Steady growth in the market cap of many stablecoins highlights investors’ interest in all aspects of the crypto market.

Cryptocurrency Financial News

Steady growth in the market cap of many stablecoins highlights investors’ interest in all aspects of the crypto market.

Tether, the issuer of the ubiquitous USDT stablecoin, cemented its dominance in 2023, ballooning its market share to a staggering 71%. This explosive growth, however, comes with a chilling undercurrent: a United Nations report linking USDT to a surge in cybercrime and money laundering in Southeast Asia.

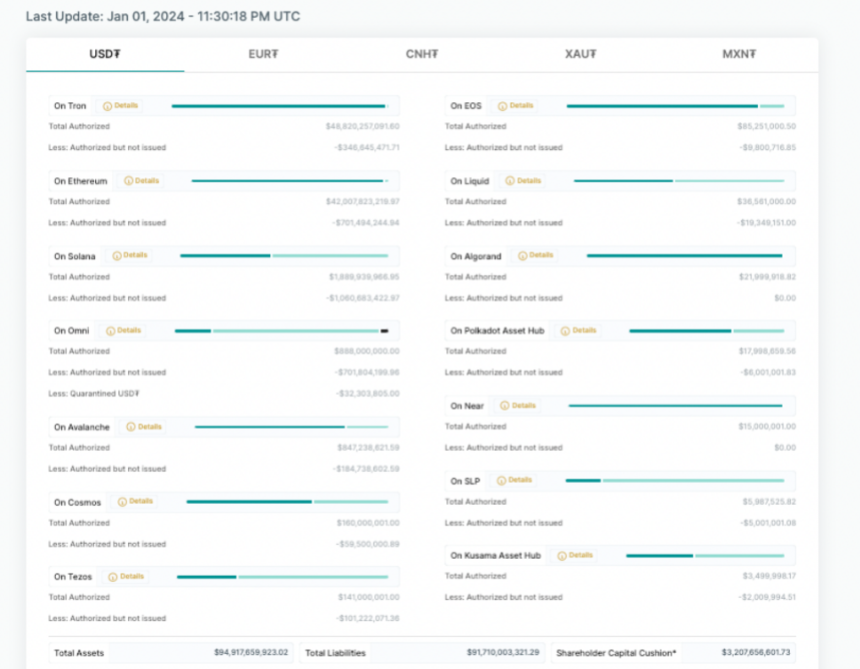

Glassnode data paints a stark picture of Tether’s ascent. Its market capitalization reached a record $95 billion in January 2024, fueled by a 40% increase in USDT supply over the past year. Meanwhile, competitors like Circle’s USDC saw their market share shrink, with USDT now commanding over 7 times the circulation of its nearest rival.

Paolo Ardoino, Tether’s new CEO, has prioritized cooperation with U.S. law enforcement. The company boasts of freezing wallets linked to sanctions lists and recovering over $435 million in illicit funds.

However, the UN report casts a shadow on these efforts, detailing how USDT facilitates “sextortion,” “pig butchering” scams, and underground banking across Asia.

While Tether has proactively banned over 1,260 addresses linked to criminal activity, the sheer volume of illicit transactions raises concerns about the effectiveness of these measures.

Critics point to Tether’s opaque reserve backing as a breeding ground for misuse, calling for greater transparency to combat money laundering.

The stablecoin market, once touted as a bridge between traditional finance and the crypto world, now faces a reckoning. Tether’s dominance is undeniable, but its association with criminal activity threatens to erode trust and trigger stricter regulations.

Meanwhile, Circle’s recent IPO filing hints at a potential shift in the landscape. With regulatory scrutiny intensifying, Tether’s future hinges on its ability to address concerns about transparency and combat illicit activity.

Can it clean up its act and maintain its crown, or will the tide turn towards its more transparent rivals? Only time will tell if Tether’s reign as the king of stablecoins will weather the storm of controversy.

With its historic 71% market share, Tether’s reign over the stablecoin realm is undeniable. Yet, the shadow of illicit activity threatens to eclipse its success.

As regulators sharpen their focus and competitors like Circle step into the ring, the question looms: will Tether clean house and retain its crown, or will this be the tipping point for a stablecoin revolution, reshaping the future of crypto itself?

Only time will tell if Tether’s dominance signals a bright new era for digital currencies or serves as a cautionary tale, paving the way for a more transparent and accountable crypto landscape. The gloves are off, and the fight for the future of stablecoins is just beginning.

Featured image from Shutterstock

In a recent development, US lawmakers have urged the US Department of Justice (DOJ) to initiate a criminal investigation into cryptocurrency exchange Binance (BNB) and stablecoin issuer Tether (USDT).

The lawmakers, led by Senator Cynthia Lummis, reference a controversial Wall Street Journal (WSJ) report that alleges Hamas and its affiliate raised significant funds through cryptocurrencies.

In a joint letter signed by Senator Lummis and Representative French Hill, the lawmakers express deep concern over reports indicating that “unregulated crypto intermediaries” outside the United States have allegedly facilitated illicit financial activities, including financing terrorism, such as Hamas’s attacks on Israel.

Lummis and Hill urged the DOJ to promptly reach a charging decision regarding Binance, considering the extent of its involvement, and to conclude the ongoing investigation into Tether’s alleged illicit activities.

The lawmakers refer to the WSJ report of October 10, 2023, which disclosed that Hamas, Palestinian Islamic Jihad, and Hezbollah had received cryptocurrency funding since August 2021. They stress the DOJ’s need to hold any entities facilitating illicit activities accountable. The letter further reads:

We believe that it’s imperative that the Department of Justice hold bad actors accountable if they are shown to facilitate illicit activity. Binance, notably, is an unregulated crypto asset exchange based in the Seychelles and Cayman Islands. Binance has historically been linked to illicit activity and is purportedly the subject of a current Department of Justice investigation.

On the other hand, Tether faced a fine by the Commodity Futures Trading Commission (CFTC) in 2021 for issues related to backing its stablecoin USDT.

The lawmakers urged the DOJ to thoroughly assess whether Binance and Tether have provided material support and resources for terrorism by violating applicable sanctions laws and the Bank Secrecy Act. Lummis and Hill emphasize the importance of swift action to cut off funding sources for terrorists targeting Israel.

In response to Senator Lummis and Rep. Hill’s claims, Tether issued a statement addressing the “misinformation” surrounding the potential misuse of cryptocurrencies.

Tether references independent investigations by Chainalysis and Elliptic, which found significant errors and faulty attribution techniques in reports, including the WSJ’s article.

Tether emphasizes its commitment to regulatory compliance, due diligence, and global collaboration with law enforcement agencies. They highlight their track record of freezing assets tied to illicit activities and assert no evidence of sanctions law or Bank Secrecy Act violations.

Tether further notes the inherent transparency of blockchain technology and the proactive measures taken by virtual asset service providers to monitor and report potentially illicit activities.

They reaffirm their dedication to transparency, compliance, and collaboration with authorities, inviting constructive dialogue and cooperation.

As the call for a DOJ investigation unfolds, the cryptocurrency community awaits further developments and the potential impact on Binance and Tether’s operations.

As of this writing, BNB is trading at $221, representing a decrease of 0.9% within the last 24 hours. However, it is worth noting that the token has experienced significant gains over the past seven and thirty days, amounting to 5.3% and 4.9%, respectively.

Featured image from Shutterstock, chart from TradingView.com

Tether, the world’s largest stablecoin company, has reaffirmed its commitment to combating cryptocurrency-funded terrorism and warfare by collaborating with law enforcement agencies worldwide.

The company has frozen 32 addresses containing $873,118.34, allegedly linked to illicit activities in Israel and Ukraine.

According to a blog post on October 16, Tether has played a significant role in assisting 31 law enforcement agencies across 19 jurisdictions, freezing $835 million in assets primarily associated with thefts from blockchain and exchange hacks.

The company’s collaborations span various countries, including Brazil, Singapore, Germany, Canada, Argentina, China, Ukraine, and the United States. By actively engaging with authorities, Tether aims to contribute to the fight against cybercrime and ensure stolen funds are returned to legitimate users. The company further stated:

Of this, Tether has frozen 32 addresses, containing $873,118.34, that were found to be linked to illicit activity in Israel and Ukraine. Tether has been working with the NBCTF in Israel to counter cryptocurrency-funded terrorism and warfare.

The ability of Tether to freeze and return illicitly obtained funds highlights the traceability and transparency of blockchain transactions. Contrary to common misconceptions, cryptocurrency transactions are not anonymous; they are meticulously recorded on the blockchain, allowing for the tracking and tracing of fund movements.

The recently announced CEO of Tether, Paolo Ardoino, emphasized that criminals using cryptocurrencies for illegal activities will inevitably be identified. Ardoino stated:

Tether remains committed to promoting responsible blockchain technology use and standing as a robust defense against cybercrime. We eagerly anticipate continued collaboration with global law enforcement agencies as part of our commitment to global security and financial integrity.

While Tether’s actions demonstrate the industry’s capacity to combat criminal use effectively, some critics within the blockchain industry continue to scrutinize the crypto sector, often neglecting to address the slow or inadequately equipped traditional financial system’s role in combating criminal funding.

On this matter, Tether’s CEO emphasized the importance of recognizing the traceability and trackability of blockchain transactions, which serve as potent deterrents to illicit activities.

As the stablecoin company behind USDT continues to collaborate with law enforcement agencies globally, the company’s efforts highlight the potential of blockchain technology to enhance financial security and integrity.

The traceability of transactions provided by blockchain technologies offers a robust defense against cybercrime and illicit financial activities.

As the fight against cybercrime intensifies, continued collaboration between cryptocurrency companies and law enforcement agencies will play a crucial role in ensuring the integrity and stability of the digital asset space.

Featured image from Shutterstock, chart from TradingView.com

According to a Bloomberg report, Circle, a prominent player in the stablecoin market, strategically leverages its substantial cash reserves of over $1 billion to weather fresh competition from non-crypto giants like PayPal.

The company’s market share of the second-largest stablecoin, USD Coin (USDC), has been declining, mainly due to factors such as Binance’s decision to reduce its usage of USDC.

However, per the report, Circle remains optimistic about the future of stablecoins and aims to stem the decline while exploring new revenue streams and global expansion.

The circulation of Circle’s USDC has witnessed a significant drop from $45 billion to approximately $26 billion this year, while Tether, the leading stablecoin, has experienced growth during the same period.

Circle attributes part of this decline to Binance’s reduced utilization of USDC to promote its native token. Increasing competition from non-crypto companies like PayPal further intensifies the challenges for Circle.

The company’s over $1 billion cash cushion provides a significant hedge against market headwinds. The company generates revenue primarily from interest income on assets backing the USDC, including dollar deposits and short-term Treasuries.

According to Bloomberg, Circle’s strong financial performance is “evident,” with revenues exceeding $779 million in the year’s first half.

Adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) reached $219 million in the same period, exceeding the 2022 full-year figure of $150 million.

While acknowledging the impact of “tail-risk events” on USDC adoption, Circle’s CEO, Jeremy Allaire, remains optimistic about stablecoins’ mainstream potential. Allaire believes that increasing competition, such as PayPal’s recent entry into the market, will drive more financial services and internet payment firms to embrace stablecoins.

Circle is actively pursuing partnerships to promote the broader adoption of USDC and plans to enhance transparency by regularly sharing financial reports. Moreover, the company has engaged Deloitte as its auditor.

Allaire anticipates that stablecoin issuers will face greater scrutiny and regulatory standards in the coming years. With regulators tightening control over stablecoins globally, he predicts that entities unable to meet these standards will be crowded out of the mainstream market.

Nevertheless, Circle remains confident in its ability to adapt and benefit from the evolving regulatory environment. Despite potential interest rate declines, Circle expects increased crypto activity, positioning the company for further growth.

Circle is leveraging its substantial cash reserves to navigate market challenges and competition from non-crypto players. Despite declining market share, Circle remains focused on expanding revenue streams, promoting wider adoption of USDC, and embracing transparent financial reporting.

With the regulatory landscape evolving, Circle aims to meet the highest standards and thrive in the stablecoin market, positioning itself for long-term success.

Conversely, USDC currently boasts a market capitalization of approximately $26.17 billion, securing its place as the sixth-largest cryptocurrency by market cap, according to CoinMarketCap data.

This figure represents a minute 0.37% of the total cryptocurrency market, indicating the stablecoin’s steady performance despite the highly dynamic nature of the crypto space. With a circulating supply of 26.17 billion USDC tokens, the stablecoin has established a robust presence in the market.

Furthermore, USDC’s trading volume has surged, reaching an impressive $3.03 billion in the past 24 hours. This substantial trading activity positions USDC as the fourth most actively traded cryptocurrency, evidencing its liquidity and attractiveness to market participants.

The 24-hour trading volume to market cap ratio stands at 11.59%, reflecting the strong liquidity and market depth of USDC, which further contributes to its stability and utility.

Featured image from Unsplash, chart from TradingView.com