After a turbulent start to the week, the Stellar price seems to be finding some stability, briefly climbing above the $0.28 level this weekend. This growing momentum has sparked interest from market enthusiasts, with prominent crypto analyst Ali Martinez projecting the XLM token to soon experience a sustained price rise.

XLM Primed For 40% Price Gain

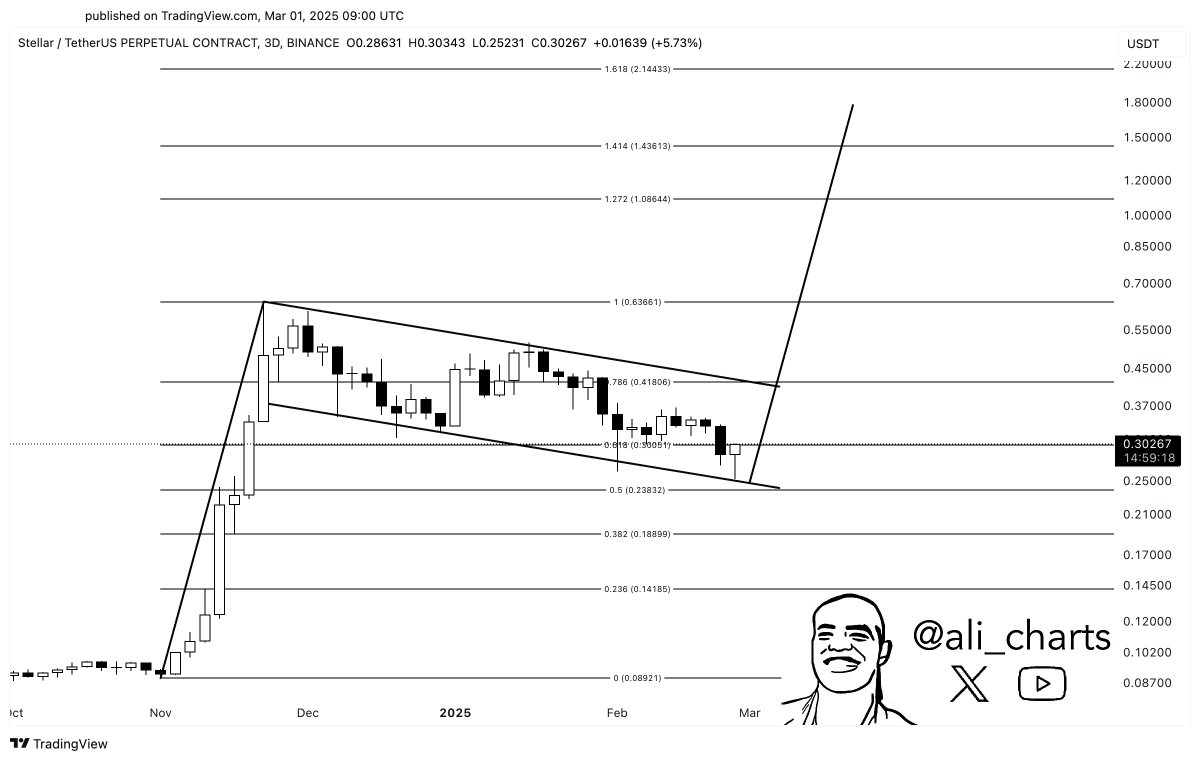

In an X post on March 15, Martinez shared an intriguing projection for Stellar price after rebounding off a crucial level. Martinez noted that the altcoin could be on its way to a new local high over the coming weeks.

This bullish projection is based on the formation of a descending channel pattern on the XLM daily chart. For context, a descending channel is a common pattern in technical analysis characterized by two major (downward-sloping) trendlines. The upper boundary line connects a series of lower highs and the lower channel line connects the lower lows.

The asset’s price typically persists within the channel; with the upper boundary line acting as resistance and the lower channel line considered a support floor. The descending channel formation is usually a bearish pattern, indicating the persistence of a downward trend.

When the price breaks down the lower channel line, it signals the continuation of the downtrend. Conversely, a break out of the descending channel can be used to identify trend reversal points — usually from a bearish trend to an upward trend.

XLM’s price has been in this descending channel since November 2024, recently bouncing back from the lower boundary line. As observed in the chart above, the altcoin fell to support around the $0.23 level in early March, but it has since turned around toward the channel’s midline.

According to Martinez, the next price target for XLM is $0.30 at the channel’s midline. However, the analyst believes Stellar could make a play for as high as $0.38 at the upper boundary line i.e. representing a potential 40% surge from the current market price. The last time the Stellar traded around the $0.38 region was in early February and has since plummeted as low as $0.23 since then.

Stellar Price Overview

As of this writing, the XLM token is valued at around $0.27, reflecting a 0.83% gain in the past 24 hours. According to data from CoinMarketCap, the Stellar price is down by 0.76% in the last seven days despite the woeful start to the week. Meanwhile, the altcoin’s value has declined by 17.25% in the past month.

Related Reading: XRP Price To $110? Bollinger Bands Creator Reveals Why It Will Become A Market Leader