USDt explained for beginners: Learn how Tether works, why it’s popular and how it stacks up against other stablecoins.

Cryptocurrency Financial News

USDt explained for beginners: Learn how Tether works, why it’s popular and how it stacks up against other stablecoins.

To best trade memecoins in 2025, research the latest market trends, use DEXs, monitor social media sentiment, and apply risk management strategies to avoid significant losses.

Bitcoin’s ability to hold $100,000 is being suppressed by rising treasury yields and a strengthening dollar. Is the “Trump trade” ending?

Traders bought up Bitcoin’s dips to $90,000, a sign that investors are confident in BTC prices above $100,000.

A triangular arbitrageur spots market irregularities and carries out concurrent trades across three asset pairs while skillfully controlling risk.

A multi-million bet on “Ethereum ETF approved by May 31” resolved to a “Yes” on Polymarket as news from the SEC broke, but the losing side argues it’s not over yet.

The Kenyan president announced the talks at an American business summit in Nairobi attended by the U.S. commerce secretary.

As a Bitcoin trader, the risks but also rewards are quite high, making it a captivating endeavor for those willing to delve into the world of digital currency trading. Bitcoin’s unique combination of volatility and potential for significant returns has captured the attention of traders globally. In this comprehensive guide, we will explore how to trade Bitcoin effectively, ensuring you are well-equipped with the knowledge to navigate this dynamic market. From the basics of Bitcoin trading strategies to identifying the best platform to trade Bitcoins, we will cover it all.

A Bitcoin trader is an individual who participates in the cryptocurrency market by buying and selling Bitcoin with the aim of making a profit. Unlike long-term investors who may hold assets for longer periods, Bitcoin traders often engage in more frequent transactions. This can range from long-term positions, where they hold Bitcoin with the expectation of price appreciation, to a short-term day-trade, where they capitalize on the market’s volatility.

Being a Bitcoin trader involves a deep understanding of the market trends, analysis of technical and fundamental indicators, and an ability to make informed decisions based on current market conditions. Successful Bitcoin traders use various strategies like day-trading, scalping, swing trading, and position trading, each requiring different skill sets and levels of market engagement.

Moreover, being a Bitcoin trader means staying updated with the latest news and developments in the cryptocurrency world, as these can significantly impact market prices. Also, risk management is a crucial aspect of trading Bitcoin, as the market is known for its rapid price fluctuations.

Why Trade Bitcoin?

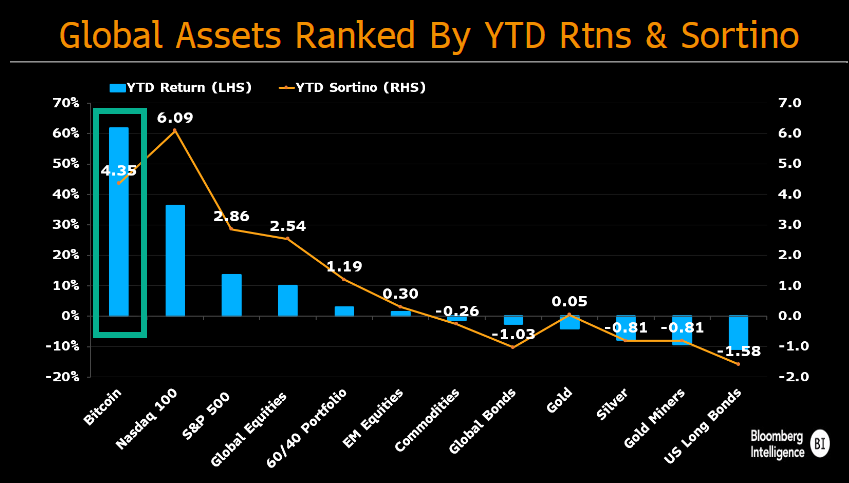

Trading Bitcoin has become increasingly popular for several compelling reasons. Firstly, Bitcoin offers exceptional volatility, which, while risky, provides unique opportunities for substantial profits. Secondly, Bitcoin operates 24/7, unlike traditional stock markets. This round-the-clock trading allows traders to react immediately to market news and global events.

Another reason to trade Bitcoin is its potential for high returns. Bitcoin has shown a remarkable ability to increase in value over time, outperforming traditional investments over the past more than 14 years (since inception). Traders who can skillfully navigate the market’s ups and downs stand to gain significantly.

Bitcoin’s decentralized nature also offers a degree of freedom from traditional financial institutions. This independence from central banks and governments appeals to traders who seek alternatives to traditional financial systems.

Additionally, the increasing mainstream acceptance and adoption of Bitcoin by large companies like MicroStrategy or financial service providers like BlackRock, Fidelity and Invesco have added legitimacy to its trading. As more people use and invest in Bitcoin, its market grows, providing more trading opportunities and liquidity.

Trading Bitcoin effectively requires a solid understanding of the market and a well-thought-out strategy. The process begins with setting up a trading account on a cryptocurrency exchange or platform. Once your account is set up and funded, you can start trading. Here’s a basic overview:

Bitcoin Trading Strategies

When it comes to trading Bitcoin, employing the right strategy is crucial for success. Each trader’s approach may vary based on their risk appetite, investment size, and trading goals. In this section, we’ll introduce various Bitcoin trading strategies that are commonly used in the market.

Day-Trade Bitcoin

Day-trading Bitcoin is a fast-paced strategy focused on taking advantage of Bitcoin’s short-term price movements within a single trading day. It requires a deep understanding of market trends and the ability to quickly interpret technical analysis, including chart patterns and trading indicators.

Success in day trading hinges on prompt decision-making and expert-level knowledge of chart patterns and technical indicators.. Effective risk management is vital, with strict adherence to stop-loss orders to mitigate potential losses. Day traders must also stay constantly informed about market conditions and news to make timely, informed decisions.

Bitcoin Scalping

Bitcoin scalping is a meticulous trading approach where traders capitalize on minute price fluctuations in the Bitcoin market. This strategy involves making numerous trades over short periods, sometimes just a few minutes, to accumulate small but frequent profits.

Scalping demands an exceptional level of market analysis, precision, and quick execution. Scalpers must stay intensely focused, often dedicating several hours to monitoring market movements closely. They rely heavily on technical analysis tools and real-time data to identify profitable trade opportunities, using different scalping strategies.

Due to the high frequency of trades, managing fees and maintaining a disciplined approach to avoid significant losses is crucial in Bitcoin scalping.

Swing Trading

Swing trading in the Bitcoin market involves holding positions for several days or weeks to capitalize on expected directional moves or price ‘swings’. This strategy requires a blend of fundamental and technical analysis to predict potential price movements.

Swing traders focus on larger price movements than day traders, allowing for a more relaxed trading pace. The key to success in swing trading is identifying trends and momentum in Bitcoin’s price, which often involves understanding market sentiment and macroeconomic factors influencing the cryptocurrency market.

Bitcoin traders who utilize this strategy need to be patient, as holding positions for longer periods can mean enduring some volatility. However, this strategy can yield substantial returns if market trends are accurately anticipated.

Bitcoin Position Trading

Position trading in Bitcoin is a long-term strategy where traders hold their positions for extended periods, often weeks, months, or even years. This approach is less about the short-term fluctuations and more about the long-term growth potential of Bitcoin.

The Bitcoin traders base their decisions on extensive fundamental analysis, considering factors like market trends, upcoming technological developments, and potential regulatory changes in the cryptocurrency landscape. Unlike day trading or scalping, position trading requires less time dedicated to frequent market monitoring but demands a thorough understanding of the broader economic and technological factors affecting the market.

Patience and a strong belief in Bitcoin’s long-term potential are essential for position trading, as it involves weathering short-term market volatility with an eye on long-term gains.

Step-By-Step Guide: How To Trade Bitcoin

Trading Bitcoin can seem daunting at first, but by following a structured approach, you can navigate the market effectively. Here is a step-by-step guide to help you start your Bitcoin trading journey:

Achieving profitability as a Bitcoin trader hinges on a nuanced understanding of market dynamics and disciplined strategy execution. Success involves identifying and capitalizing on Bitcoin’s price movements, underpinned by a robust grasp of market trends and drivers.

Key to profiting is the application of advanced technical analysis, incorporating chart patterns and predictive indicators to gauge future price movements. Additionally, astute risk management, characterized by calculated position sizing and the judicious use of stop-loss orders, plays a pivotal role in safeguarding against market volatility.

Seasoned traders often emphasize the importance of emotional discipline, avoiding impulsive decisions driven by market euphoria or panic.

How To Trade Bitcoins For Beginners (Spot Market)

For newby Bitcoin traders, the spot market is an ideal starting point. In the spot market, traders buy and sell Bitcoin for immediate delivery, reflecting real-time supply and demand. The immediate trading activities of traders directly determine Bitcoin’s price in this market. It offers a direct and transparent trading method, with transactions settled instantly at prevailing market prices.

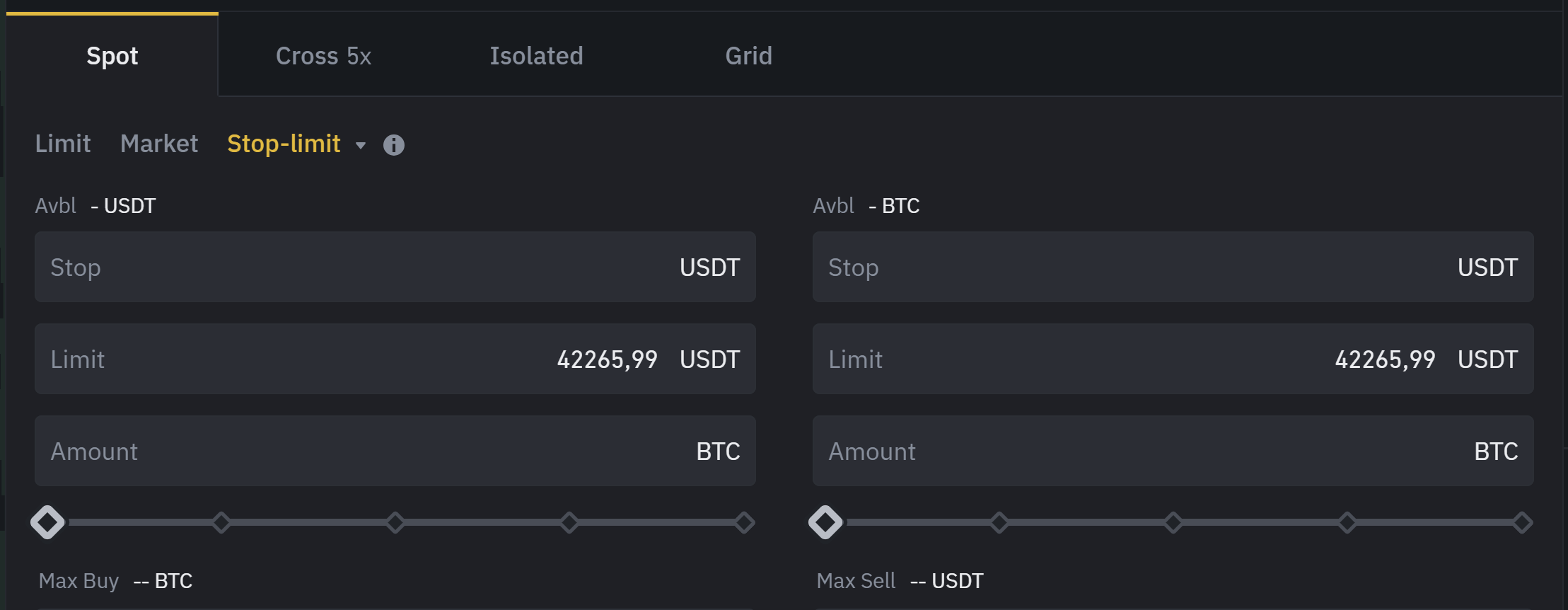

Types Of Orders Explained

How To Trade Bitcoins On The Spot Market

Beginners should select trading platforms known for their ease of use, robust security features, and educational resources. Look for platforms with a high reputation and low Bitcoin trading fees.

Navigating the order book can be crucial. The order book is a real-time ledger of all buy and sell orders in the market. It shows the depth of the market, indicating how many orders exist at various price levels. Beginners can use this to gauge market sentiment and potential price movement directions.

Beginners should start with small investments to minimize potential losses. Understand the volatility of the Bitcoin market and be prepared for price fluctuations. Use stop-loss orders to automatically sell your Bitcoin if the price falls to a certain level, thus limiting your loss.

How To Trade Bitcoin Futures

Trading Bitcoin futures primarily involves dealing with perpetual contracts, a distinct type of futures contract without an expiry date. This allows traders to hold positions indefinitely, providing more flexibility compared to traditional futures. Here’s a guide on how to trade Bitcoin futures:

How To Trade Bitcoin Options

Bitcoin options are financial derivatives that give the holder the right, but not the obligation, to buy or sell Bitcoin at a predetermined price before a certain expiration date. Here’s a guide on how to trade Bitcoin options:

Options Types: Understand the two types of options – ‘Call options’ allow buying Bitcoin at a specific price, while ‘Put options’ allow selling it at a set price.

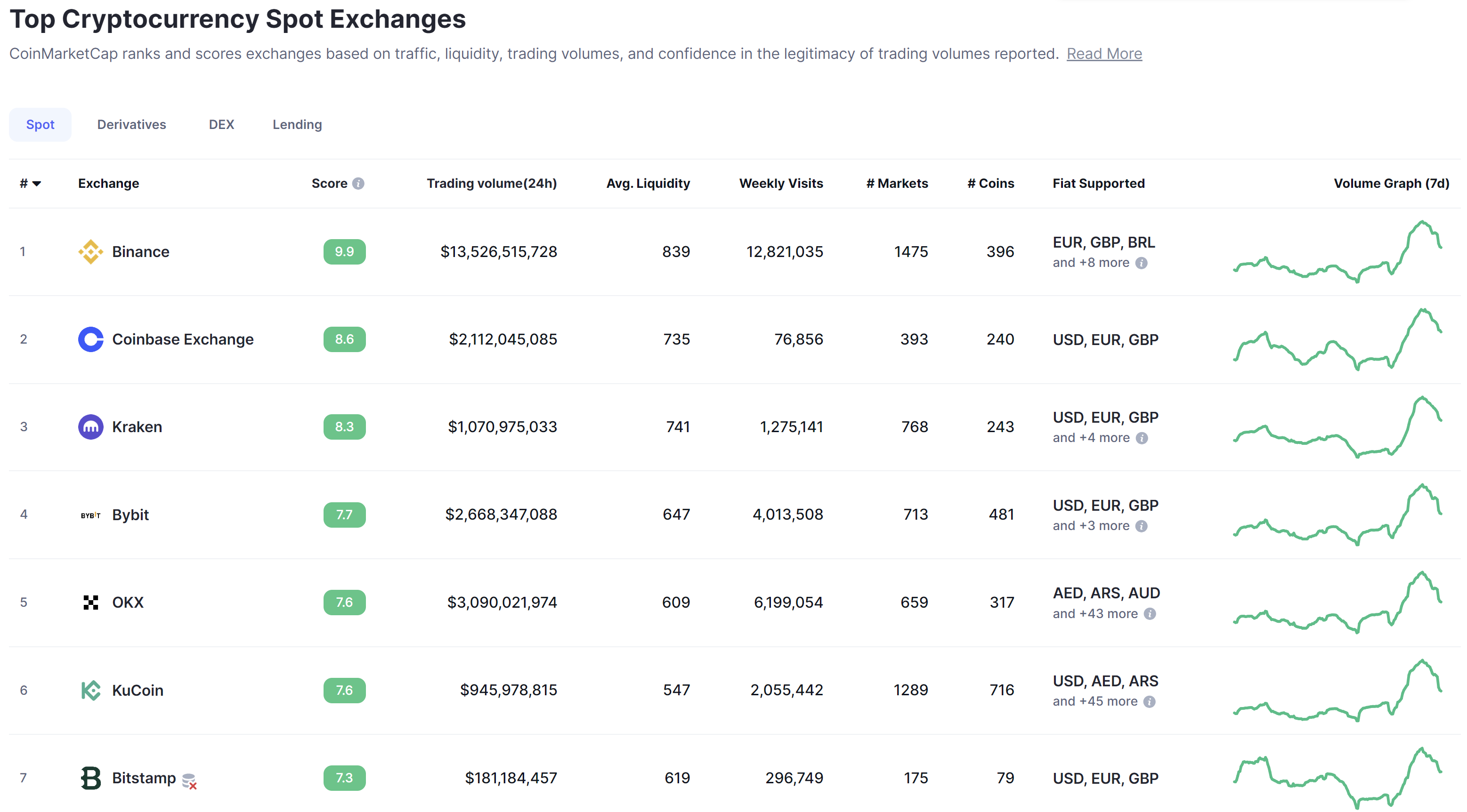

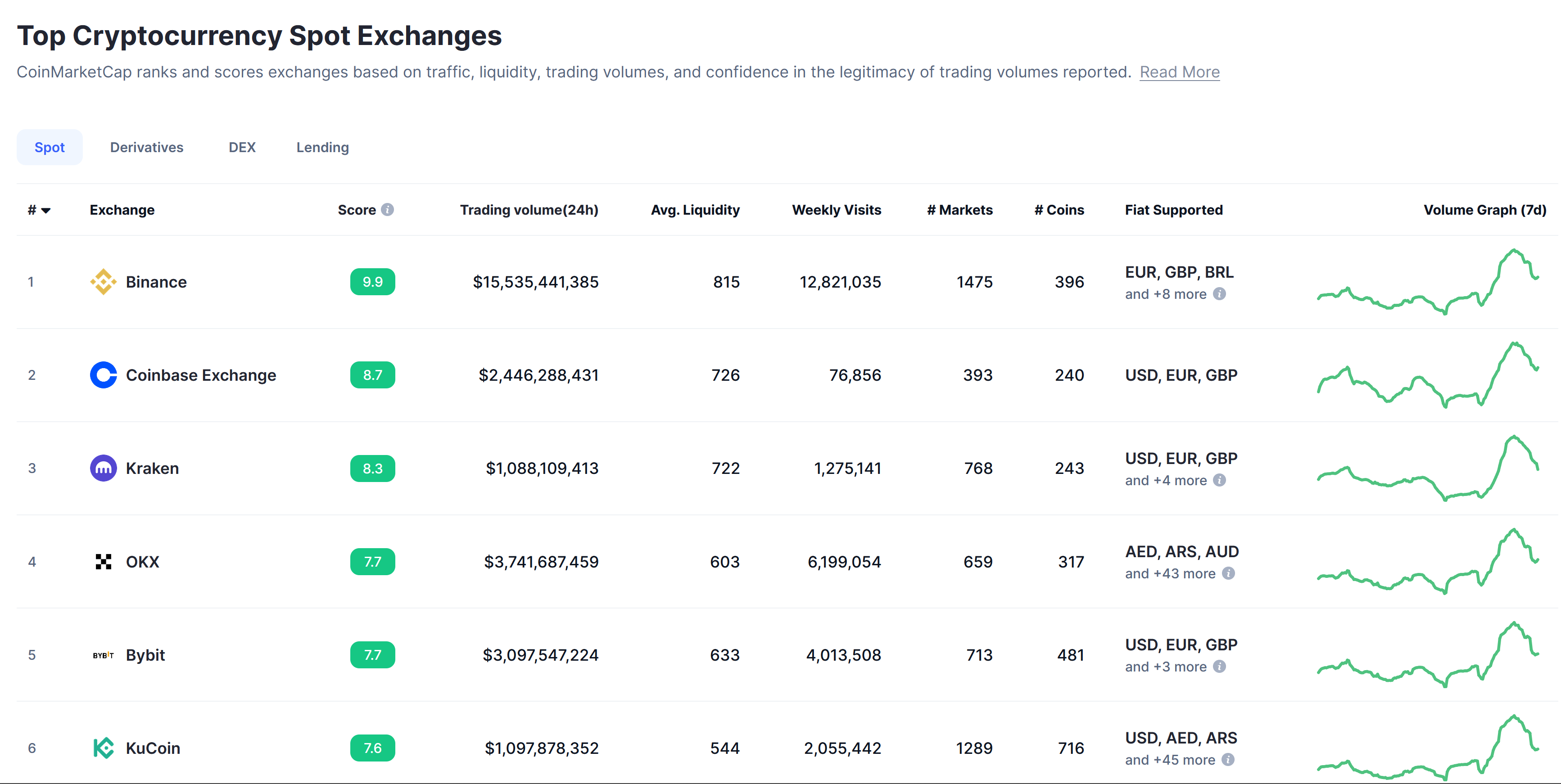

Choosing the best platform to trade Bitcoins requires considering various factors such as security, user interface, fees, liquidity, and available features. Based on the latest data from CoinMarketCap regarding spot trading volume, here are some of the top cryptocurrency exchanges:

Where To Trade Bitcoin? Key Criteria

Selecting the right platform is a critical step in your Bitcoin trading journey. The best platform for trading Bitcoins not only aligns with your trading style and goals but also offers security, functionality, and reliability. Here are key factors to consider when choosing your trading platform:

Successful Bitcoin trading often hinges on the use of key indicators to make informed decisions. These indicators provide insights into market trends and potential future movements. Here are some essential indicators used in Bitcoin trading:

Trade Bitcoin With On-Chain-Indicators

In addition to traditional technical indicators, on-chain indicators specific to Bitcoin provide deep insights into the underlying blockchain dynamics, helping traders make informed decisions. Glassnode, a leading blockchain data and intelligence platform, highlights several key on-chain indicators:

Combining these on-chain indicators with traditional technical tools offers a comprehensive approach to trading Bitcoin, allowing traders to glean insights from both market sentiment and fundamental blockchain data.

Trading Bitcoin, like any financial venture, comes with its own set of risks and rewards. Understanding and balancing these aspects is crucial for successful trading.

Managing Risks As Bitcoin Trader

The Reward Potential In Bitcoin Trade

How To Day Trade Bitcoin?

Day trading Bitcoin involves executing short-term trades to capitalize on price fluctuations within a single day. It requires a thorough understanding of market trends, technical analysis, and disciplined risk management.

How To Trade Bitcoin and Make Profit?

Profitable Bitcoin trading involves a deep understanding of market trends, utilizing effective trading strategies, and employing robust risk management to mitigate risks while capitalizing on market opportunities.

Where To Trade Bitcoin?

Bitcoin can be traded on various cryptocurrency exchanges and platforms. Popular exchanges include Binance, Coinbase, Kraken, Bybit, OKX, and KuCoin.

How Do You Trade In Bitcoins?

Trading in Bitcoins involves buying and selling on a cryptocurrency exchange, using different trading strategies like day trading, swing trading, or position trading.

Can You Day Trade Bitcoin?

Yes, you can day trade Bitcoin. It involves making multiple trades within a single day, taking advantage of Bitcoin’s price volatility.

How To Trade Bitcoins?

Trading Bitcoins involves choosing a reliable trading platform, analyzing the market, executing trades based on your strategy, and managing your risks.

How To Trade In Bitcoin?

To trade in Bitcoin, set up an account on a cryptocurrency exchange, deposit funds, decide on a trading strategy, and start executing buy or sell orders based on market analysis.

How To Trade Bitcoin Options?

Trading Bitcoin options involves buying or selling options contracts on Bitcoin, predicting future price movements. It requires understanding of options trading and market analysis.

How To Trade Bitcoins For Cash?

You can trade Bitcoins for cash by buying and selling your Bitcoin on a cryptocurrency exchange.

How Do You Trade Bitcoin?

Trading Bitcoin involves analyzing the market, setting up a trade on a cryptocurrency exchange, and managing the trade with proper risk management techniques.

How To Trade Bitcoin Futures?

Bitcoin futures trading involves entering contracts to buy or sell Bitcoin at a future date at a predetermined price. It requires knowledge of futures markets and risk management.

How to Trade Bitcoins For Beginners?

Beginners should start by understanding the basics of Bitcoin, choosing a user-friendly trading platform, practicing with small amounts, and using simple trading strategies on the spot market.

How To Trade Bitcoins For Profit?

To trade Bitcoins for profit, implement a well-researched trading strategy. You also need to manage risks effectively, and stay informed about market trends and news.

How To Trade Bitcoins Online?

Trading Bitcoins online involves registering on a cryptocurrency exchange, depositing funds, conducting market analysis, and executing trades through the platform’s interface.

How To Trade Bitcoins To Make Money?

To make money trading Bitcoins, develop a solid trading strategy, utilize technical analysis, manage risks wisely, and stay adaptive to market changes.

How to trade crypto – a question that resonates with many in the rapidly evolving digital asset space. Whether you’re a novice eager to learn how to crypto trade or an experienced crypto trader looking to refine your strategies, this guide is your comprehensive resource. From understanding the best time to trade crypto to exploring the best cryptos to day trade, we’ll delve into every aspect you need to know.

A successful crypto trader is not just someone who knows how to trade crypto, but an individual equipped with a unique set of skills, especially in technical analysis. Technical analysis is the cornerstone of crypto trade decisions. It involves interpreting market data and price charts to forecast future price movements. This skill is particularly crucial for those who day trade crypto or engage in short-term trading strategies like crypto scalping.

Technical analysis in crypto trading often involves understanding and utilizing various tools and indicators. For instance, a proficient crypto trader should be adept at reading candlestick charts, which are fundamental in identifying market trends and potential reversals. Knowledge of trend lines, chart patterns, indicators like the Relative Strength Index (RSI) and the Moving Average Convergence Divergence (MACD) as well as moving averages is also vital in making informed decisions about when to enter or exit a trade.

Apart from technical skills, a crypto trader must also have a strong psychological makeup. The ability to remain calm under pressure and maintain discipline, especially in volatile market conditions, is what separates seasoned traders from novices. This mental fortitude is especially important in high-stakes trading scenarios, such as when one is learning how to leverage trade crypto or engage in crypto futures trading.

Trading cryptocurrency offers unique advantages that make it an appealing market for many investors and traders. Here are some key reasons why people choose to trade crypto:

When it comes to crypto trading , the initial steps involve laying a strong foundation and acquiring the necessary tools and mindset. Here’s a fundamental guide to getting started:

Choosing a crypto trade is one of the first challenges for potential crypto traders. You need to align your strategy with your goals, risk tolerance, and time commitment. Each strategy comes with its own set of advantages and challenges.

Day-Trade Crypto

Day trading in crypto involves buying and selling cryptocurrencies within the same trading day. Traders capitalize on short-term market movements to make profits.

Pros: The primary advantage of day trading is the potential for quick profits due to the high volatility of the crypto market. It also limits exposure to overnight market risks since positions aren’t held beyond a day. Day trading is highly engaging and can be very rewarding for those who have the time to monitor the market constantly.

Cons: However, day trading is time-consuming and requires constant market analysis, which can be stressful. It also demands a good understanding of market trends and technical analysis. The high frequency of trades can lead to significant transaction fees, and the fast-paced nature of this strategy can amplify losses just as quickly as gains.

Crypto Scalping

Scalping is a strategy where crypto traders make profits from small price changes, often entering and exiting positions within minutes.

Pros: Scalping allows traders to profit from even the smallest market movements, making it a good strategy in both volatile and stable market conditions. It also reduces exposure to long-term market risks.

Cons: Scalping requires immense discipline and a strict exit strategy to prevent significant losses. It’s a high-intensity strategy, demanding constant attention and quick decision-making. Scalping also typically involves a large number of trades, which can result in high transaction costs.

Crypto Swing Trading

Swing trading involves holding onto cryptocurrencies for several days or weeks to capitalize on expected upward or downward market shifts.

Pros: This strategy is less time-consuming than day trading or scalping, allowing traders more time to analyze the market. Swing traders can capture more significant price shifts than day traders, potentially leading to higher profits.

Cons: Swing trading involves the risk of holding positions overnight or longer, exposing the trader to unforeseen market changes. It also requires a good understanding of market trends and the patience to wait for the right moment to enter or exit a trade.

Position Trading

Position trading is a long-term strategy where traders hold their positions for months or even years, based on their analysis of long-term market trends.

Pros: This strategy requires less time to monitor daily market fluctuations and can yield substantial returns if the long-term market trend predictions are accurate. Position traders are less affected by short-term volatility.

Cons: The main downside is that capital is tied up for a long time, making it unavailable for other investment opportunities. It also requires a deep understanding of the market and strong conviction in one’s predictions, as holding positions through market ups and downs can be challenging.

Trading crypto can seem daunting at first, but by following a structured approach, you can navigate the process with greater ease. Here’s a step-by-step guide to help you get started:

Preparation: How To Become A Good Crypto Trader

Start Crypto Trading

Securing your cryptocurrencies is a crucial aspect of trading and investing in the digital currency space. Here’s how you can ensure the security of your assets:

Selecting the best cryptos to day trade is a nuanced process that hinges on several key factors. As a day trader, your focus should be on finding cryptocurrencies that not only exhibit high volatility but also possess substantial liquidity and trading volume. This ensures that you can enter and exit positions quickly and at desirable prices.

Factors To Consider:

Liquidity is paramount in day trading. Highly liquid cryptocurrencies allow for smoother transactions without causing significant price shifts upon entry or exit. Larger, well-established cryptocurrencies like Bitcoin and Ethereum typically offer higher liquidity, making them reliable choices for day trading.

Trading volume is another critical aspect. In general, cryptos with high daily trading volumes are preferred as they indicate active trading activity, which in turn suggests more opportunities for price movements that day traders can exploit. On the other, a strategy can involve trading altcoins with low liquidity, making it vulnerable for larger price swings.

Beyond liquidity and volume, a crypto trader should also look at the technical aspects like chart patterns and indicators. Cryptocurrencies that show clear and predictable patterns can be more manageable for crypto traders who rely on technical analysis. Indicators such as moving averages, RSI, and MACD are tools often used to analyze and predict short-term price movements in these volatile markets.

Furthermore, being cognizant of the current trends in the crypto market can provide an edge. For instance, if there’s growing interest in specific sectors like GameFi or AI altcoins, these could present unique trading opportunities. These sectors might exhibit increased volatility and trading volume, creating favorable conditions for day trading.

Overall, it’s crucial to balance technical considerations with a sense of market sentiment and news.

Selecting the best platform to trade crypto is a critical decision for any trader. Based on spot trading volume, here are the top platforms:

Where To Trade Crypto?

Choosing where to trade crypto involves careful consideration of various factors. Here’s a guide to help you make an informed decision:

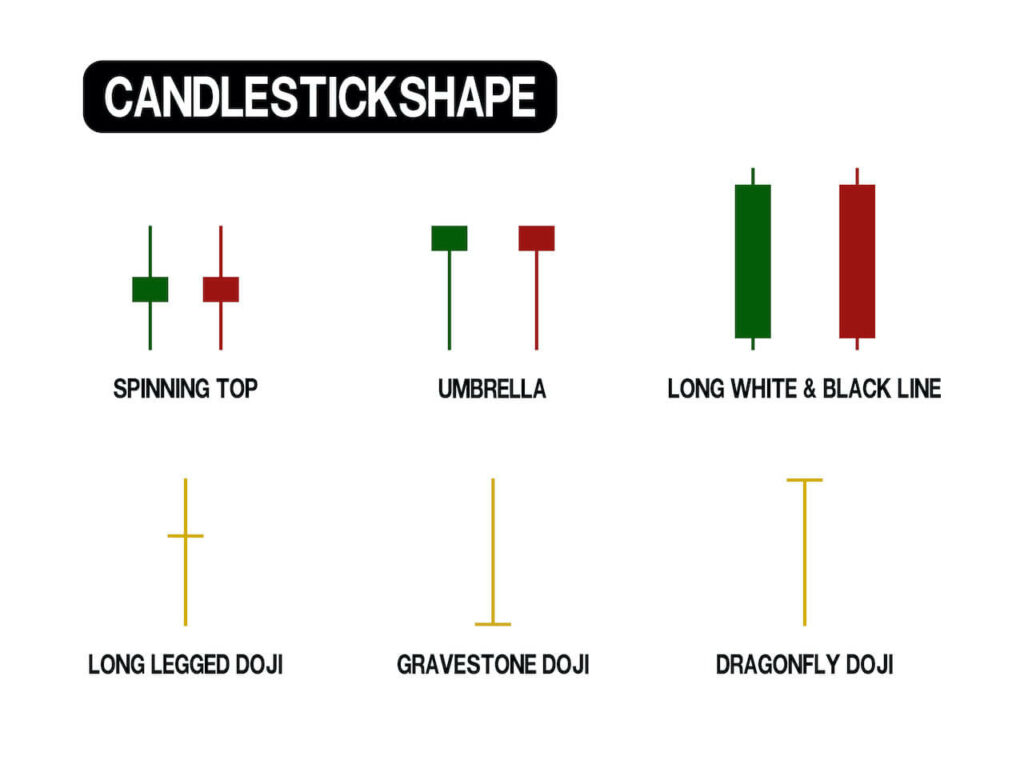

Candlestick Charts

Candlestick charts are essential for understanding market movements in crypto trading. Each candlestick represents price movements within a specific timeframe. The ‘body’ shows the opening and closing prices, while ‘wicks’ indicate the high and low. Crypto traders look for patterns like ‘Doji’ (indicating indecision) or ‘Bullish Engulfing’ (signaling a potential upward trend) to predict future price movements.

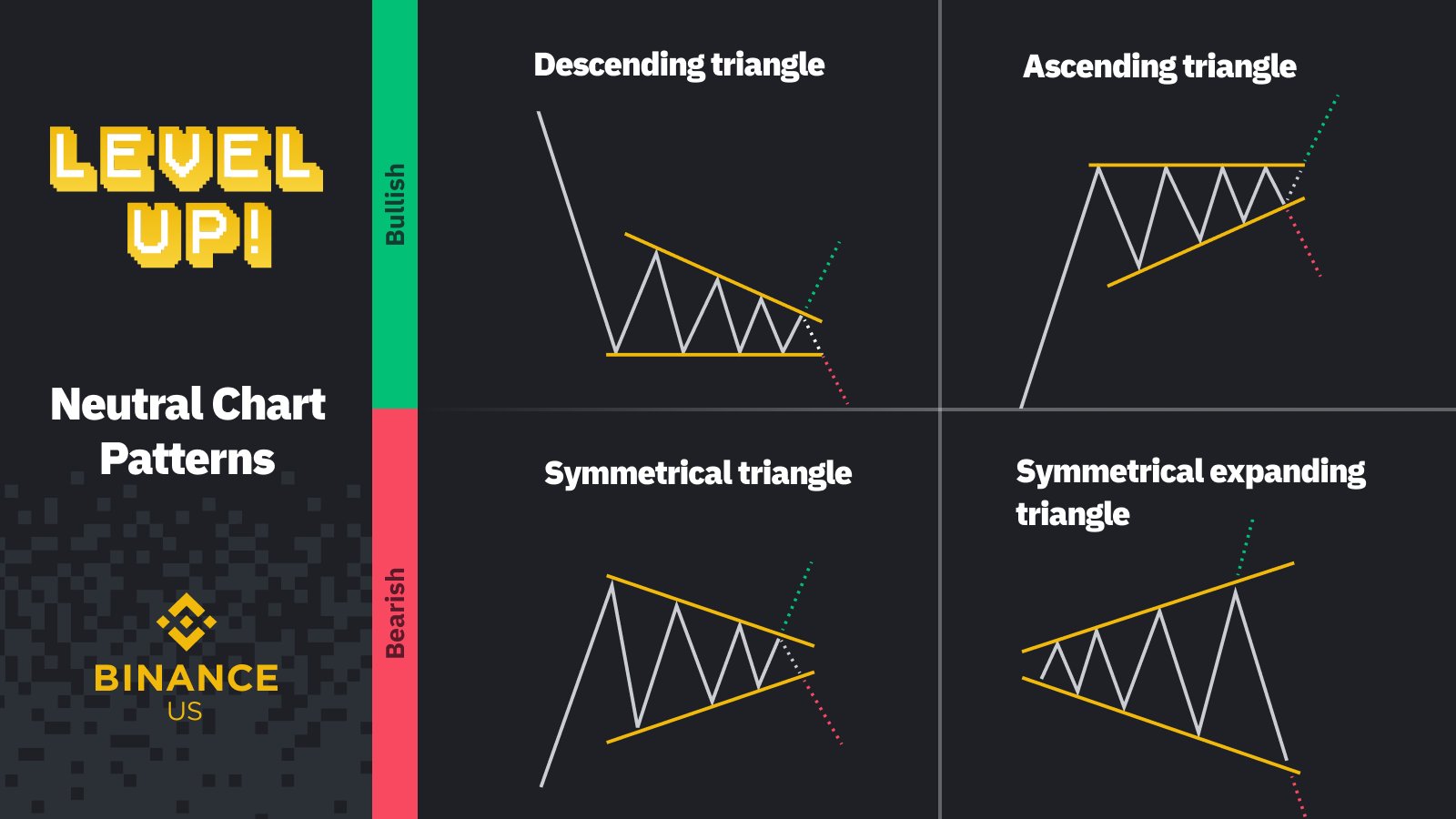

Trend Lines And Triangle Patterns

Both patterns are vital tools in technical analysis for crypto traders.

Trend Lines:

You draw straight lines on price charts that connect a series of highs or lows. In an uptrend, an upward trend line connects the higher lows, indicating support levels where the price gains strength and bounces upwards. In contrast, a downward trend line in a downtrend connects lower highs, marking resistance levels. Breaking through a trend line often signals a potential change in the market trend.

Triangle Patterns:

These are formed by drawing two converging trend lines as prices move in a narrowing range. There are three types:

Crypto traders use these patterns to make predictions about future price movements. A breakout above or below a triangle pattern often signals a strong move in the direction of the breakout. However, it’s crucial to confirm these signals with other indicators and market factors.

Moving Averages

Moving Averages (MAs) are crucial indicators in crypto trading, used to smooth out price fluctuations and identify trends. The two most common types are:

Crypto traders use MAs to identify support and resistance levels. For example, a rising MA indicates support, suggesting an uptrend, while a falling MA indicates resistance, suggesting a downtrend. MAs also serve in crossover strategies: A short-term MA crossing above a long-term MA signals a potential upward trend (bullish crossover), while crossing below indicates a potential downward trend (bearish crossover).

However, combining these indicators with other analysis tools is advisable, as they can lag the current market price due to their reliance on averaging past data.

Relative Strength Index (RSI)

RSI is a momentum indicator, ranging from 0 to 100, that assesses whether a crypto is overbought (above 70) or oversold (below 30). Crypto traders use it to spot potential reversal points. For instance, if RSI rises above 70, it signals that the market is red hot, while a value above 90 is almost a guarantee for a near term price pullback.

MACD (Moving Average Convergence Divergence)

The MACD consists of two lines – the MACD line (the difference between two EMAs) and a signal line. When the MACD crosses above the signal line, it suggests a bullish trend, and a cross below indicates a bearish trend. Divergences between MACD and price can also indicate potential market reversals.

Advanced crypto trading, such as day trading and options trading, requires a sophisticated understanding of the market and specific strategies.

How To Day Trade Crypto

Day trading crypto is about exploiting short-term market fluctuations. It’s not just about buying low and selling high within a day but also involves nuanced strategies like playing on news-based volatility or using specific technical indicators for quick entry and exit points. An example is a day trader focusing on a particular cryptocurrency that has announced a major partnership. The crypto trader uses tools like RSI and MACD to determine the optimal entry and exit points within the day, capitalizing on the news-induced volatility.

How To Trade Crypto Options

Crypto options trading involves more complex strategies compared to regular trading. For instance, a crypto trader might buy a ‘call option’ if they anticipate the price of a cryptocurrency to rise before a specific date. Conversely, a ‘put option’ might be purchased if they expect the price to fall. This method requires a deep understanding of market sentiment and potential triggers for price movements. A practical example would be a crypto trader buying options ahead of a significant event, like a blockchain upgrade, betting that this event will cause substantial price movement.

Two major styles of options exist: European-style, which can only be exercised on the expiration date, and American-style, which can be exercised any time before expiration. For trading crypto options, some of the most renowned platforms include Binance, Deribit (known for being the most liquid crypto options trading platform), OKX, Bybit, Delta Exchange, and CME (a regulated exchange in the United States).

Effective risk management is vital in crypto trading to protect your investments and ensure long-term success.

Setting Stop-Loss Orders: Stop-loss orders are an essential tool. They automatically sell an asset when it reaches a certain price, limiting potential losses. If you buy a cryptocurrency at $100 and set a stop-loss order at $90, the asset will automatically sell if its price drops to $90, thereby limiting your loss to 10%.

Diversifying Your Portfolio: Diversification involves spreading your investments across various assets to reduce risk. Instead of putting all your capital into a single cryptocurrency, diversify across different coins, sectors, or even different asset classes.

Avoiding Emotional Trading: Emotional trading often leads to impulsive decisions, like chasing losses or making overconfident trades. To combat this, develop a trading plan and stick to it, making decisions based on logic and analysis rather than emotion. It’s also helpful to set predetermined entry and exit points for trades to avoid emotional biases.

Implementing these risk management strategies can significantly improve your trading outcomes and help in maintaining a more stable and sustainable trading career in the volatile crypto market.

How To Trade Crypto?

Begin by choosing a reliable crypto trading platform, set up and fund your account, and educate yourself on the basics of cryptocurrencies and market trends. Develop a trading strategy based on your risk tolerance and goals, and start trading by making informed buy and sell decisions.

How To Day Trade Crypto?

Day trading involves buying and selling cryptocurrencies within the same day. Focus on understanding market trends, use technical analysis to make informed decisions, and always manage risks with stop-loss orders and disciplined trading practices.

When Is The Best Time To Trade Crypto In US?

Cryptocurrency markets operate 24/7, but the best time to trade can depend on market liquidity and volatility. Generally, overlapping hours between major financial markets (like the New York and London stock exchanges) can see increased activity.

What Is The Best Way To Trade Crypto?

The best way to trade crypto varies based on individual goals and risk tolerance. Options include day trading, swing trading, and long-term investing. Using a combination of technical and fundamental analysis is generally advised.

How To Leverage Trade Crypto?

Leverage trading in crypto involves borrowing funds to increase potential returns. Start by selecting a platform that offers leverage, understand the risks involved, use stop-loss orders to manage potential losses, and start with lower leverage to mitigate risk.

How To Trade Crypto Coins?

Trading crypto coins involves buying and selling different cryptocurrencies. Use a crypto exchange, stay informed about market trends and news, analyze price charts, and execute trades based on your analysis and strategy.

How Old Do You Have To Be To Trade Crypto?

The minimum age requirement to trade crypto varies by platform, but typically, you must be at least 18 years old.

How To Become A Crypto Trader?

Gain a thorough understanding of the crypto market, trading principles, and risk management. Practice with a demo account, stay updated with market news, and gradually build your trading experience and portfolio.

How To Trade Crypto And Make Money?

Profitable crypto trading requires in-depth market knowledge, a well-thought-out strategy, disciplined risk management, and continuous learning. Focus on understanding market trends and technical analysis to make informed trading decisions.

How To Be A Crypto Trader?

Educate yourself about cryptocurrencies, trading strategies, and market analysis. Start with a demo account (or small amounts) to practice, choose a reliable trading platform, develop a risk management strategy, and continuously update your knowledge and skills.

How To Day Trade Crypto For Beginners?

Start with understanding the basics of the market and technical analysis. Practice with a demo account, develop a disciplined trading routine, use risk management tools like stop-loss orders, and stay informed about market news.

How To Margin Trade Crypto?

Margin trading involves borrowing funds to trade. Choose a platform that offers margin trading, understand the risks of amplified losses, use stop-loss orders, and start with small trades to gain experience.

How To Swing Trade Crypto?

Swing trading involves holding assets for several days to capitalize on expected directional moves. Study market trends (crypto bull runs vs. crypto bear markets). Also, use technical analysis to identify entry and exit points, and maintain a disciplined approach to trading.

How To Trade Crypto Futures In US?

Select a platform that offers crypto futures trading in the US. Understand the basics of futures contracts, the associated risks, and legal requirements. Use risk management strategies and stay updated with market and regulatory developments.

Can You Day Trade Crypto?

Yes, you can day trade crypto. It requires a deep understanding of the market, quick decision-making, and strong risk management strategies.

What Is The Best Time To Trade Crypto?

The best time to trade crypto can depend on individual trading strategies and market conditions. Generally, periods of high market activity, such as during overlapping trading hours of major financial markets, can offer increased opportunities.

Tron’s native token [TRX] traded at a premium of up to 17% on recently-hacked exchange Poloniex over the weekend, creating a potentially lucrative arbitrage trade.

The proof of concept enabled devices to act autonomously and produce accurate information to support global trade processes, the companies said.

Cross margin uses whole balance, and isolated margin allocates specific collateral for each trade, encouraging diversification.

Iran’s Trade Ministry has approved the use of cryptocurrency payments for imports in a bid to bolster trade in the country.

Ethereum shows strength as MATIC rises 7%

Global market jitters spread to crypto at the weekend, with Bitcoin falling to $42K before bouncing to almost $50K.

Markets are digesting multiple uncertainties, including the many unknowns of the Omicron variant, and the possibility of an end to pandemic-era central bank stimulus. Combined with thin weekend trading volume and the build up of leverage, this led to cascading sell orders and liquidations across the crypto market on Saturday. Nevertheless, El Salvador’s President Nayib Bukele was not deterred and joined MicroStrategy in buying the dip.

In a show of strength, Ethereum outperformed Bitcoin during the downturn. The leading smart contract platform stayed above $4K, showing only 6% weekly losses compared to Bitcoin’s 15%. Even stronger, Layer 2 solution Polygon (MATIC) emerged from the downturn with 6% weekly gains.

This Week’s Highlights

Ethereum outperforms Bitcoin

Ethereum showed relative strength during the weekend drop; losing less value and recovering faster, in line with the trend of recent months.

Both cryptoassets have fallen significantly from the record highs set in November, yet since December 2020 Bitcoin has doubled in value, while Ethereum has gained about 530%. In response, some traders are calling for a “flippening” where Ethereum overtakes Bitcoin as the biggest cryptoasset.

The outperformance could be down to Bitcoin’s more established role as a macro asset that trades on economic data and global trends, compared to Ethereum which is more associated with the hottest crypto growth sectors such as decentralized finance (DeFi), non-fungible tokens (NFTs), and the metaverse.

Polygon’s MATIC rises against the market

A flash of green in a sea of red, Polygon’s MATIC token pushed against the falling market to finish the week with 6% gains.

The buoyancy of the Layer 2 network could be attributed to the announcement of a new partnership with GameOn Entertainment to build NFT games on the network, and the recent release of a new JavaScript library.

Elsewhere, few other smart contract platforms matched MATIC’s resilience. Algorand managed to stay flat and hold against the downturn, while Polkadot and Cardano suffered double-digit losses.

eToro lists Celo

eToro’s expansion of supported cryptoassets continues with the listing of Celo.

Celo is the native token of the Celo platform, which aims to use blockchain to bank the unbanked, making it possible for anyone to settle payments in crypto between mobile devices without the need for financial institutions.

The launch brings the total number of cryptoassets available on eToro to 41.

On the Digest & Invest podcast this week…

Tune in to Digest & Invest to hear eToro’s Sam North interview the CEO of Chiliz and Socios.com Alexandre Dreyfus.

Week ahead

The swing lower has shifted market sentiment to Extreme Fear, as traders worry that more downside could be in store.

On the upside, others argue that the wipeout has washed out excess leverage in the market, potentially setting up healthier conditions for a more sustainable price rise in the near future.

In the week ahead, regulatory developments could set the tone for trading as a handful of crypto industry executives are set to testify before US lawmakers on Wednesday.

Image: Pixabay

Bitcoin and ether suffered a major flash crash over the weekend, sending cryptoasset values down by some 20% at points. Prices have now recovered somewhat but both cryptos remain trading well below pre-weekend levels.

Bitcoin began last week trading in the $57,000 range, with some movement during the week, but nothing remarkable. This changed on Friday however as the cryptoasset began to fall precipitously. BTC declined to a low of $45,412 in a matter of hours – a near 20% collapse.

Ether likewise fell victim to the flash crash. Having traded up toward $4,700 midweek ETH began to fall in trading on Friday from around $4,600 to a low of $3,652 – a fall of over 20%.

Both cryptoassets have regained a measure of stability since, with prices rebounding modestly. BTC is now trading around $47,900 while ETH is trading around $4,000.

Speculation has been rife over what caused the flash crash, with some analysts citing the expiry of leveraged positions. Other evidence meanwhile points to significant increased activity with investors moving cryptoassets from wallets to exchanges – making reaction to price movement more precipitous when it comes.

The wider backdrop of investment market fears over Omicron seems to be in play too however.

Bitcoin spot ETF launches in Canada

Major asset manager Fidelity Investments has a bitcoin spot ETF in Canada.

The ETF – named the Fidelity Advantage Bitcoin ETF invests directly in bitcoin or through derivative instruments. At least 98% of the ETF’s holdings will be stored in cold wallets.

The fund is listed on the Toronto stock exchange with the ticker FBTC. The fund will have a 0.4% management fee for investors with customers given the option of investing via Canadian or US dollars.

Canada is a popular destination for crypto ETFs with more than 20 available to Canadian investors. Fidelity’s offering however is unique among crypto ETFs in offering physical holdings of bitcoin rather than trading on futures.

MercadoLibre to accept cryptoassets

Major Latin American online marketplace MercadoLibre now allows customers in Brazil to exchange and pay for products in cryptoassets.

The firm has announced users in Brazil will be able to buy, hold and sell bitcoin, ether and a U.S Dollar based stablecoin, Pax Dollar.

The combination of two major cryptoassets and a stablecoin on MercadoPago, the payments platform of MercadoLibre, will enable customers to conduct transactions for products priced in fiat currency using their cryptoassets.

MercadoPago is authorised by Brazil’s central bank, making it easier for the firm to begin its crypto operations there. But MercadoLibre more generally operates in many Central and South American countries, suggesting a potential customer base for new crypto payments of millions as it expands its offering.

Square rebrands in wake of Dorsey Twitter departure

Payments firm Square has announced it is rebranding to ‘Block’, days after its chief executive Jack Dorsey stepped down as head of Twitter.

The company said in its announcement the new name had many associations, but among them was the use of Blockchain technology in some of its projects.

Square Crypto, a separate initiative of the firm which aims to promote the use of bitcoin is also changing its name to Spiral.

The Square brand won’t be disappearing though – Square remains the name of the firm’s seller business, which is among a stable of brands that now also includes Cash App, TIDAL and TBD54566975.

Jack Dorsey announced his sudden departure from Twitter last week, with many speculating he would move to focus more of his time on crypto and blockchain projects, with his now rebranded firm Block at the forefront of this.

Meta crypto head departs firm

The head of Meta’s (formerly Facebook) crypto arm is departing the firm as the launch of stablecoin Diem remains in doubt.

David Marcus announced he would be departing the firm after seven years, having worked on Meta’s financial offering since May 2018, when the company’s Libra crypto project was first announced.

The project later morphed into a payments wallet called Novi with the cryptoasset to go with it called Diem. The crypto wallet has since launched, but the launch of Diem remains elusive.

Meta has faced significant hurdles in the launch of its crypto products. Commenting on the departure, Meta chief executive Mark Zuckerberg commented on Marcus’s post: “We wouldn’t have taken such a big swing at Diem without your leadership, and I’m grateful you’ve made Meta a place where we make those big bets.”

This is a marketing communication and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without having regard to any particular investment objectives or financial situation, and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past performance of a financial instrument, index or a packaged investment product are not, and should not be taken as a reliable indicator of future results.

All contents within this report are for informational purposes only and does not constitute financial advice. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared utilizing publicly-available information.

Cryptoassets are volatile instruments which can fluctuate widely in a very short timeframe and therefore are not appropriate for all investors. Other than via CFDs, trading cryptoassets is unregulated and therefore is not supervised by any EU regulatory framework. Your capital is at risk.

Image: Pixabay

First major upgrade in four years set to accelerate Bitcoin innovation

After briefly eclipsing all-time highs on shocking inflation figures, Bitcoin settled down to finish the week with 2% losses as the long-awaited Taproot upgrade was activated

At its peak on Wednesday, Bitcoin flirted with the $69K level. Within a few hours however, fresh fears of an Evergrande-induced financial collapse swept over the market, dragging cryptoassets down alongside the S&P 500. Adding to the blow, the Securities and Exchange Commission then denied another spot Bitcoin ETF application on Friday.

This volatility capped gains in the altcoin market, with most smaller cryptoassets finishing the week in the same place they started. However, Zcash, and Litecoin, which both share DNA with Bitcoin, enjoyed double-digit gains as their big brother got an upgrade.

This Week’s Highlights

Taproot upgrade set to accelerate Bitcoin innovation

Bitcoin’s first major upgrade in four years rolled out on Sunday, introducing Schnorr signatures and scripting capabilities to the flagship cryptoasset.

Known as Taproot, the upgrade will allow for greater levels of privacy, cheaper transaction costs (particularly for more complex transactions), and improved programmability for simple applications such as multisignature schemes.

The additional functionality is expected to accelerate Bitcoin innovation over the coming years, and could boost valuations too. SegWit, Bitcoin’s last major upgrade, took place in August 2017 and was followed by a monster rally that saw prices quadruple.

Bitcoin hits record high on inflation fears

Ever since legendary investor Paul Tudor Jones said Bitcoin was the “fastest horse in the race”, the cryptoasset been more widely considered an inflation hedge and a viable alternative to gold.

This safe haven appeal was showcased on Wednesday, when Bitcoin bolted out the stable on hot inflation data, leaving gold behind as it surged beyond record highs near $69K.

Although the price fell shortly afterwards on fears of an Evergrande default, Bitcoin’s reaction to the news cemented its newfound role as an inflation hedge. This reflects the view of Bloomberg analysts, who found in a recent study that “the importance of inflation and hedging against uncertainty” have become more important drivers for Bitcoin, “accounting for 50% of price moves in the latest cycle relative to 20% in 2017.”

eToro lists SushiSwap, Axie Infinity, Quant, and Chiliz

eToro has listed SushiSwap (SUSHI), Axie Infinity (AXS), Quant (QNT), and Chiliz (CHZ), taking the total number of cryptoassets available on the investment platform to 40.

SushiSwap is a decentralized exchange based on the automated maret market model (AMM), Axie Infinity is a Pokémon-inspired blockchain-based game, and Quant is an enterprise-grade interoperability solution for connecting public blockchains.

Last but not least, Chiliz is the leading blockchain for sports and entertainment — an industry close to eToro’s heart as one of Europe’s biggest football club sponsors.

Note: These new cryptoassets are not yet available in the US.

Week ahead

As Bitcoin consolidates around all-time highs, traders are keenly awaiting a catalyst to tip prices towards $70K, or the much-anticipated meme level of $69,420.

In the week ahead, prices could be buoyed by talk of inflation, which is likely to remain a hot topic amid earnings reports in traditional markets.

Elsewhere, Stellar could be in the spotlight as the altcoin hosts its annual community conference on Wednesday and Thursday.

New eToro additions Polkadot and Solana lead altcoin rally with double-digit gains

Bitcoin has soared above $60K, getting tantalizingly close to all-time highs on reports that the first Bitcoin futures exchange-traded fund (ETF) has been approved by the U.S. Securities and Exchange Commission (SEC).

This bombshell blasted Bitcoin 8% higher over the last week, boosted further by Russian President Vladimir Putin who told CNBC on Wednesday that he believes crypto has value. Meanwhile, JPMorgan CEO Jamie Dimon took the opportunity to assert his own view that “Bitcoin is worthless”, two weeks after his bank released a note that said institutions are replacing gold with Bitcoin.

Elsewhere, recent eToro additions Polkadot, Polygon, and Solana pushed ahead of the market with double-digit gains all round. Shiba fell down in exhaustion with 11% weekly losses after a mega rally, and Dogecoin made a half-hearted attempt to catch up with 4% gains.

This Week’s Highlights

Bitcoin celebrates ETF approval

In a monumental victory for crypto, the Securities and Exchange Commission (SEC) is set to let the first U.S. Bitcoin futures ETF launch on Monday after years of rejected applications.

Sources said to be familiar with the matter told CNBC that the SEC isn’t likely to block the ETFs proposed by ProShares and Invesco, triggering a rally that saw Bitcoin break through $60K, for the first time since April of this year.

Although these ETFs have attracted criticism for being backed by futures contracts and not the underlying asset, they could still have big implications for Bitcoin — allowing tax-sheltered and retirement accounts to easily get exposure, and potentially opening the cryptoasset to a much broader audience.

Polkadot pushes towards $50 on parachain milestone

While all eyes were on Bitcoin, Polkadot quietly surged more than 20% as the blockchain platform announced it was ready to roll out the final piece of its roadmap.

On Wednesday, the team announced a date for the launch of parachains. These are independent chains that can issue their own tokens and be tailored to a specific use case, while still connecting back to the main Polkadot chain.

Slots for parachain development will be sold via auctions starting on November 11th, and are expected to reduce the circulating supply of Polkadot by requiring participants to lock up the asset for the duration of the parachain lease.

eToro adds Solana to investment platform

eToro has added Solana (SOL) to its selection of cryptoassets. The SOL token powers a blockchain platform that claims to be able to support 50,000 transactions per second without sacrificing decentralization.

Solana joins the recent additions of Filecoin (FIL) and Polkadot (DOT), bringing the total number of cryptoassets available on eToro to 32.

Week ahead

The last time Bitcoin approached all-time highs at $20K, it was beaten back fiercely for weeks before it finally broke though.

This time however, the amount of Bitcoin held on exchanges is approaching all-time lows — suggesting traders have no intention of selling and could be moving funds to wallets for long-term storage.

On the bearish side, Pantera Capital CEO Dan Morehead anticipates that the ETF launch could be a classic “sell the news” moment, and trigger a similar dump to that seen after the CME’s listing of Bitcoin futures in December 2017.

Image by Niek Verlaan from Pixabay

Bitcoin soared last week, closing back in on its all-time high (ATH) as investors bought the news of a new bitcoin ETF.

After the confirmation of a bitcoin ETF (more below) by the US Securities and Exchange Commission (SEC), the price began to pop. Having traded as low as $54,611 on Wednesday, BTC soared 14% to reach a high of $62,516. At the time of writing the cryptoasset is trading around $61,700.

The turnaround for BTC has seen it close in on its previous ATH – $63,569 – set on 14 April this year. Investors will now be watching closely to see if momentum is sustained early this week to tip over that threshold.

Ether meanwhile has experienced similar gains, although it is still a little further off from its previous ATH. ETH traded as low as $3,419 on Monday before rising across the week to a high of $3,957. ETh previous ATH came on 12 May when it reached $4,177. It is currently trading around $3,820.

Grayscale drops bitcoin ETF hint

Cryptoasset management firm Grayscale has given its biggest indication yet it plans to convert its bitcoin trust into a physically settled exchange-traded fund (ETF).

While not confirmed at the time of writing, chief executive Barry Silbert hinted in a two-word tweet that the firm may soon switch up its trust to an ETF structure. The thread came as the CEO criticised futures-backed bitcoin ETFs saying: “Friends don’t let friends buy and hold futures-based ETFs.”

The pointed remark comes after the approval of the ProShares ETF – which is a futures-based bitcoin fund. The announcement boosted bitcoin’s price as investors see support from regulators for crypto-based funds as a seal of approval for their activities.

Putin gives crypto seal of approval

Russian President Vladimir Putin has come out with a relatively dovish stance on cryptoassets.

While not outing himself as an enthusiast, speaking to CNBC last Thursday the Russian leader expressed his relative amenability to crypto.

Putin said in the interview cryptocurrency: “has the right to exist and can be used as a means of payment.” He also added it was too soon to discuss the idea of trading oil and other commodities via crypto, which forms a large part of Russia’s export base.

Putin’s relative amenability to crypto likely comes as Russia struggles with difficulties in accessing international capital in the form of US dollars. The Eurasian nation has been hit by sanctions since its 2014 invasion of Crimea.

ARK Invest backs bitcoin ETF

Cathie Wood’s Ark Invest has backed a bitcoin futures ETF by putting the firm’s name to the fund.

The bitcoin futures ETF, which was filed for approval to the US SEC last Wednesday, will be called ARK 21Shares Bitcoin Futures Strategy ETF, carrying the ARKA ticker.

The ETF was filed by Alpha Architect and notes 21Shares as an investment adviser. ARK’s role in the ETF will be to provide marketing support alone, according to the filing.

Wood’s ARK firm is best known for its disruptive innovation-focused ETFs. The firm has struggled in 2021 with assets under management (AUM) plunging by some $8 billion.

ARK joins a growing list of asset managers looking to offer a bitcoin-related ETF, with more than 12 Wall Street firms now looking to offer such a product to its clients.

This is a marketing communication and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without having regard to any particular investment objectives or financial situation, and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past performance of a financial instrument, index or a packaged investment product are not, and should not be taken as a reliable indicator of future results.

All contents within this report are for informational purposes only and does not constitute financial advice. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared utilizing publicly-available information.

Cryptoassets are volatile instruments which can fluctuate widely in a very short timeframe and therefore are not appropriate for all investors. Other than via CFDs, trading cryptoassets is unregulated and therefore is not supervised by any EU regulatory framework. Your capital is at risk.

Image by Vined from Pixabay

Shiba Inu Token runs ahead with 100% gains

Bitcoin has surpassed $56K, reclaiming its trillion dollar market cap as the U.S. treasury

rules out minting a platinum coin of the same value.

The move higher comes on a raft of positive news: the U.S. Securities and Exchange Commission (SEC) has approved an exchange-traded fund (ETF) giving exposure to companies holding crypto, the investment firm founded by billionaire George Soros has revealed a Bitcoin allocation, and Brazil is following El Salvador by preparing a bill that will make the cryptoasset a recognized currency.

All this action has put Bitcoin center stage with over 15% weekly gains, but several altcoins have also put on a wild performance. Shiba Inu doubled in price and Stellar added 8% on a new partnership with MoneyGram. Meanwhile, Tezos gave back recent gains by sinking 14%.

This Week’s Highlights

Shiba shakes off the leash with 100% weekly gains

Shiba Inu Token has doubled in value over the last week, running ahead of the pack to reach twelfth place in the market cap rankings.

At its highest point, Shiba was up over 300%. This followed a tweet from Elon Musk about his dog Floki of the same breed, and the launch of 10,000 Shiboshi NFTs on the recently launched decentralized exchange ShibaSwap.

Meanwhile, Musk’s pet project Dogecoin is laying low. The rival canine-themed crypto finished the week with 4% losses.

Regulatory fears fade as White House weighs executive order

The rising prices come as the Biden administration considers an executive order to regulate the crypto industry.

This is widely expected to be bullish as it follows positive comments from the heads of U.S. government agencies. SEC Chair Gary Gensler told Congress on Tuesday that the agency has no plans to follow China into a crypto ban, joining Federal Reserve Chairman Jerome Powell, who expressed the same sentiment at the end of September.

Instead of a ban, more nurturing regulation might come in the form of the “Clarity for Digital Tokens Act of 2021.” This bill was proposed last Tuesday and would create a “safe harbor” for projects that raise funds to build decentralized networks.

eToro launches Filecoin and Polkadot on its investment platform

eToro has added two more assets to its crypto offering, bringing the total number of cryptoassets available to 31.

The new cryptos are Filecoin (FIL), which powers a decentralized storage network, and Polkadot (DOT), a platform for cross-chain transfers.

Week ahead

As Bitcoin continues to close in on all-time highs, chatter about the approval of a Bitcoin ETF in the U.S. is reaching fever pitch.

The first ETF to be approved could be the ProShares Bitcoin Strategy ETF, backed by Bitcoin futures, which is due to be decided on October 18th.

Meanwhile, traders will be keeping their eyes peeled for broader regulatory developments from the highest branches of the U.S. government.

Image by Petra Göschel from Pixabay

Cryptoassets staged a significant rebound last week with Bitcoin closing back in on its all-time highs.

The world’s largest cryptoasset, bitcoin rose across the week. Having started trading below $48,000 it surged on Thursday to over $54,000 and has staged further gains in early trading today.

The cryptoasset is currently trading around $56,500 its highest level since May this year, and crucially is back within the range that saw it reach an all-time high of $63,569 on 14 April.

Ether meanwhile has had a more mixed week with significant volatility, but is still well above its end-of-September levels.

ETH started last week trading around $3,350 and saw its price hit $3,665 on Friday.

Amid an overall trend of gains last week the cryptoasset has been dogged by volatility – plunging on 6 October after starting the day above $3,500, collapsing to $3,362, then surging back to above $3,600.

ETH saw wild swings late on Sunday too but the cryptoasset is currently trading around $3,500.

White House mulls crypto order

US President Joe Biden and his team are considering the publication of an executive order on crypto that could have far-ranging consequences for the asset class.

Per Bloomberg, the order is designed to coordinate responsibilities of different federal agencies on the treatment of crypto, and also mandate those agencies to study and offer recommendations for its regulation.

With Biden’s financial regulators increasingly aggressive stance on cryptoassets, any executive order would look to shed more light on the industry and attempt to place controls upon it.

According to Bloomberg, no decision has been made on releasing the order yet, but the framework would bring together the work of agencies such as the Treasury Department, Commerce Department, National Science Foundation, financial regulators and security agencies.

The administration is also looking to appoint a crypto ‘czar’ to oversee action within the President’s remit.

Bitcoin miner looks to list in London

Bitcoin mining firm Bitfury is considering a $1 billion float on the London Stock Exchange.

The firm is looking to list in the next 12 months, in what would be the largest ever European cryptoasset float, according to The Telegraph.

Bitfury is headquartered in the Netherlands but its legal base is in the UK. Filings show the firm is currently valued around $1 billion per its last funding round.

The firm, which was founded in 2011 by a Latvian entrepreneur called Valery Vavilov, mines bitcoin with operations in Canada, Norway, Iceland and Central Asia.

The company also supplies miniature data centres encased in shipping containers to customers looking to deploy their own mining operations.

Brazil to adopt bitcoin as legal tender

Brazil could soon be adopting Bitcoin as legal tender, following in the footsteps of El Salvador.

South America’s most populous nation currently has a bill passing through its chamber of deputies (equivalent of the House of Commons in the UK) which would create a legal regulatory environment for cryptoassets.

The Federal Deputy sponsoring the bill, Aureo Ribeiro says he wants to create regulatory certainty for consumers with this bill, which would allow for the transparent transaction of a basket of cryptoassets.

“We want to separate the wheat from the chaff, create regulations so that you can trade, know where you’re buying and know who you’re dealing with.

“With this asset you will be able to buy a house, a car, go to McDonald’s to buy a hamburger – it will be a currency in the country as it happened in other countries. This will allow transactions of this asset in our country, which will be regulated by a government agency.

“We already made an agreement with both, Central Bank and the Securities and Exchange Commission of Brazil (CVM), over opportunities of this asset and its recognition within, for example, real estate value or currency of daily use.”

This is a marketing communication and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without having regard to any particular investment objectives or financial situation, and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past performance of a financial instrument, index or a packaged investment product are not, and should not be taken as a reliable indicator of future results.

All contents within this report are for informational purposes only and does not constitute financial advice. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared utilizing publicly-available information.

Cryptoassets are volatile instruments which can fluctuate widely in a very short timeframe and therefore are not appropriate for all investors. Other than via CFDs, trading cryptoassets is unregulated and therefore is not supervised by any EU regulatory framework. Your capital is at risk.

Image by YOONHEECHO from Pixabay