Famous for his motto “I test in prod”, Andre Cronje, inventor of Yearn Finance and other DeFi protocols, will launch a new platform. Called ve(3,3) it has been designed as an Automated Market Maker (AMM) to operate with a “protocol for protocols” architecture.

Related Reading | Solana DeFi Goes Stratospheric as Hubble Protocol Announces $3.6M Raise

In other words, this new AMM will be easy to integrate with other platforms to incentivize their own liquidity and without tradeoffs. The protocols that decide to add ve(3,3) won’t lose fees, volumes, or liquidity, as the creator of Yearn Finance explained in an official post.

Cronje believes AMMs utility has undergone a change, from primarily serving as a tool for liquidity providers to serving as an addition to projects. Thus, ve(3,3) seeks to meet the demand of AMM’s new users; other protocols.

His new project, ve(3,3), will remove friction from the process of adding token incentives to a protocol’s liquidity, will make it simpler for projects to accrue fees from incentives, and will operate as a permissionless platform. The Yearn Finance developer said:

With the above in place, any protocol or project can easily incentivize their own liquidity, be it for their token, their stable coin, or even other derivatives, and while doing so, they fully accrue fees.

Cronje’s new protocol will have multiple features, including the capacity to natively support swaps between closely correlated assets, and uncorrelated assets, Uniswap v2 compatibility which will let projects deploy its interface, the possibility to permissionless create pools, gauges, and bribes.

In addition, the protocol will operate with a 0.01% fee to be paid in base assets. Cronje’s protocol for protocols will let other platforms support delegation, increase “holdings proportional to emission”, and conduct locks with capital efficiency, amongst many other features.

Yearn Finance Inventor To Take AMM Utility To Its Next Phase?

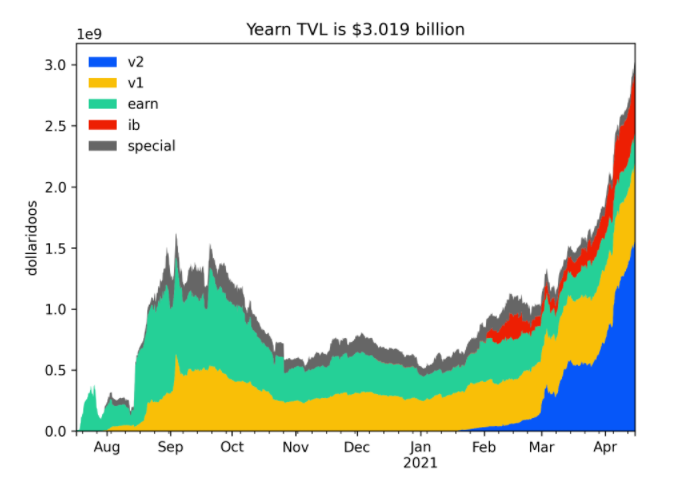

As an additional incentive for projects to implement Cronje’s protocol, the platform will reward them with ve(3,3) tokens. Those projects that occupy the top 20 by total value locked (TVL) will receive these rewards two weeks after the protocol launches.

The launch could take place next week, as Cronje announced via Twitter. By the end of next week, the platform will take a snapshot to determine the projects that will receive a percentage of the 2,000,000 ve(3,3) available for rewards. Cronje added:

It is up to them (the selected projects) to decide what they will incentivize, be it their own token, stable coin, or other liquidity. The timeline for this will thus be 2 weeks post protocol launch until distribution starts.

Final commit sent off for peer reviews, audits, and third party reviews.

Target of TVL snapshot end of next week.

One week for voting (and bribes), and then emission starts.

Website will be up next week.

Launching on

— Andre Cronje

(@AndreCronjeTech) January 11, 2022

(@AndreCronjeTech) January 11, 2022

As of press time, Yearn Finance native token YFI trades at $32,139 with a 2.7% profit in 24-hours.

Related Reading | Yearn Finance Launches New Vault, While YFI Retakes Bullish Momemtum

YFI moving sideways in the 4-hour chart. Source: YFIUSDT Tradingview