Optimism networks that are part of the Superchain rely on Ethereum to communicate with each other in order to move assets, which tends to make such moves slow and expensive. To address that, Optimism is releasing its own interoperability roadmap.

Optimism Suffers 21% Loss – Will On-Chain Activity Regain Investor Trust?

Losses mount for Optimism as the market suddenly flips from bullish to bearish, wiping significant gains made after it rebounded last week. According to CoinMarketCap, the token is down over 21% since last month, putting significant pressure on investors as the market continues with its choppy trading days.

Despite the market’s hostility in the past 24 hours, on-chain news still reinforces investor confidence as the platform’s Superchain continues to grow. But questions remain as to how this can affect the token’s price in the coming days and weeks.

Conduit, Mode, And Zora Join Optimism Collective Security Council

Last Saturday, the official Optimism X account revealed that Conduit, along with Zora and the Mode Network, gave their L1 contract upgrade keys to the Optimism Collective Security Council. According to Optimism, this is “a significant step for these chains to progress towards Stage 1 Decentralization.”

Heading to Stage 1!

Today, @modenetwork @zora and @metal_l2 officially transferred their keys to the Optimism Collective Security Council.

This is a significant step for these chains to progress towards Stage 1 Decentralization.

Read more

https://t.co/c1yRLQrQyN

— Optimism (@Optimism) August 8, 2024

Conduit released a post detailing the reasoning why the move is significant for the participating platforms’ decentralization.

“Rollups must be decentralized in order to be secure and censorship-resistant. But that isn’t feasible from day one. Optimism has a 3-stage process for Superchain rollup teams to gradually transition their chains to full decentralization…,” stated Conduit on their thread.

Rollups must be decentralized in order to be secure and censorship-resistant. But that isn’t feasible from day one. Optimism has a 3-stage process for Superchain rollup teams to gradually transition their chains to full decentralization, inspired by @VitalikButerin:…

— Conduit (@conduitxyz) August 8, 2024

This is in line with what the Optimism Collective Security Council is about. In its proposal stages, the Security Council will effectively hinder any attempt at one-party control over the network and the systems beneath it. The move will help keep the network secure while keeping scalability on the table for developers.

The scalability half is Optimism’s greatest strength. Optimism said that the first half of the year saw open-source contributors push over half of the platform’s current features in the OP stack. This commitment to decentralization along with network features helps it to be flexible and scalable making Optimism a viable investment for the long term.

Optimism Still Looking At Minor Hurdles In The Long Run

The market rebound created gains for investors while this week’s opening moves wiped the majority of it to the ground. This created an atmosphere of fear, uncertainty, and doubt for the token’s future movement. As of writing, the token remains on the $1.2-$1.6 price range which it entered last week because of the market retreat.

The slight uptick in price by the tailend of last week has exhausted the bears, putting OP into consolidation mode for the coming weeks. If the bulls are successful in defending this position, the token will see itself trading on a narrower range before shooting up toward the $2 mark.

But this can only happen if the market recovers from its 5% downward move today. If they can weather the coming FUD within the next two weeks, OP has a chance to regain lost ground pushing its price upward.

Featured image from KuCoin, chart from TradingView

Bitcoin bulls were obliterated, but is it time to catch the falling knife?

Bitcoin derivatives show traders’ morale is low, weakening the odds of a 20% rise from the $49,320 BTC bottom.

Optimism Drops 12%: Should Investors Still Be Optimistic? These Metrics Say Yes

Optimism has been seeing bearish action since the start of this month. But this week, it has been much worse for investors and traders. According to Coingecko, the token is down more than 12% since last week.

With a market correction underway, more pain can come to all portfolios carrying OP. However, there are several reasons why investors and traders should still be on board with Optimism.

Growing On-chain Use By An Expanding Userbase

Price-wise, OP looks like a hard bargain after a month of hard-battering by the bears. However, on-chain data looks vastly different.

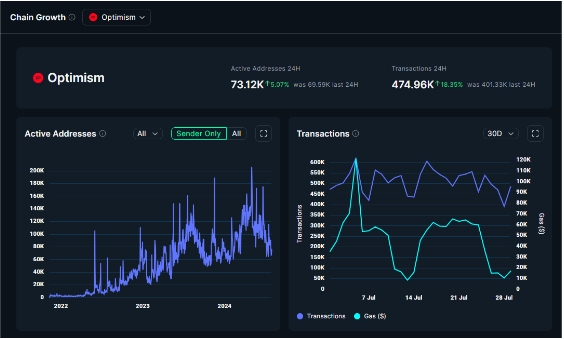

According to data tracked by Nansen, on-chain growth is booming for Optimism. The platform’s growth as the self-named “Superchain” on Ethereum is working as active addresses continue to ramp up along with transactions, indicating chain-wide usage across its different constituent chains.

The platform has also announced several events that potentially impacted this on-chain growth.

Optimism is hosting a chain-wise hackathon tomorrow, July 31, contributing to this sudden increase in active addresses on the platform. This should offset any shift in investor confidence as it paints Optimism positively: a platform worthy of development with the support of a growing community.

Superhack is a Superchain wide hackathon.

Sign up and check out bounties from teams like @worldcoin @base @modenetwork @Celo and more!

Details via link in @ETHGlobal‘s bio.

Apply before July 31. https://t.co/EBsgKWk9Z2— Optimism (@Optimism) July 26, 2024

The organization also announced the next Retro Funding round which will reward projects based on three categories: Ethereum core contributions, OP stack research and development, and OP stack tooling. The reward for the event will be 8 million OP tokens which will further help the winning projects increase their impact on-chain.

PUMP THIS SHIT pic.twitter.com/jySc2uxBnI

— ProfessorAstrones (@Astrones2) July 24, 2024

These metrics contribute to a stronger bullish sentiment among analysts like X user Professor Astrones, showing support for OP as he shows that the token has broken through the downward trend it has followed since early this year.

Although confidence in the platform and token is still high, some things have to happen to OP to see green once more.

Bulls Should Wait For The Perfect Timing

As of writing, OP bulls have a perfect and stable platform for a rocket upwards, and it should be noted that $1.694 is the long-term support level for this movement.

However, its high correlation with Ethereum leaves much to be desired. Bitcoin and Ethereum move in sync, meaning if one experiences pain, the other drops too. OP’s indirect correlation with Bitcoin will have a big impact on how the token moves soon.

With the current market correction, investors and traders should lower their expectations of a breakout in the coming days. However, the strong support on $1.694 gives bulls a stable platform to launch upward.

Should the bulls lose this position, expect more pain within the coming days or weeks. But if the level is held strongly $2.331 will be the target level for the bulls.

Featured image from Pexels, chart from TradingView

World Chain, Sam Altman’s Layer-2 Project, Opens to Developers

This means that select developers can apply to build, test, and give feedback to Tools For Humanity, the developer firm behind Worldcoin, according to a press release shared with CoinDesk.

TON flips ETH in daily active users, but that’s not the full picture

TON has seen more daily active addresses than Ethereum in 10 of the last 11 days — however, that figure doesn’t include Ethereum layer 2s.

Optimism Activates Fault-Proofs On Mainnet, OP Is Down 55% In 3 Months

In a major milestone for Ethereum and layer-2s, Optimism, a layer-2 scaling platform for the second most valuable network, has announced the activation of open source and permissionless fault proofs.

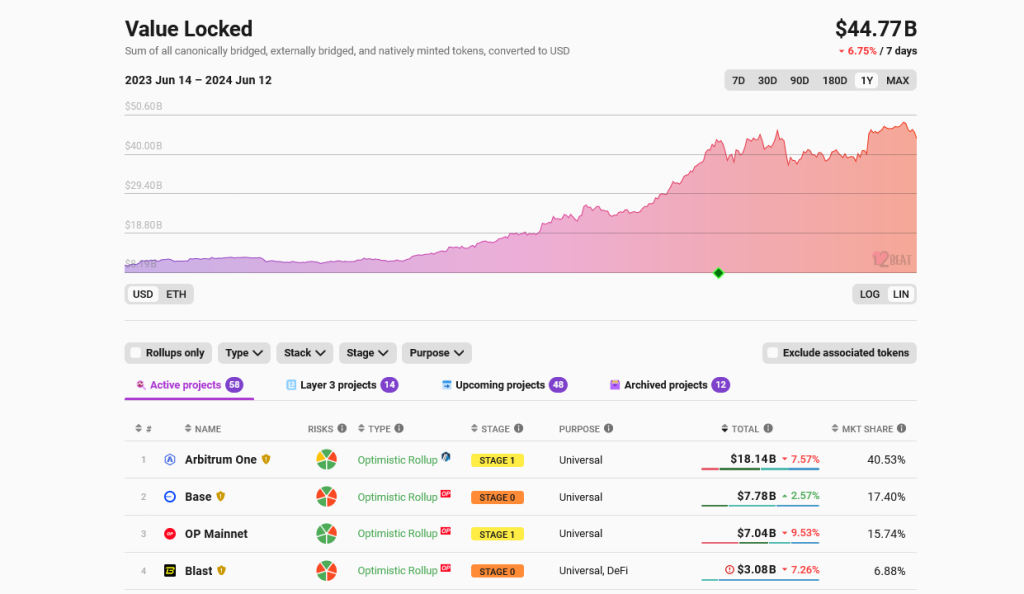

Even though the platform manages over $7 billion of assets, according to L2Beat, Optimism, like most optimistic rollups, lacked a way of trustlessly verifying transactions. It relied on a centralized sequencer and fraud-proof system for this function.

Optimism Activates Trustless Fraud-Proof System

Activating the open-source fault-proof system is crucial to creating a more decentralized and secure future for the Optimism ecosystem. Overall, fault proofs are a critical component, allowing users to verify the validity of all offchain transactions.

Most importantly, it allows users to challenge any fraudulent activity on Optimism, creating a safeguard against unauthorized withdrawals, for example, and much more.

In a post, Optimism Labs said the layer-2 platform relied on a centralized system. Here, the Optimism Security Council held the power to initiate withdrawals.

However, the platform eliminates this dependency with trustless fault proof in place. This means that any user can withdraw tokens without the council intervening. The power move is huge for the community and decentralization.

Even so, to ensure the safe implementation of this fault-proof system, the Optimism Security Council will still have the power, at least temporarily, to intervene in cases of critical failures. This decision means Optimism will continue to operate securely as it decentralizes gradually.

Eventually, the platform plans to release a “multi-proof nirvana” that is open-source and modular, possibly including zero-knowledge proofs. This will go beyond the current “Cannon” system.

Buterin Acknowledgement, But Why Is OP Crashing?

Vitalik Buterin, the co-founder of Ethereum, acknowledged this milestone, welcoming Optimism to the “club of stage 1+ L2s.” Nonetheless, the co-founder still needed more zero-knowledge proof-based layer-2 platforms to join the ranks.

Optimism is the second layer-2 platform after Arbitrum to announce the release of fault-proof systems, though both are still being tested. Dubbed the Bounded Liquidity Delay (BOLD), Arbitrum’s fraud-proof system was launched on Testnet early last month.

Despite this milestone, OP is firm but under pressure in the first half of June.

At spot rates, OP is down roughly 55% from March highs. With Ethereum and Bitcoin prices under pressure, the token could break May lows of $1.8 with eyes on $1.1.

The Protocol: How Optimism Filled in Its Missing Tooth

In this week’s newsletter, we delve into the Ethereum layer-2 network Optimism’s delivery of “fault proofs,” a piece of functionality that was glaringly missing even though it was at the heart of the project’s security setup.

Optimism Finally Gets Its Mission-Critical ‘Fault Proofs’

For years, Optimism was missing a core feature at the heart of its design: “Fault proofs.” On Monday, that tech is finally here.

Optimism reaches ‘Stage 1’ decentralization, implementing fault proofs

The team has implemented fault proofs on Optimism mainnet, and users can now independently initiate withdrawals “without involvement from any trusted third parties.”

Base TVL surges to $8B just days after overtaking OP Mainnet

Base has topped Ethereum layer 2 leaderboards by transaction count and has been the most profitable Ethereum scaler for three consecutive months.

Optimism Network Activity Metrics Approach Record Levels, Propelling OP 9% Higher

Layer 2 (L2) scaling solution Optimism reported a series of strong network metrics in the first quarter (Q1) 2024, with its native OP token surging 9% on the back of this bullish momentum.

Optimism Sees Higher Activity And Rising Transaction Fees

According to a recent Messari report, Optimism’s circulating market cap increased 11% quarter-over-quarter (QoQ) to $3.7 billion, while its fully diluted market cap rose 1% to $15.7 billion.

Despite the broader crypto market rally, with Bitcoin (BTC) and Ethereum (ETH) gaining 69% and 53% QoQ, respectively, OP’s market cap ranking slipped from 26th to 39th among all blockchain networks. However, within the Ethereum ecosystem, OP remains one of the top four rollups by market capitalization.

Driving this growth was a significant uptick in Optimism network activity. Daily active addresses reached 89,000 in Q1 2024, a 23% QoQ increase, while daily transactions surged 39% to 470,000 over the same period. These metrics approached, but did not quite reach, their all-time highs in Q3 2023.

The network’s revenue also saw a substantial 78% QoQ increase to $16 million, driven by higher activity and a 48% rise in the average transaction fee to $0.42. However, this average fee dropped significantly in the latter half of March due to the implementation of Ethereum Improvement Proposal (EIP) 4844, which reduced L1 submission costs by 99%.

Total Value Locked Jumps 18% In Q1

Despite the fee reduction, Optimism’s on-chain profit for Q1 2024 increased 14% QoQ to $2 million. The network’s Total Value Locked (TVL) also grew by 18% to $1.2 billion, though its TVL ranking among all networks fell to 11th place.

Within Optimism’s TVL, the DeFi sector dominated, accounting for 86% of active addresses. According to Messari, non-fungible token (NFT) applications and gaming followed with 6.9% and 6.7%, respectively.

TVL’s leading protocols included Synthetix ($307 million, +4% QoQ), Aave ($270 million, +52% QoQ), and Velodrome ($171 million, +10% QoQ).

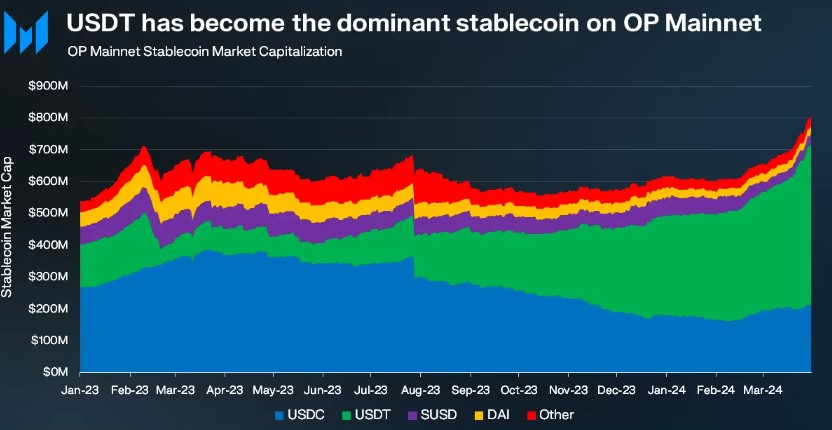

Optimism’s stablecoin market capitalization also grew significantly, reaching $809 million (+32% QoQ) by the end of Q1 2024. Circle’s USDC stablecoin and Tether’s USDT made up most of this, with USDT seeing a 64% QoQ surge to $512 million, or 63% of the total stablecoin market cap on Optimism.

OP Rebounds Alongside Crypto Market Resurgence

Despite Optimism’s strong performance across key metrics in Q1 2024, the network’s native token, OP, did not see a corresponding price increase at the end of Q1. Instead, OP followed the broader market downtrend, hitting an annual low of $1.80 just one month after hitting an all-time high of $4.84 in March.

However, OP has followed suit as the overall cryptocurrency market has seen a resurgence of bullish momentum in the past few days. In the past 24 hours, the token has recorded a 9% price increase and a 3% uptick in the past week, currently trading at $2.56.

Furthermore, CoinGecko data shows a 19% increase in OP’s trading volume over the past 48 hours, reaching $290 million.

While this renewed bullish sentiment is encouraging, OP still trades 46% below its all-time high and faces significant resistance levels soon before a potential retest of this milestone.

The first key resistance is at $2.65, followed by $2.90, which must be overcome before the token can push towards the $3.00 level. Conversely, the $2.34 support level has proven crucial and must be monitored closely in case of any bearish resurgence.

Featured image from Shutterstock, chart from TradingView.com

Celo Community Ratifies Plan to Use Optimism’s OP Stack for New Layer-2 Chain

The vote passed with overwhelming support, with 65 addresses representing 14.6 million CELO tokens signaling approval for the measure.

Optimism to roll out new Superchain features for layer-3 devs

The layer-2 Ethereum scaling provider wants to onboard developers to build layer-3 DApps on its Superchain.

Vested crypto tokens worth over $3B to be unlocked in May

Sui, Pyth Network, Avalanche, Arbitrum and Aptos are set to release vested crypto tokens in May, according to data tracker Token Unlocks.

Pike Finance clarifies ‘USDC vulnerability’ statement on $1.6M exploit

Pike highlighted that the exploit occurred due to their team’s inadequate integration of third-party technologies such as the CCTP or Gelato Network’s automation services.

Market Downturn? Not For Optimism: A16z’s Major OP Purchase Sends Price Skyrocketing By 9%

In a month marked by a challenging correction in the crypto market, Layer 2 (L2) blockchain protocol Optimism has emerged as a standout performer. Within the past 24 hours, Optimism’s native OP token skyrocketed by 9%, positioning it as the best-performing token among the top 100 cryptocurrencies.

Behind this surge lies venture capital firm a16z, which has reportedly invested around $90 million in Optimism’s OP token, signaling further institutional support for the layer 2 protocol.

OP Receives Major Investment

Sources familiar with the matter have revealed to Unchained that a16z has acquired a significant stake in Optimism’s OP token.

The investment, which comes with a two-year vesting period, underscores a16z’s interest in the Layer 2 protocol and aligns with its growing involvement in crypto. Notably, a16z’s portfolio already includes crypto exchange Coinbase.

The investment by a16z comes amidst notable activity and growth within the Optimism ecosystem. Optimism’s OP Stack has experienced increased usage, further validating its value proposition. The protocol’s ability to increase scalability and reduce fees on the Ethereum blockchain has also garnered significant attention.

Optimism’s spokesperson expressed enthusiasm for the investment, acknowledging the energy and momentum surrounding the protocol. The partnership with a venture capital firm like a16z is expected to fuel further development and innovation within the Optimism ecosystem.

On March 7, the Optimism Foundation disclosed the sale of approximately 19.5 million OP tokens, valued at nearly $90 million, to an undisclosed buyer.

These tokens were reportedly sourced from a 30% pool of OP’s original treasury, dedicated to the foundation’s working budget. Reports indicated that the buyer could delegate their tokens to third parties, enabling them to participate in Optimism’s governance.

The foundation clarified that, due to the private nature of the sale, specific details regarding the terms and purchaser were not disclosed.

Key Levels To Watch For Optimism

Despite the recent surge in the Optimism ecosystem and its native token OP, the token still trades well below its all-time high (ATH) reached on March 6, 2024, currently down over 47% from that level.

However, OP’s trading volume has experienced a notable surge, indicating continued interest in the token. According to CoinGecko data, the OP trading volume has increased by over 113% compared to the previous trading day on April 30, amounting to nearly $600 billion in 24 hours.

Key levels to monitor for the token soon include OP’s significant resistance at the $2.62 price mark and a potential retest of the $3 zone.

However, a clear indication of a positive trend for the Optimism token would require a successful consolidation above the $3.92 zone, marking the end of the month-and-a-half downtrend structure.

Conversely, the $2.37 zone has proven to be a crucial support level for OP, as it has held for the past five days and prevented further price decline for the token.

Digging deeper, the $2.25 mark is also a key support, with the most critical support level at $2.11. This level holds the key to Optimism’s macro bullish structure, as it initiated the token’s current uptrend.

Featured image from Shutterstock, chart from TradingView.com

Optimism Soars By 17% Despite Recent Security Revelations

Optimism (OP) has grabbed investors’ attention in the last day following an intriguing positive price performance. Interestingly, OP’s market gain has occurred following a recent disclosure of certain security flaws associated with the popular layer-2 platform.

OP Bounces Back Amidst Optimism Security Concerns

On April 26, Offchain Labs, the initial developers of the prominent Ethereum L2 solution Arbitrum, highlighted certain security flaws found in the Optimism Stack fault-proof system. Via a blog post, the team at Offchain disclosed that they discovered two major systemic vulnerabilities in the newly released security program currently running on the Optimism testnet.

In communication with OP Labs, they stated that these security flaws could enable a bad actor to bypass the existing security measures of the Optimism network by enforcing the acceptance of a malicious claim or the rejection of a right claim. By exploiting these flaws, OffChain Labs stated these hackers could initiate a network dispute that is irresolvable.

The nature of these vulnerabilities is said to originate from the timers in the OP stack fault-proof system. If this program were introduced on the Optimism mainnet with such defects, users’ funds would be exposed to a “very high” level of risk.

However, these vulnerabilities were revealed to OP Labs about a month ago, which has now updated the Optimism testnet to address these security flaws. Interestingly, following these revelations, OP’s price took a nosedive, falling by almost 5% to trade at $2.274 on April 27. However, in the last day, Investors expressed solid confidence in Optimism’s security and future sustainability.

According to data from CoinMarketCap, OP has gained by 17.16% in the past 24 hours attaining a market price of $2.69. In tandem, the token’s daily trading volume is up by 110.64% and is valued at $402.77 million.

Hold Your Altcoins, Analyst Says Why

In the week following the Bitcoin Halving event, popular crypto analyst Michaël van De Poppe has advised users to invest heavily in altcoins. Via an X post on April 27, van De Poppe stated that the catalyzing effect of the Halving and the introduction of spot ETFs on Bitcoin are likely over, with momentum now shifting to the altcoin market.

In comparison to BTC, the crypto analyst notes that most altcoins are undervalued and set for massive gains in the current bull cycle. Furthermore, van de Poppe predicted that the upcoming crypto bull run could last longer than the previous cycle, based on the current extended bear market.

Particularly, van de Poppe identified Optimism (OP) as a promising altcoin with the potential to achieve three times the market growth compared to Bitcoin in this bullish cycle. Additionally, the analyst highlighted other tokens, including Chainlink (LINK), Woo (WOO), Celestia (TIA), and Skale (SKL), as potentially profitable investments.

OP trading at $2.693 on the daily chart | Source: OPUSDT chart on Tradingview.com

Featured image from Moneycontrol, chart from Tradingview

Avail Data Availability Integrated by Arbitrum, Optimism, Polygon, StarkWare, ZkSync

The chains’ users will be able to opt in or out to use Avail for data availability, to stash the reams of data produced for all their transactions taking place.