Users in Russia report they once again can use locally issued Mastercard and Visa cards to deposit money on the crypto exchange more than a year following a wartime prohibition on such transactions.

Ukraine plans to adopt EU’s new cryptocurrency regulations

Immediately after passing the European Parliament, Ukrainian authorities announced plans to adopt the EU’s MiCA regulations on crypto assets.

In the Ukraine War, Stellar Aid Assist Is Using Crypto to Give Mass Aid

The Stellar Development Foundation designed a payment app that leverages stablecoins for fast and cheap transfer and is user-friendly for trauma and disaster victims. That’s why Stellar Aid Assist is one of CoinDesk’s Projects to Watch 2023.

Bear markets are for filming: The Bitcoin Film Festival in Warsaw

Lights, camera, Bitcoin: A Bitcoin Film Festival in Poland brought the Bitcoin revolution to the big screen.

This Ukrainian Startup Is Looking to Automate Crypto Crime Reporting Using Smart Contracts, AI

HAPI Labs has launched a platform for reporting of scam- and crime-related addresses in partnership with Ukraine’s cyber police.

Ukraine’s central bank sees both promises and threats in Bitcoin

The central bank of Ukraine sees crypto as a threat to macro-financial stability and a promising opportunity for better payments at the same time.

Russia-Ukraine war: How both sides of the conflict have used crypto to win

While tens of millions worth of crypto were donated to Ukraine in the last year, pro-Kremlin groups have also leveraged digital currencies to buy military supplies and spread propaganda.

Binance recommends P2P as Ukraine suspends hryvnia use on crypto exchanges

Following the temporary suspension from Ukraine’s central bank, crypto exchanges like Binance and Kuna made official announcements informing investors about the inconvenience.

War had no impact on Ukraine’s regulatory approach to crypto, Kyiv lawmaker says

The adoption of crypto law in Ukraine has been slowed down mainly due to the need to adapt it to tax and civil codes, an official told Cointelegraph in an exclusive interview.

Ukraine-based blockchain firm reports company ‘stronger’ one year into war

Russian military forces invaded areas of Ukraine in February 2022, and workers at businesses including Everstake have faced life in shelters and the constant threat of shelling.

Stellar (XLM) Poised To Rally? Ukrainian Bank Reveals Successful E-Money Pilot

The Stellar (XLM) price remains in a long-term downtrend. After seeing an all-time high of nearly $0.81 on May 10, 2021, XLM’s price has fallen massively. Currently, XLM is 90.6% down from its ATH. Since October 2021, Stellar has also been in a descending trend channel.

At press time, XLM was trading at $0.0822. Thus, the price is showing initial signs of strength and could make a first attempt to break through the upper line of the trend channel at $0.10. What would probably be needed is a clear move that catapults the XLM price toward the next important resistance level at around $0.13.

Should this succeed, the XLM bulls could target the next resistance zone around $0.23.

Bullish News Pushing Stellar Out Of The Bearish Trend?

A potential catalyst for a breakout out of the bearish trend was provided yesterday by the Stellar Foundation. It shared in a tweet that TASCOMBANK, one of Ukraine’s oldest commercial banks, published the results of its e-money pilot project on the Stellar network.

Remarkably, TASCOMBANK is one of the leading Ukrainian commercial banks, which is regarded as a system bank. It operates in many areas of banking, including consumer and corporate lending, factoring, e-commerce, and trade finance.

The report on the project, which was launched in December 2021, informs the National Bank of Ukraine and the Ministry of Digital Transformation about the benefits of issuing e-money on the Stellar blockchain, highlighting the advantages.

Transparency, accountability, and low transaction costs were among the many cited benefits of blockchain in a report by @tascombank.

During their Pilot, one of Ukraine's oldest banks cited the future of e-currency on Stellar as "promising"https://t.co/SSGkUdONNi

— Stellar (@StellarOrg) January 12, 2023

As stated in a Stellar Foundation blog post, TASCOMBANK praises the blockchain’s transparency, security, and confidentiality of customer data, low transaction costs, instant payment functionality, and high throughput “at each stage of development, from conducting operations to testing”

The goal of the project was to test the issuance of e-money, focusing on peer-to-peer and merchant payments, as well as payroll. Sergii Kholod, First Deputy Chairman of the Board of TASCOMBANK, commented:

As part of a pilot project we explored a new way of issuing and managing electronic money which could be a new generation means of payment for the citizens and organizations of Ukraine, their employees and clients, government institutions, and international organizations.

Speaking about the pilot project, Oleksii Shaban, Deputy Governor of the National Bank of Ukraine, said that there are “still many hypotheses” that need to be investigated in the pilot project. However, he expressed that the pilot results are an important basis for use at commercial and central banks.

Oleksandr Bornyakov, the Deputy Minister of Digital Transformation of Ukraine, also revealed that his ministry and TASCOMBANK are currently examining “the approaches to further rollout of blockchain-based payment instruments.”

Ukrainian pharmacies enable crypto payments via Binance Pay

Ukraine continues adopting cryptocurrency payments with the Binance crypto exchange amid the ongoing war with Russia.

Making the case that Bitcoin is not freedom: Pacific Bitcoin Panel

Is Bitcoin really bringing freedom to the world? Experts discussed the complexities of using Bitcoin as a tool for emancipation at a panel at Pacific Bitcoin.

Crypto OTC trading to get traction due to FTX fiasco, exec says

The FTX crash could trigger a bigger demand for crypto OTC services as investors are looking for alternative crypto exchange methods amid weak trust in CEXs.

Stellar partners with UNHCR to give Ukrainian refugees cash via USDC

One new project attempts to help bankless Ukrainian refugees, while another hopes to streamline international Red Cross projects.

Ukraine collabs with international consultants to update crypto framework

The Advisory Council on the Regulation of Virtual Assets held its first meeting, dedicated to adjusting the National Tax Code to the crypto market.

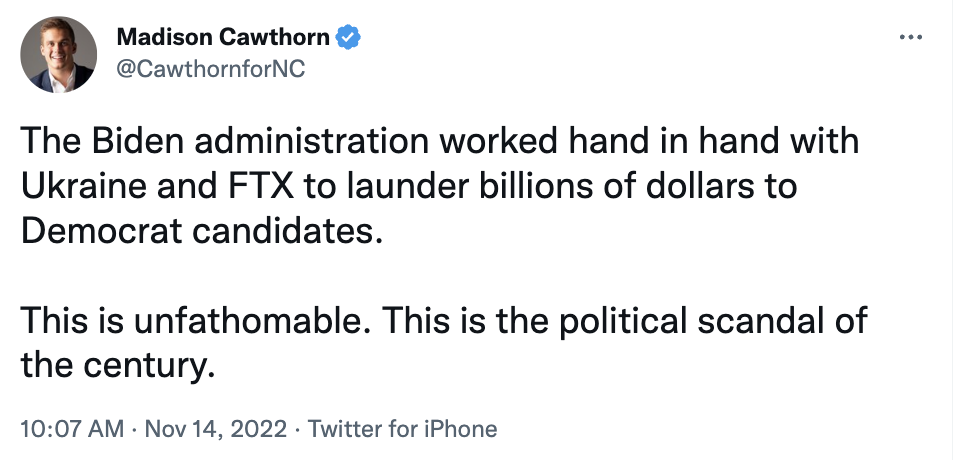

Ukraine-based blockchain firm blasts ‘fake news’ for crypto donation rumors amid FTX collapse

Sergey Vasylchuk, the CEO of Everstake, said individuals behind Russian propaganda used the fall of FTX “to spin yet another tale about money laundering.”

National Bank of Ukraine releases draft concept for digital hryvnia

One of the design options for the Ukrainian CBDC describes the e-hryvnia available for usage in crypto exchange operations.

Ukraine pro-crypto groups announce Web3 roadmap

A roadmap proposes the launch of a regulatory sandbox and the creation of a national blockchain-backed realty register

Can Russia Circumvent EU Sanctions Through Cryptocurrency?

Russia has seemingly turned to cryptocurrency since the West decided to ‘punish’ the nation for its invasion of Ukraine. A list of sanctions had been imposed upon the country by the United States and the EU which worked to essentially cut Russia off from world traders. However, with the rise in popularity of crypto, it has provided a possible way for the country to evade these sanctions which would have otherwise stuck when fiat currencies were the only form of payment.

Why Russia Could Turn To Cryptocurrency

One thing that has drawn investors to cryptocurrencies such as Bitcoin is the fact that they are decentralized. A decentralized currency is not controlled by an entity. Hence, sanctions do not apply to them regardless of how severe they are. This has made it attractive to those who want to evade detection by governments, or in this case, countries trying to circumvent sanctions.

Lately, Russia has been warming up to crypto as a way to foster trade around the sanctions. The most prominent of these have been the sanctions on Russian gas purchases, which breeds the possibility of the country accepting crypto as a form of payment for their oil and gas. By using a cryptocurrency such as Bitcoin, Vladimir Putin could be able to completely evade these sanctions and the established banking system.

Back in September, the US Treasury’s assistant secretary for Terrorist Financing and Financial Crimes, Elizabeth Rosenberg, told lawmakers that it was possible for the Kremlin to actually evade sanctions levied against it. Senator Elizabeth Warren also echoed this concern, pointing to the fact that there was already widespread use by North Korea to evade sanctions, and it was just as easy for Russia to do the same.

Market cap at $984 billion | Source: Crypto Total Market Cap on TradingView.com

Still An Important Player

Even though there are currently sanctions against Russia, the EU still relies heavily on the supply of oil and gas from the Kremlin. Companies in Europe, although they have shown support for Ukraine in the war, continue to quietly acquire products from Russia.

Given this, it is not a stretch to say that Russia would have an abundance of customers if it were to switch to crypto payments for its oil and gas. It is already an established player in the oil and gas industry and companies will not have an easy go of it having to change suppliers. So it would make sense to go through the relatively small inconvenience of converting fiat to crypto to pay Russia than spending millions of dollars to change international suppliers.

Russia is already softening its stance on cryptocurrencies since the war started. In September, it was reported that the government had reached an agreement with the central bank on a rule that would allow residents to carry out cross-border payments using crypto. Trade Minister Denis Manturov said back in May that the country would legalize digital asset payments “sooner or later.”

Featured image from PYMNTS, chart from TradingView.com

Follow Best Owie on Twitter for market insights, updates, and the occasional funny tweet…