The euphoria around the inauguration of US President-elect Donald Trump drove the massive $2.2 billion in inflows to crypto ETPs last week.

Cryptocurrency Financial News

The euphoria around the inauguration of US President-elect Donald Trump drove the massive $2.2 billion in inflows to crypto ETPs last week.

The post-US election honeymoon is likely over as macroeconomic data is once again a key driver of crypto ETPs, CoinShares’ James Butterfill said.

In an unprecedented case that underscores the complex regulatory environment in the European Union, Jupiter Asset Management was compelled to divest its XRP Exchange Traded Product (ETP) investment valued at approximately $2.5 million. This decision underscores the complexities and regulatory discrepancies within the European Union concerning cryptocurrency investments.

The incident, which was initially reported by the Financial Times, involved Jupiter’s Ireland-domiciled Gold & Silver fund. The fund had invested $2,571,504 in 21Shares’ Ripple XRP ETP during the first half of 2023, a move that was subsequently flagged by Jupiter’s compliance department.

“The trade was made, picked up by our regular oversight process and then cancelled,” a Jupiter spokesperson articulated, emphasizing the rigorous internal review processes that led to the identification and rectification of the regulatory misalignment.

Ireland’s firm stance against incorporating crypto assets into Undertakings for Collective Investment in Transferable Securities (UCITS) funds mandated the reversal of this investment. Consequently, the cryptocurrency ETP holding was sold for $2,570,670, resulting in a nominal loss of $834, which the firm addressed.

“Jupiter sold the cryptocurrency ETP holding for $2,570,670, at a loss of $834, according to a financial statement. The firm has made up the difference,” confirmed a spokesperson from Jupiter.

This development is particularly noteworthy as it contrasts with the regulatory positions of other EU countries. For instance, Germany’s regulator permits a more flexible approach, allowing crypto ETP exposure in UCITS funds under specific conditions, as demonstrated by DWS’s Fintech fund maintaining an investment in an Ethereum exchange-traded note.

The incident has sparked a broader discussion on the need for a harmonized regulatory approach within the EU. The discrepancy not only affects investment strategies but also impacts the overall investment ecosystem, creating a fragmented market.

This is further complicated by the varying interpretations and applications of the UCITS directive across different member states, leading to a lack of clarity and uncertainty for fund managers looking to innovate their investment portfolios.

Regulatory bodies in Ireland and France have recently affirmed their positions against the inclusion of crypto assets in UCITS funds, underscoring a cautious approach towards investor protection within regulated fund structures. Meanwhile, the UK and Germany adopt distinct stances, with the latter allowing certain crypto exposures under defined criteria.

This incident is not only highlighting the complexities involved in navigating the regulatory landscape for crypto investments but also emphasizes the need for a unified regulatory framework within the European Union.

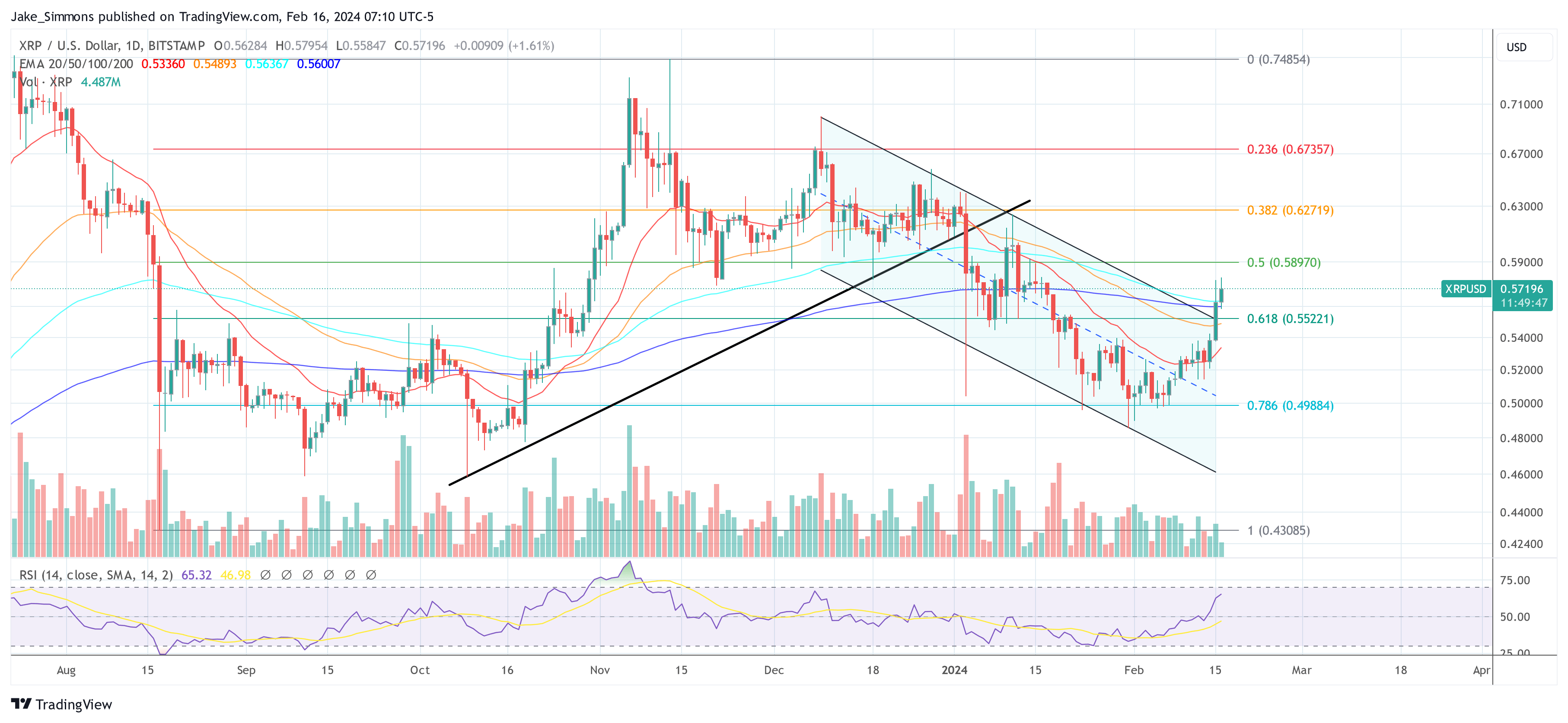

At press time, the XRP price stood at $0.57196. As predicted yesterday, XRP has managed to break out of the descending channel and rise above the 20-, 50-, 100- and 200-day EMA cluster. This means that the XRP bulls have a good chance of gaining the upper hand again. A breakout above the 0.5 Fibonacci level at $0.5897 would be another important step.

The XRP price may be gearing towards a bullish momentum with the potential release of multiple ETPs and the anticipated launch of Valour’s XRP ETP into the European markets next month.

Valour, a publicly traded company backed by DeFi Technologies, a crypto-based software organization, has announced a new XRP Exchange Traded Product (ETP). In a press release published on Wednesday, DeFi Technologies disclosed the launch of Valour’s XRP ETP in December 2023.

A popular YouTuber, Zack Rector has stated in a recent YouTube video that the token is positioned to take advantage of a large flow of liquidity driven by the initiation of multiple XRP ETPs.

Including Valour’s ETP, there have been many other ETPs launched by industry-leading crypto companies. 21 Shares, a Swiss financial institution, is one of the prominent companies that issued its XRP ETP (AXRP) in 2019. Since its launch, AXRP has recorded approximately $49 million in assets under its control and the ETP earns a year-to-date return of +69%.

Rector disclosed that the growing number of ETPs could trigger significant institutional inflows that could push the adoption of the token and possibly drive its price upwards. Furthermore, the integration of an XRP ETP has the potential to significantly advance the ecosystem by enhancing liquidity and improving accessibility for retail and institutional investors.

The announcement of Valour’s XRP ETP comes as a positive development for the community and the broader crypto space. Various crypto investors have expressed their optimism about the significant impacts these ETPs could have on the XRP market.

Just as the news of Spot Bitcoin ETF applications propelled Bitcoin’s price above $37,000, institutional flows from Valour’s XRP ETP could drive the token’s price to $10.

The ETP issued by 21 Shares Ripple is a prime example of how XRP ETPs have performed in the past. After being traded 447 times on the market, this particular ETP generated $5 million in revenue.

Valour’s upcoming ETP has become a focal point for investors seeking strategic investment opportunities. Crypto investors are closely monitoring the market to assess the potential gains that may follow the ETP’s debut.

The anticipated launch of Ripple’s IPO and the final resolution of the lawsuit between Ripple and the United States Securities and Exchange Commission (SEC) are also major events that could help drive the price of the token to higher levels.