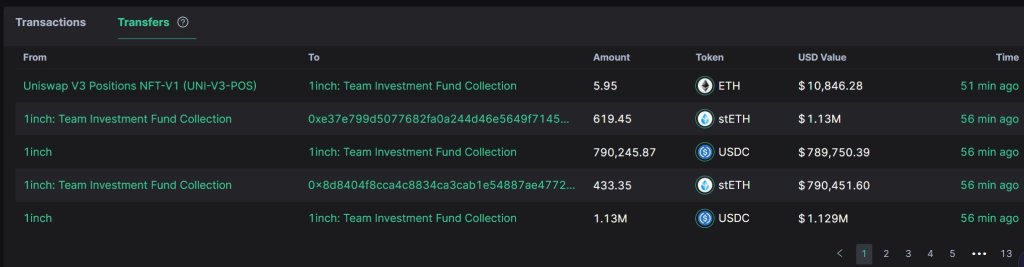

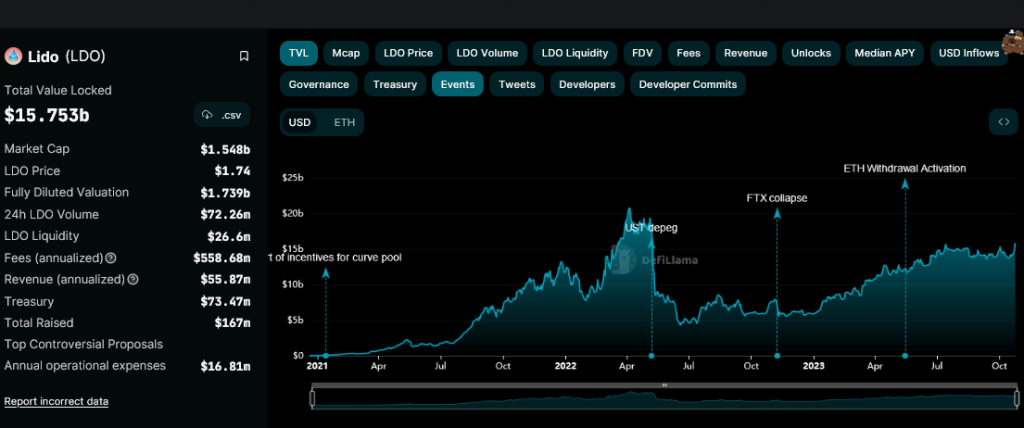

Even so, as of December 6, wBTC only accounted for $5.7 billion worth of collateral in some of the largest DeFi protocols, per Lido data, whereas $14.5 billion in ETH was being used, and $11.1 billion worth of stETH. Even “wrapped ether,” or eETH — a relatively new liquid token that allows users to benefit from EigenLayer restaking rewards at the same time as native ETH staking yield — provided $5.8 billion in collateral.

In fact, stETH and weETH have been slowly eating into other coins’ market share, to the point that ARK Invest stated in a recent report that the entire DeFi economy was reorganizing itself around stETH and the benchmark yield provided by staked ETH. Other tokens — like Solana’s SOL or Avalanche’s AVAX — offer higher interest rates for staking, the implication being that these assets, being more volatile, are riskier to hold in the long run.

Stablecoin lenders have also felt pressure from stETH’s ascent, ARK Invest said, with Sky (SKY) (formerly MakerDAO) increasing locked DAI’s interest rate, while rewards for lending stablecoins on Aave (AAVE) and Compound (COMP) have grown, because users would rather lend stETH and borrow stablecoins than lend stablecoins directly.

Not to mention the various tokenized money market funds being developed by financial giants such as BlackRock and Franklin Templeton, which could end up allowing DeFi users to gain exposure to U.S. Treasury bills and use such tokens as collateral.

So LBTC is facing tough competition. But Philips says the token can succeed where wBTC has struggled thanks to that extra little push afforded by its yield. “Staking yield will be generated in time. The LBTC yield is expected to be in the range of the ETH staking rate,” he said.

“Lombard’s initial goal is just to get people to take their bitcoin out of the coldest of cold storage, and just take the most primitive step into on-chain finance. And then we’ll show you the battle-tested protocols, safer than your bank, that exist out there,” Philips added. “It’s possible that the yield could dry up. LBTC as an asset, producing any amount of yield, would still be an attractive asset.”

The pitch has certainly been met with interest. Lombard raised $16 million this summer from a number of heavy-hitters, including Polychain Capital, Franklin Templeton and Nomad Capital. Philips said that entities already familiar with DeFi had been the most enthusiastic. “Anybody who has dabbled in crypto already, it’s an easy pitch to get them onboard for bitcoin staking. Or at least they’re very open to the conversation.”