Uniswap Labs, the creator of one of the largest decentralized trading platforms, is challenging a potential enforcement action by the US Securities and Exchange Commission (SEC), arguing that crypto tokens should not be classified as securities.

The New York-based firm recently refuted the allegation that it operated as an unregistered exchange and broker-dealer. This response follows the SEC’s issuance of a Wells Notice to Uniswap Labs, signaling its intent to recommend legal action against the company.

Uniswap Labs Challenges SEC’s Claims

In a 40-page filing submitted to the SEC, Uniswap Labs outlined numerous reasons why the agency’s pursuit of legal action should be reconsidered. The SEC’s claims are primarily based on the assumption that all tokens are securities, a premise that Uniswap Labs disputes.

Marvin Ammori, Chief Legal Officer of Uniswap Labs, emphasized that tokens are merely a file format for value and not inherently securities. He criticized the SEC’s attempt to redefine the terms “exchange,” “broker,” and “investment contract” to encompass Uniswap’s operations.

This year, the SEC has taken action against numerous crypto firms through Wells notices, lawsuits, or settlements.

The commission’s scrutiny has increasingly focused on Ethereum and decentralized finance players, including Uniswap, ShapeShift, TradeStation, and Consensys. Additionally, reports suggest that the Ethereum Foundation is under investigation.

Distinction Between Tokens And Securities

Uniswap Labs believes that the SEC’s case against them is flawed. It fails to recognize the distinction between tokens as files for value and tokens as securities.

If the SEC proceeds with a lawsuit accusing Uniswap Labs of operating as an unregistered exchange, it risks facing adverse consequences regarding its authority over crypto tokens.

Uniswap Labs warned that such litigation could set a precedent undermining the SEC’s ongoing rulemaking efforts. The company expressed its willingness to litigate if necessary and expressed confidence in a favorable outcome, stating:

But we’re prepared to fight. Our lawyers are 2-0 in high-profile SEC cases. Andrew Ceresney, a former head of enforcement at the SEC, represented Ripple in their victory over the SEC. Don Verrilli, a former U.S. solicitor general, has argued more than 50 cases before the U.S. Supreme Court and represented Grayscale in its successful case against the SEC.

SEC Chairman Gary Gensler has consistently maintained that decentralized exchanges are not genuinely decentralized and should fall under the regulator’s purview.

Gensler has also argued that many digital assets qualify as unregistered securities subject to SEC regulations. Uniswap Labs, in its response, contended that its governance token, UNI, does not meet the requirements of the Howey Test, a legal framework used to evaluate investment contracts.

The company also disputed the SEC’s classification of LP tokens, which are used as securities for liquidity provision in Uniswap pools. Uniswap Labs asserted that LP tokens are accounting tools rather than investment instruments.

Uniswap’s native token UNI has seen significant gains of nearly 20% in the last 24 hours alone, as the market rebounded from a two-month consolidation period to trade at $9.34.

Featured image from Shutterstock, chart from TradingView.com

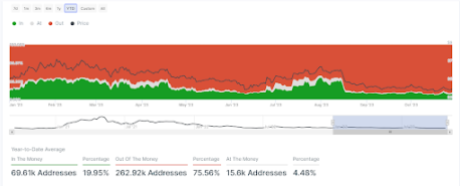

More addresses are out of the money | Source: IntoTheBlock

More addresses are out of the money | Source: IntoTheBlock