The platform will use Proof of Climate awaReness as a validating protocol to encourage users to minimize their environmental footprint.

Here’s Why Crypto Traders Should Be Attentive to ‘De-Inversion’ of Treasury Yield Curve

Treasury curve suggests the widely-anticipated U.S. economic recession is near. Historically, the signal has brought pain to risk assets.

Blockchain-Based Debt Protocol Obligate Records First Bond Issuance on Polygon Network

Swiss commodities trading firm Muff Trading AG issued corporate bonds using Obligate’s decentralized finance platform, which is set to open to the public on 27 March.

MakerDAO passes proposal for $750M increase in US Treasury investments

The emergency proposal increases MakerDAO’s holdings of United States bonds by 150%, aiming to diversify the Dai stablecoin’s collateral exposure.

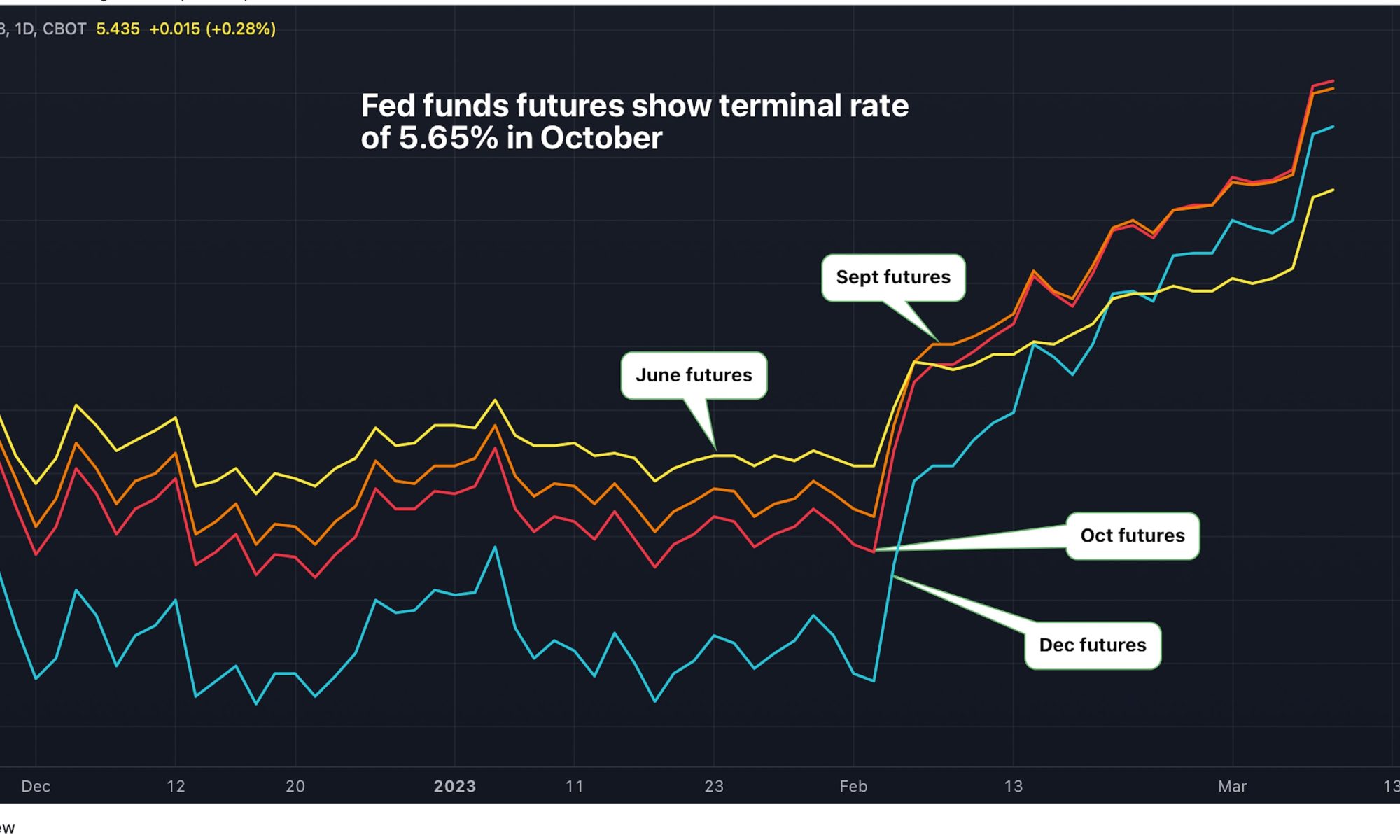

Bitcoin Slips to 3-Week Low as Market Sees Federal Reserve Lifting Rates to 5.65%

The Fed funds futures show traders pricing in a higher-for-longer interest rates mantra by the Fed.

Bitcoin Volatility Holds Steady as the VIX and MOVE Spike

Bitcoin’s relative stability is reflective of mainstream disinterest in the crypto market, one observer said.

Crypto Biz: Celsius, FTX feel investors’ wrath as lawsuits multiply

Celsius creditors have filed a proposal to sue Alex Mashinsky, while creditors of FTX are turning their attention to the exchange’s venture backers.

Hong Kong issues HK$800m in tokenized green bonds

The bonds were underwritten by four banks and priced at a yield of 4.05%.

Explaining the Disconnect Between Bitcoin and Treasury Yields Post US Inflation Data

Bitcoin and technology stocks rose Tuesday even as hotter-than-expected U.S. inflation revived Fed angst and lifted Treasury yields.

Siemens Issues Blockchain Based Euro-Denominated Bond on Polygon Blockchain

The $64 million bond has a maturity of one year.

Tether taps Cantor Fitzgerald to help oversee bond portfolio: Report

The USDT issuer has made inroads into the traditional finance and accounting sectors as it attempts to increase transparency around its holdings.

Tokenized government bonds free up liquidity in traditional financial systems

There are a number of benefits associated with tokenized government bonds, yet adoption may take time.

Bukele’s government introduced a bill to launch the ‘Bitcoin bonds’

A new bill confirms the government’s plan to raise $1 billion and invest them into the construction of a “Bitcoin city.”

UBS AG launches digital bond settled on blockchain and traditional exchanges

With atomic settlement technology, the company said its digital bond settles through the SIX Digital Exchange (SDX), not requiring a central clearing counterparty.

Israel kicks off live tests for its tokenized digital bonds

Israel’s Ministry of Finance and the Tel Aviv Stock Exchange expect to finish the pilot project by Q1 2023.

El Salvador focused on bringing investment to Bitcoin City, says ambassador

The El Salvador official noted that the government is looking to attract more investments to its Bitcoin City with special incentives for businesses investing early.

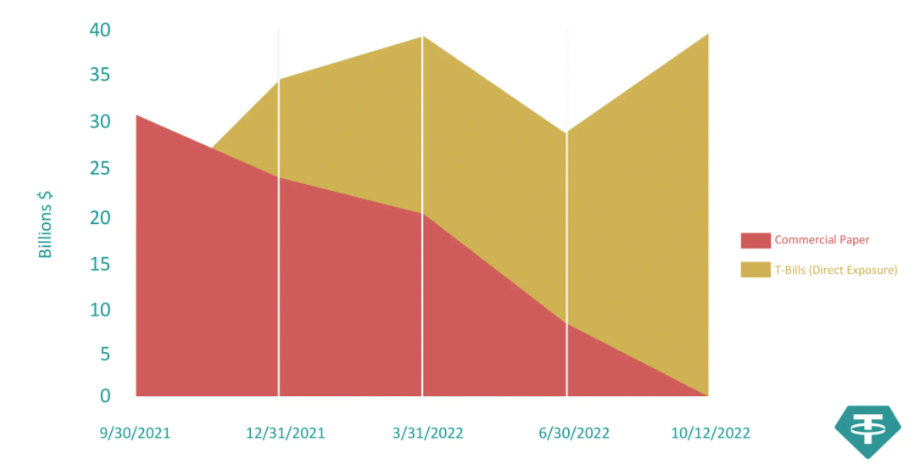

Tether reduces commercial paper exposure to zero, replaces investments with T-Bills

The USDT issuer has faced criticisms for its exposure to commercial paper and, specifically, its alleged holdings of Chinese commercial paper.

US Treasury yields are soaring, but what does it mean for markets and crypto?

The 10-year U.S. Treasury yield recently hit its highest level in 12 years, but how might this impact investors’ sentiment toward stocks and cryptocurrencies?

Bitcoin holds $19K, but volatility expected as Friday’s $2.2B BTC options expiry approaches

Traders expect an uptick in volatility due to the possibility of September’s $2.2 billion options expiry putting pressure on BTC price near a critical support level.

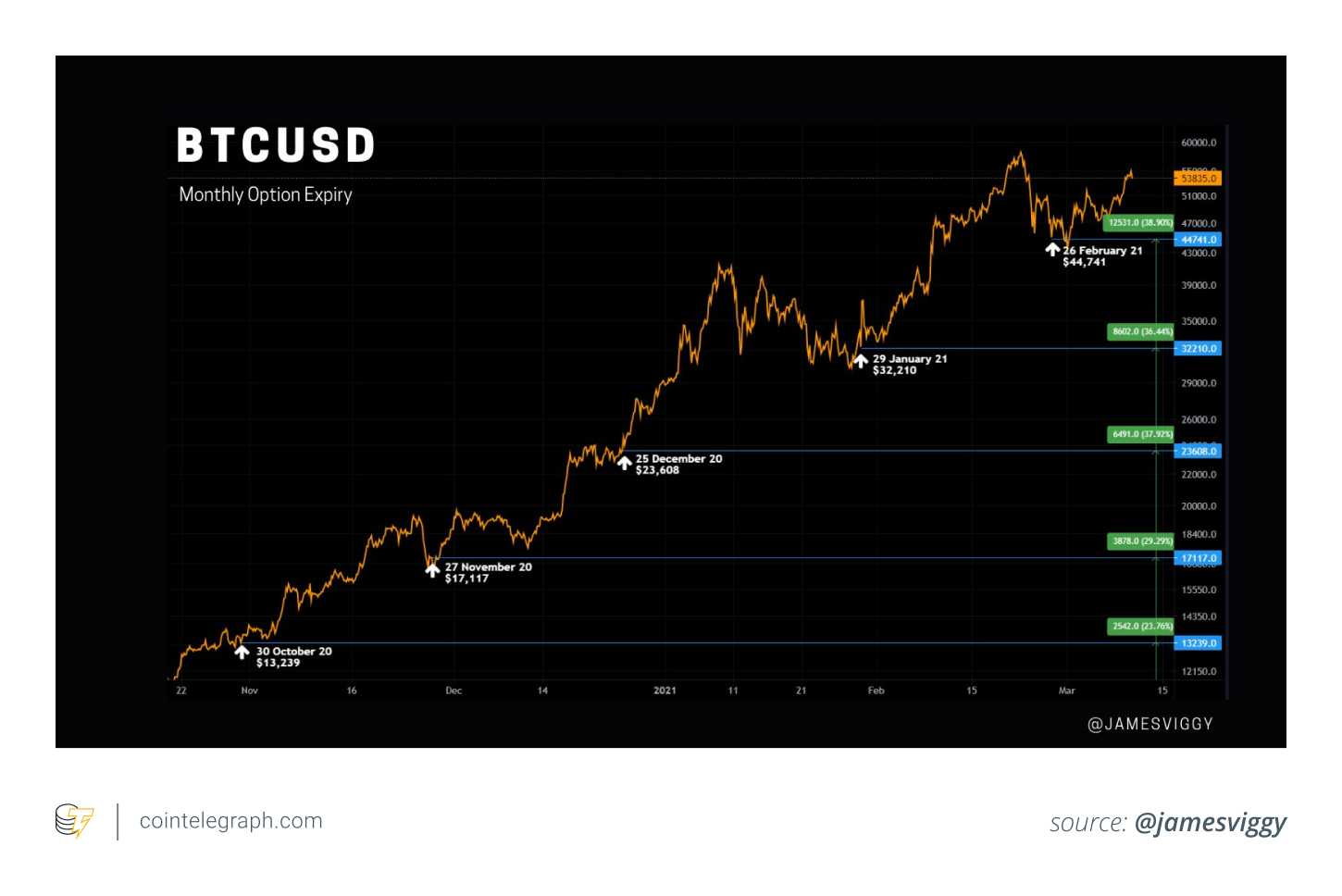

‘The bond market bubble has burst’ — 5 things to know in Bitcoin this week

A time tunnel to November 2020 opens on BTC price action as the U.S. dollar lays waste to currencies and equities alike.