Uniswap, one of the world’s largest decentralized exchanges (DEX), is poised for significant growth with the upcoming launch of its V4 upgrade. This anticipated update will introduce custom Automated Market Maker (AMM) functionality directly on top of Uniswap, eliminating the need for separate AMM designs.

In addition, Uniswap’s governance token, UNI, has seen notable growth, with a 6.8% increase in the last 24 hours and an 8% increase in the previous 30 days, bringing the UNI token to $7.318.

However, while these developments favor the exchange and investors, decentralized finance (DeFi) researcher DeFi Ignas has raised concerns regarding the launch and its potential impact on critical features.

The Ultimate DeFi Liquidity Solution With Uniswap V4?

According to DeFi Ignas’ latest analysis on X (formerly Twitter), Uniswap V4 represents a significant transformation from a protocol to a platform. Like the Apple Store’s impact on the iPhone, Uniswap V4 will consolidate all pools into a single framework, reducing creation costs by 99% and enabling more cost-effective multi-pool swaps.

The introduction of the “Hooks” system is particularly noteworthy. These hooks act as plugins or extensions, allowing for customized code execution during crucial events within a pool.

The 13 available hooks enable various functionalities, including on-chain limit orders, time-weighted average market making, liquidity depositing into lending protocols, auto compound liquidity provider (LP) fees, and know-your-customer (KYC) integration.

Introducing hooks leads DeFi Ignas to believe that the launch of Uniswap V4 will allow developers to experiment and launch their protocols while leveraging Uniswap’s liquidity.

According to the researcher, this has the potential to attract even more liquidity from other decentralized exchanges and establish Uniswap as the dominant liquidity layer for all DeFi activities, from trading to lending.

Yet, while unified liquidity may benefit users by increasing market efficiency, it raises concerns about potential market concentration and stifling of competition.

UNI Token Gains Momentum

Uniswap’s V4 liquidity sourcing could concentrate liquidity within the platform, potentially making it the go-to liquidity layer for DeFi. According to DeFi Ignas, this dominance, coupled with Uniswap’s operating license that prohibits forking until 2027, raises questions about market competition and the potential impact on decentralized finance.

In addition, reports suggest that Uniswap Labs has sent takedown notices to gateways of the InterPlanetary File System (IPFS) – a decentralized and distributed protocol designed to facilitate the storage and sharing of files on a peer-to-peer network – adding another layer of concern about decentralized access and censorship resistance.

Regarding the potential upside of Uniswap V4 acting as a catalyst for the exchange’s token, the research went on to suggest that while UNI’s value “accrual” for retail investors has been relatively modest, the introduction of Uniswap V4 and its hooks opens up new possibilities.

In this sense, DeFi Ignas believes the UNI token could function as a platform/ecosystem token, benefiting from third-party decentralized applications (dApps) developed using Uniswap’s hooks, expanding the token’s use cases and potentially attracting more investors.

Additionally, there is speculation that Uniswap may solidify its dominance and liquidity by launching its chain, potentially as a layer-two (L2) solution, which could further boost the valuation of the UNI token.

As the upgrade deadline for Uniswap approaches, the impact of the exchange’s upgrade on the UNI token remains uncertain. However, there has been a noticeable growth in the token’s value over the past few weeks.

After reaching a 17-month high of $8.260 in January, the token experienced a correction but has since broken out of that pattern. As the upgrade deadline draws near, it is yet to be determined whether the token can consolidate its gains and regain previous levels.

Featured image from Shutterstock, chart from TradingView.com

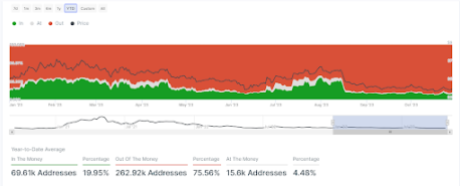

More addresses are out of the money | Source: IntoTheBlock

More addresses are out of the money | Source: IntoTheBlock