Bitcoin has come a long way since its inception in 2009. From being worth less than a penny initially, it has seen massive growth over the years with some dramatic ups and downs. Today, Bitcoin is emerging as a major alternative asset class and its future valuation prospects remain optimistic.

This comprehensive guide takes a data-driven approach to analyze factors affecting Bitcoin prices and makes educated projections about its potential highs and lows in the short, medium and long-term timeframes. With cryptocurrencies gaining mainstream traction, the report aims to provide clarity to investors on what lies ahead for Bitcoin prices based on historical patterns and developments.

What is Bitcoin (BTC)?

Bitcoin is the first and most popular cryptocurrency in the world. It was created in 2009 by the pseudonymous Satoshi Nakamoto, who published the Bitcoin whitepaper and developed the Bitcoin protocol.

Bitcoin introduced blockchain technology to the world. The Bitcoin blockchain is a public ledger that records all Bitcoin transactions ever made. It is decentralized, meaning no single entity controls it. The blockchain is maintained by a global network of computers known as Bitcoin miners.

Key attributes of Bitcoin include:

Decentralized

No central authority controls Bitcoin. It is maintained by a distributed network of users.

Limited supply

Only 21 million Bitcoins will ever exist. This scarcity gives Bitcoin value.

Pseudonymous

Bitcoin addresses are not linked to real-world identities by default, giving users privacy.

Secure

Bitcoin uses cryptography and the blockchain to ensure the security of payments and ownership records.

Divisible

One Bitcoin can be divided into 100 million smaller units called satoshis, allowing small transactions.

Permissionless

Anyone can use Bitcoin without the need for permission from authorities.

These attributes make Bitcoin unique compared to traditional fiat currencies and a promising digital asset for investment.

Factors Influencing Bitcoin Price

Many factors can affect the price of Bitcoin, leading to volatility. Some major factors include:

Supply and Demand

Basic economic theory states that when demand increases while supply remains constant, price goes up. As more investors and institutions adopt Bitcoin, demand rises. But since new Bitcoins are mined at a fixed rate, supply remains steady, driving prices up.

Media Hype and Public Sentiment

Positive or negative media coverage and public sentiment can influence demand and price. For example, Elon Musk’s tweets on Bitcoin often lead to price swings based on his views.

Major Protocol Changes and Upgrades

Major Bitcoin developments like the SegWit upgrade or Lightning Network adoption can improve Bitcoin’s capabilities and affect price.

Regulations and Legal Status

Regulatory crackdowns or acceptance of Bitcoin in different countries impacts price as it affects demand.

Whales and Institutional Investors

“Whales” – entities holding large amounts of Bitcoin – can manipulate prices when they buy or sell. Increased institutional investment also drives up prices through increased demand.

Security Breaches and Scandals

Security issues with exchanges and wallets like the Mt.Gox hack or malicious business practices like the FTX collapse can erode investor confidence and depress prices.

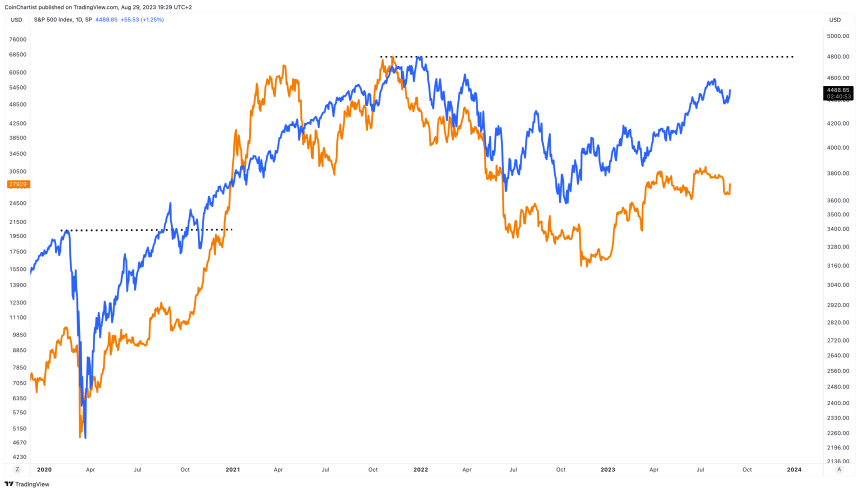

Macroeconomic Conditions

Economic instability and currency devaluations motivate investors to buy Bitcoin as a hedge, boosting its price. However, it has struggled in a hawkish Fed environment and amidst rate hikes.

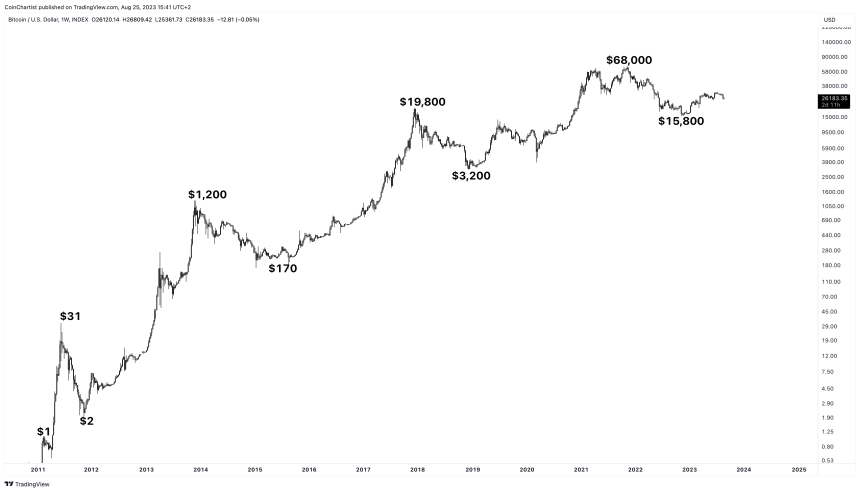

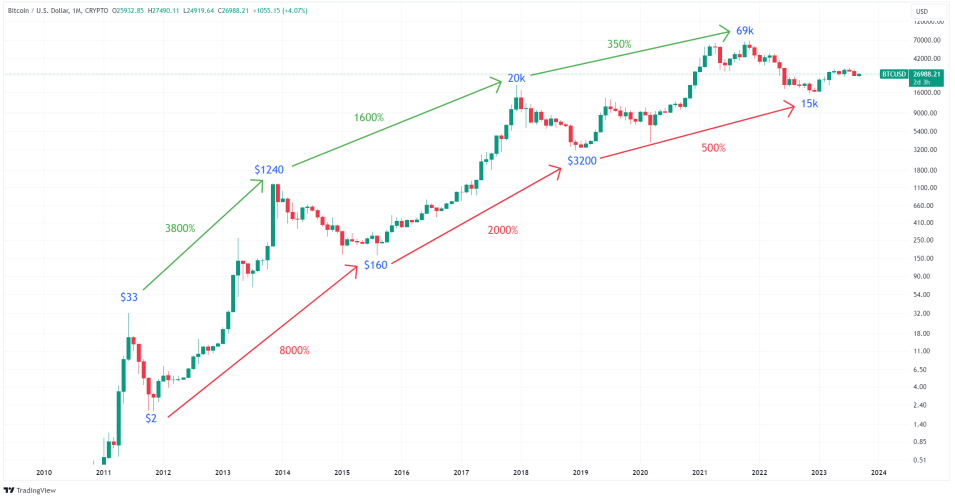

Bitcoin Price Performance in the Past

Looking at past price performance can provide insights into long-term trends and help predict future prices. Let’s take a walk down BTC memory lane.

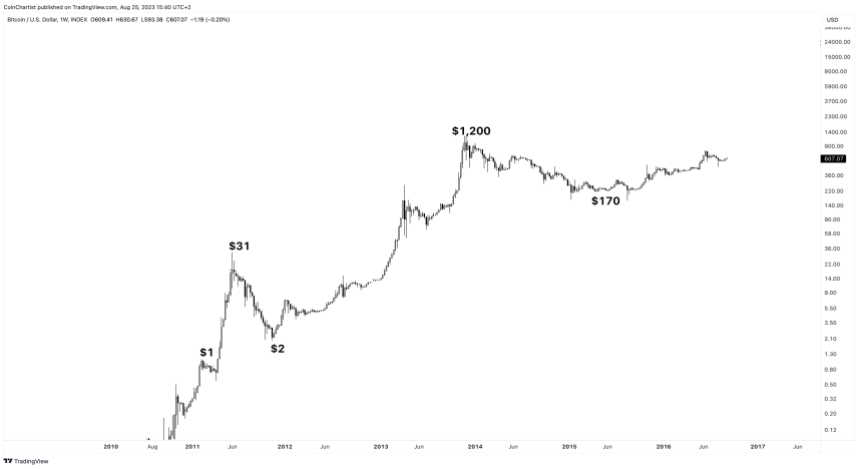

The Early Days – Volatility and Growth (2009-2013)

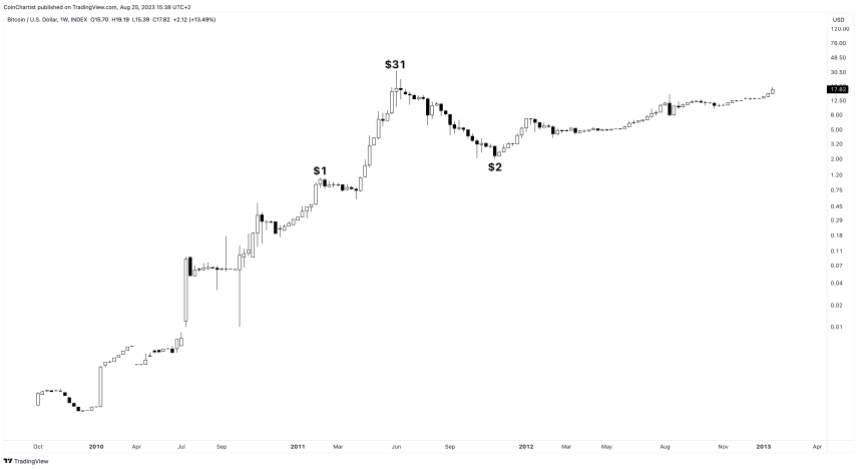

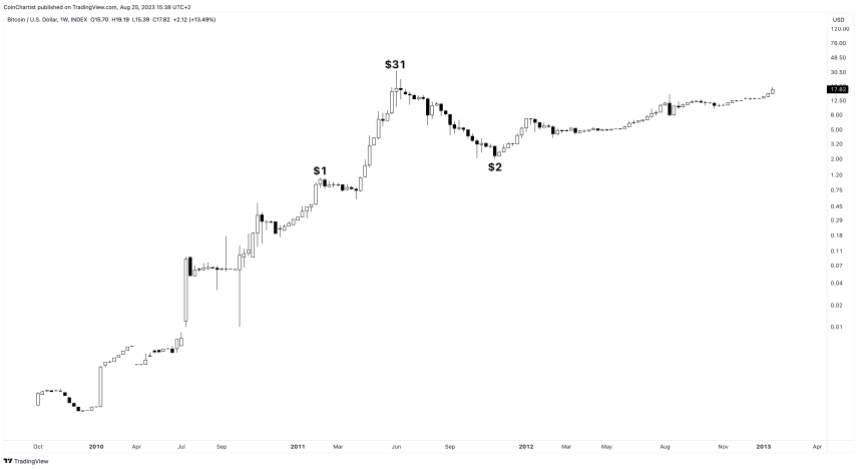

When Bitcoin launched in 2009, it was practically worthless. In 2010, Bitcoin went from $0 to $0.39 and was extremely volatile in its early days.

By early 2011, it achieved parity with the US dollar, hitting $1.00 in February 2011. In the same year, it reached $10 and then $30. This early volatility was attributed to insufficient liquidity, scarcity due to the low Bitcoin supply, and lack of exchange infrastructure.

In mid-2011, Bitcoin fell from around $30 to $2 after a series of exchange hacks and thefts shook investor confidence. It took over a year to reach $10 again.

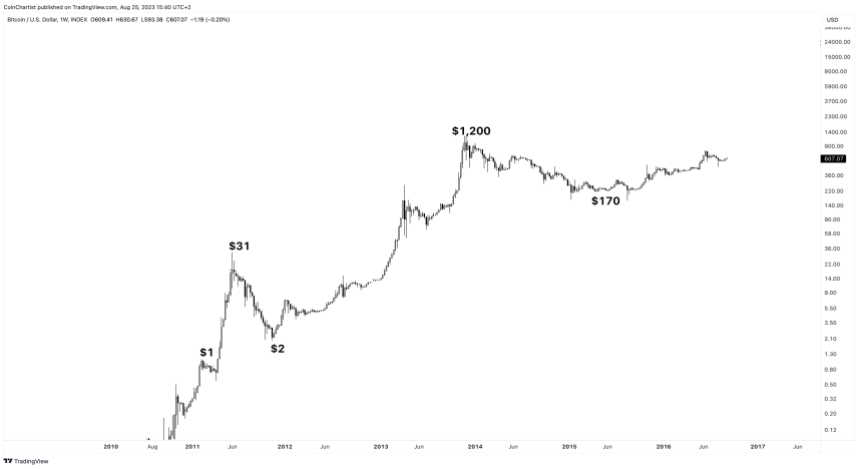

2012 saw gradual gains up to $12 but also wild fluctuations between $7-$15. In 2013, Bitcoin entered a bull run from $12 to over $1,100 driven by increasing media coverage and adoption in the dark web.

But it ended the year around $700 following a China ban on financial institutions and payment processors dealing with Bitcoin. This cycle of rapid gains and dramatic crashes would come to define Bitcoin price performance.

The 2014-2016 Bear Market

2014 kicked off with the collapse of Mt.Gox, then the largest Bitcoin exchange, after a series of hacks. This erased most gains from 2013 and caused Bitcoin to fall from around $850 to below $350.

For the next two years, Bitcoin hovered in the $200-$300 range. Increased regulation and lack of institutional interest kept mainstream adoption low during this period. Prices were relatively stable compared to past volatility.

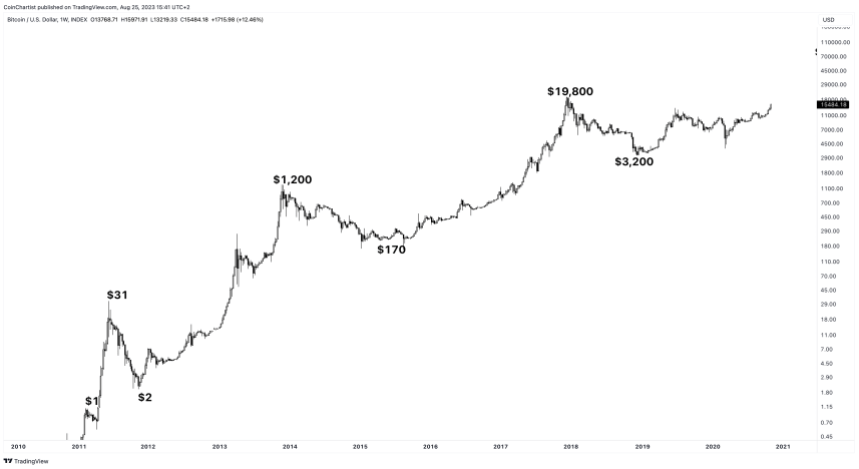

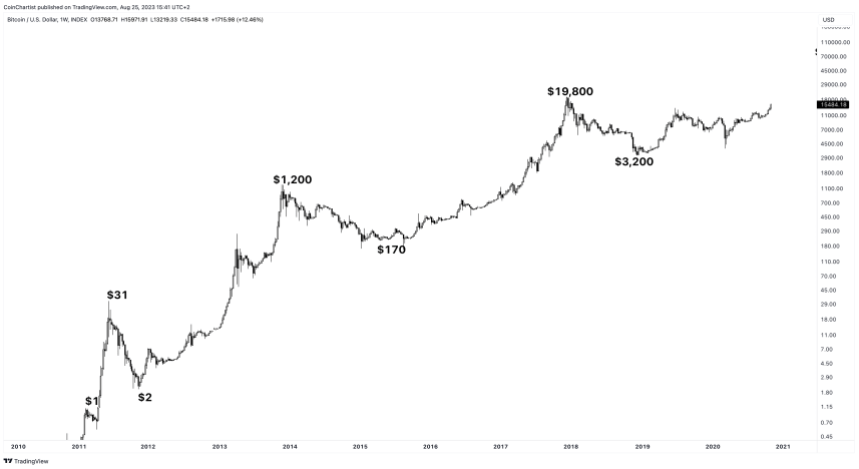

2017 – The Bull Run and Mainstream Mania

2017 marked Bitcoin’s entry into mainstream awareness and a massive growth in price to nearly $20,000.

Several factors drove this rally:

- Growing media and investment bank coverage calling Bitcoin “digital gold”

- Increased adoption in countries facing currency crises like Venezuela and Zimbabwe

- Proposals for Bitcoin ETFs (exchange-traded funds) drew investor attention

- Launch of Bitcoin futures trading on major exchanges like CME and CBOE lent legitimacy

- Large institutional investments – U.S billionaire Michael Novogratz invested $500M in Bitcoin in 2017

Demand rose as Bitcoin went from being an obscure digital asset to a household name. But by January 2018, Bitcoin had lost over 60% from its peak following regulatory measures and other factors leading to a cool down from its previously overheated state.

2018-2020 – The Crypto Winter and Maturation

Bitcoin spent much of 2018 in a bear market following the 2017 rally, trading in the $3,000-$6,000 range.

Bitcoin spent much of 2018 in a bear market following the 2017 rally, trading in the $3,000-$6,000 range.

Increased regulatory scrutiny, exchange hacks, and coin scams contributed to falling prices. But this period also saw the maturation of Bitcoin with developments including:

- Lightning Network launch – enabled fast, cheap Bitcoin micropayments

- Increased mainstream institutional investment from firms like Fidelity and US Bank

- Bitcoin futures added on Bakkt, Nasdaq exchanges

- Countries like Japan recognized Bitcoin as legal tender

These developments likely prevented further drops. By mid-2019, Bitcoin recovered to the $10k-$11k range.

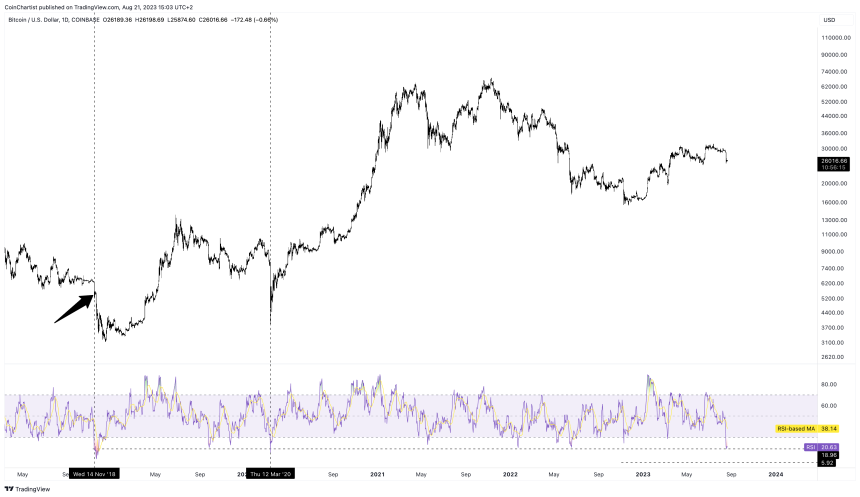

The COVID-19 pandemic and resulting economic crisis in 2020 proved Bitcoin’s value as a hedge against inflation and currency devaluation. Stimulus spending eroded fiat savings while Bitcoin held its value.

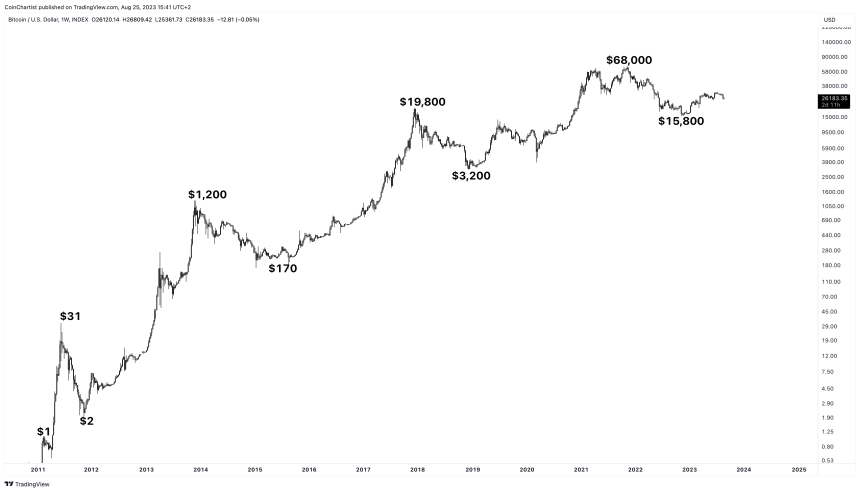

Growing institutional interest like Microstrategy’s $500M Bitcoin purchase helped take prices past 2017 highs, eventually reaching an all-time high of around $68,000 in 2021.

2021-2022 – Twin Peaks and Recession Risk

Bitcoin price made not one, but two new highs in 2021. The second high failed to move significantly past the first high, catching investors off-guard who had anticipated BTC reaching $100,000 or more.

Bitcoin price made not one, but two new highs in 2021. The second high failed to move significantly past the first high, catching investors off-guard who had anticipated BTC reaching $100,000 or more.

Instead, Bitcoin crashed throughout 2022 as the US Federal Reserve launched its QT program and began raising interest rates to fight back against inflation. The situation was worsened by the implosion of several crypto businesses, including FTX. Eventually, Bitcoin reached a local low of $15,800 in November 2022.

How is Bitcoin Doing Now in 2023?

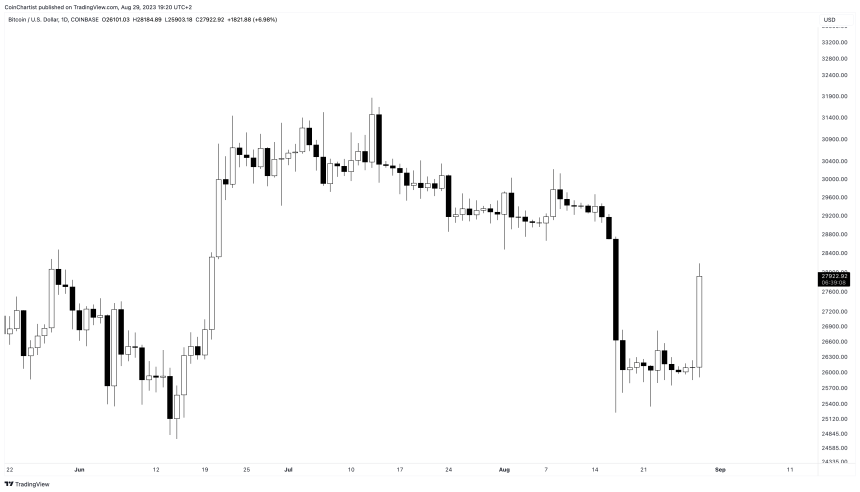

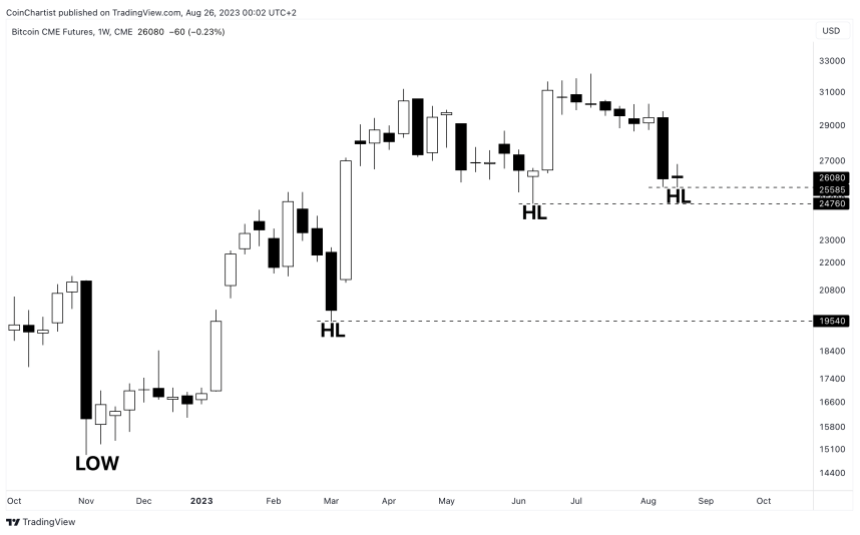

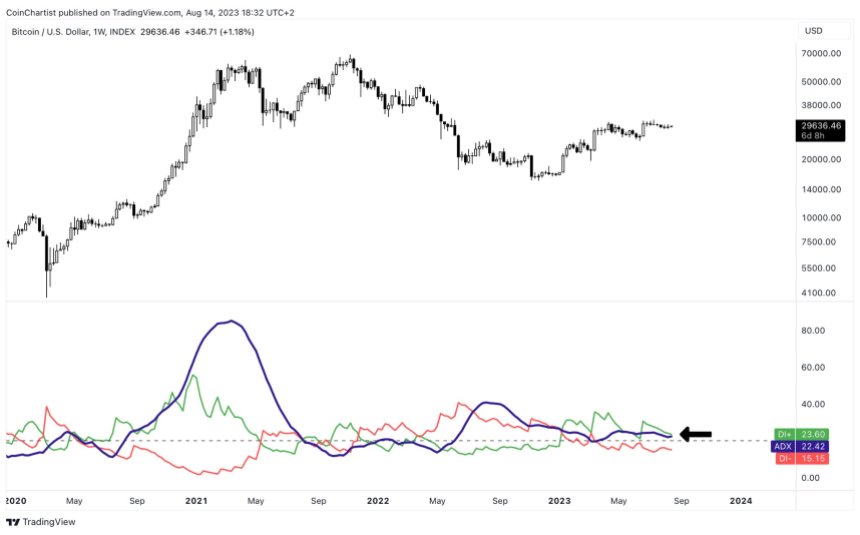

Bitcoin price is doing its best to recovery from the crypto market carnage of 2022. The US Federal Reserve continues to raise rates to record levels, and the US SEC is cracking down on the rest of the crypto industry, making it harder for Bitcoin to regain its footing.

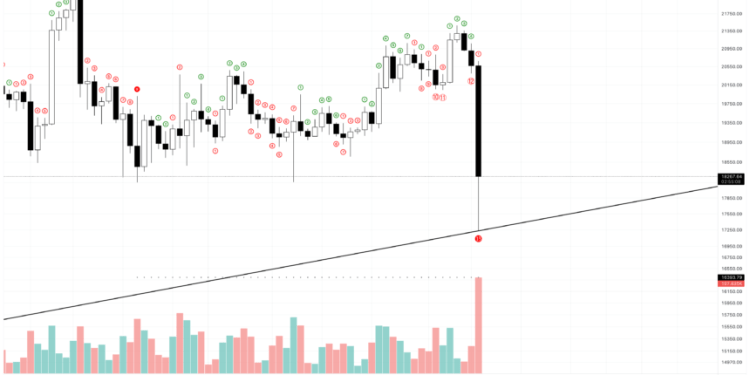

Despite the challenges, many institutions are eying launching Bitcoin EFTs, which could create a bullish narrative that drives prices higher. In the meantime, BTC is correcting after spending the majority of 2023 in a short-term uptrend. The question remains: Is Bitcoin falling back into a bear market, or will the short-term uptrend roll into a more meaningful mid-term uptrend?

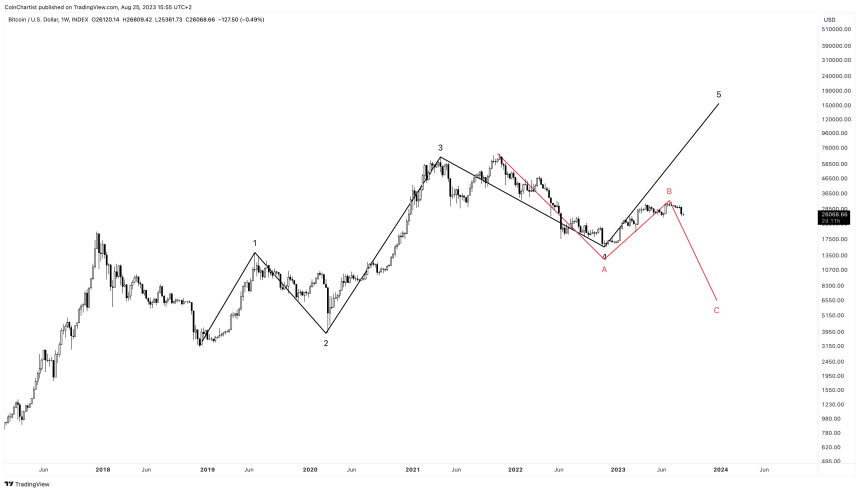

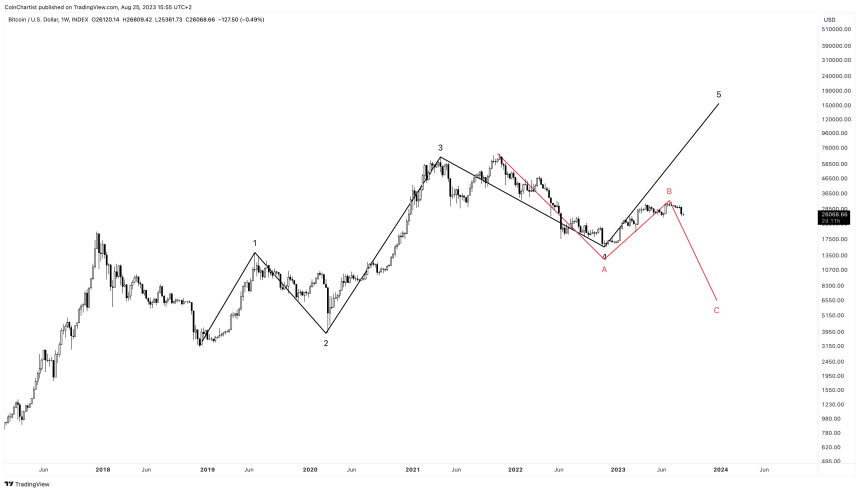

Short-Term Bitcoin Price Prediction for 2023

In the short-term, as in before the end of 2023, there are primarily three options from a technical standpoint. The bullish scenario is based on Elliott Wave Principle, and points to a wave 5 and a possible new all-time high this year. The bearish scenario would put Bitcoin in a further corrective pattern, targeting $6,000 per BTC.

Of course, an alternative scenario is that Bitcoin simple remains in a sideways consolidation phase for several months longer to finish out 2023. Otherwise, a Bitcoin price prediction of $160,000 in 2023 isn’t impossible given past price trajectories and percentage moved.

Medium-Term Bitcoin Price Prediction for 2024 & 2025

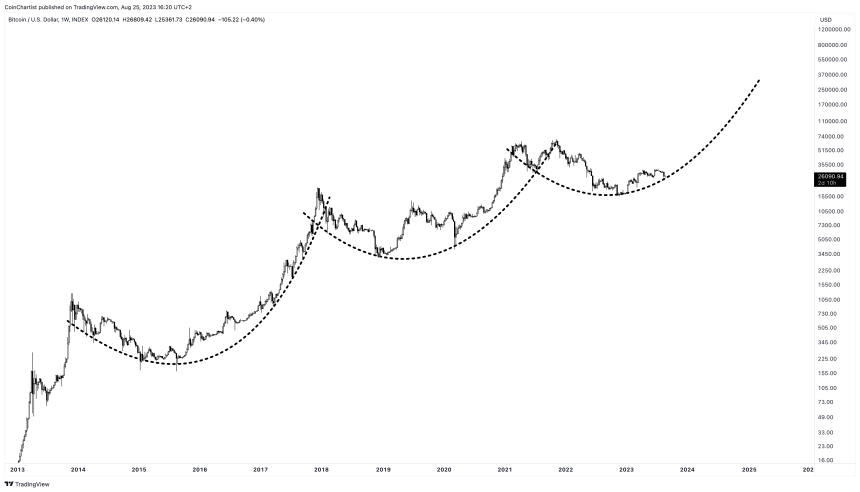

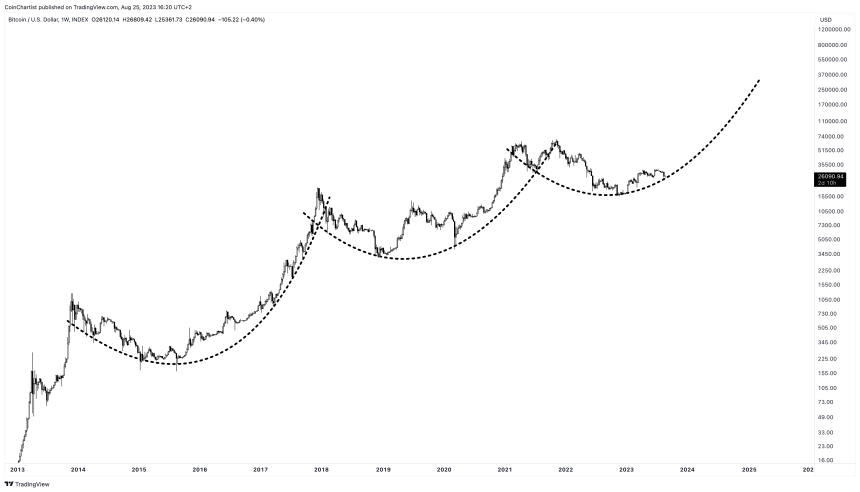

In the medium-term, Bitcoin price forecasts are based on the four-year cycle theory that relies on the Bitcoin block reward halving to tip the tides of supply and demand in favor of price appreciation. Fundamentally over the next several years, Bitcoin should have limited downside.

In the medium-term, Bitcoin price forecasts are based on the four-year cycle theory that relies on the Bitcoin block reward halving to tip the tides of supply and demand in favor of price appreciation. Fundamentally over the next several years, Bitcoin should have limited downside.

Instead, Bitcoin price predictions for 2024 and 2025 point to anywhere between $100,000 to $250,000 per coin on the upside.

Long-term Bitcoin Price Prediction for 2030 and Beyond

Predicting Bitcoin’s price in the long-term is challenging considering how new it still is. However, using a logarithmic growth curve, Bitcoin price predictions reach between $150,000 and $1 million per coin by 2030.

Further out into the future, if Bitcoin establishes itself as the leading global digital currency, it could be worth between $1 million and $10 million per coin.

Total 21 million BTC in supply would give Bitcoin a market cap of $21-$210 trillion, rivaling major assets like real estate and global broad money supply. But such valuations remain speculative. Bitcoin may also face future competition from both other cryptocurrencies and central bank digital currencies (CBDCs).

Bitcoin Price Predictions by Experts

Here are some Bitcoin price forecasts by noteworthy experts and analysts.

- Ark Invest CEO Cathie Wood believes that Bitcoin could hit over $1,000,000 per coin in the long term, with a “base case” of $600,000.

- Venture capitalist Tim Draper sees Bitcoin price ultimately at more than $250,000 per BTC by the end of 2025.

- Standard Chartered has a Bitcoin price prediction of $120,000 by the end of 2024.

FAQ: Frequently Asked Questions

Here are answers to some common questions about this Bitcoin price prediction article:

What was Bitcoin’s lowest price?

The first recorded Bitcoin transaction in 2010 valued BTC at $0.0008. Bitcoin’s lowest recent price was around $15,800 in late 2022.

What was Bitcoin’s highest price?

Bitcoin’s all-time high price was around $68,000 in November 2021.

How high could Bitcoin realistically go?

Considering growing mainstream adoption and investment interest, Bitcoin realistically could reach $100,000-$500,000 by 2030. A $1 million+ valuation cannot be ruled out in the very long-term.

Can Bitcoin price fall to zero?

It is unlikely Bitcoin price will crash to zero given its growing adoption, finite supply, and increasing regulation. There will likely always be some demand for Bitcoin which gives it fundamental value. Anything is possible, however.

Why is Bitcoin price so volatile?

As a new asset class, Bitcoin is still establishing itself, leading to volatility. Manipulation by “whales”, media hype, and regulatory uncertainty add to large price swings. Price should stabilize with broader adoption.

When will Bitcoin price stop fluctuating so much?

Bitcoin price volatility should reduce significantly as it becomes a mainstream asset and gains broader public adoption in 5-10 years. But some short-term fluctuations will always remain.

Will Bitcoin price rise in 2023?

Considering adoption trends and investor interest, the overall Bitcoin price trajectory appears to be upwards in 2023 despite some short-term fluctuations.

Bitcoin spent much of 2018 in a bear market following the 2017 rally, trading in the $3,000-$6,000 range.

Bitcoin spent much of 2018 in a bear market following the 2017 rally, trading in the $3,000-$6,000 range. Bitcoin price made not one, but two new highs in 2021. The second high failed to move significantly past the first high, catching investors off-guard who had anticipated BTC reaching $100,000 or more.

Bitcoin price made not one, but two new highs in 2021. The second high failed to move significantly past the first high, catching investors off-guard who had anticipated BTC reaching $100,000 or more.

In the medium-term, Bitcoin price forecasts are based on the four-year cycle theory that relies on the Bitcoin block reward halving to tip the tides of supply and demand in favor of price appreciation. Fundamentally over the next several years, Bitcoin should have limited downside.

In the medium-term, Bitcoin price forecasts are based on the four-year cycle theory that relies on the Bitcoin block reward halving to tip the tides of supply and demand in favor of price appreciation. Fundamentally over the next several years, Bitcoin should have limited downside.

Retweet = Yes

Retweet = Yes  Like = Soon

Like = Soon

Take a peek & sign-up here:

Take a peek & sign-up here: