Bitcoin’s recent performance has sent shockwaves through the crypto market, with retail investors who bought the token at its peak particularly bearing the brunt of this downward push.

However, as we’ve mentioned time and time again, corrections in the market – any market – are healthy.

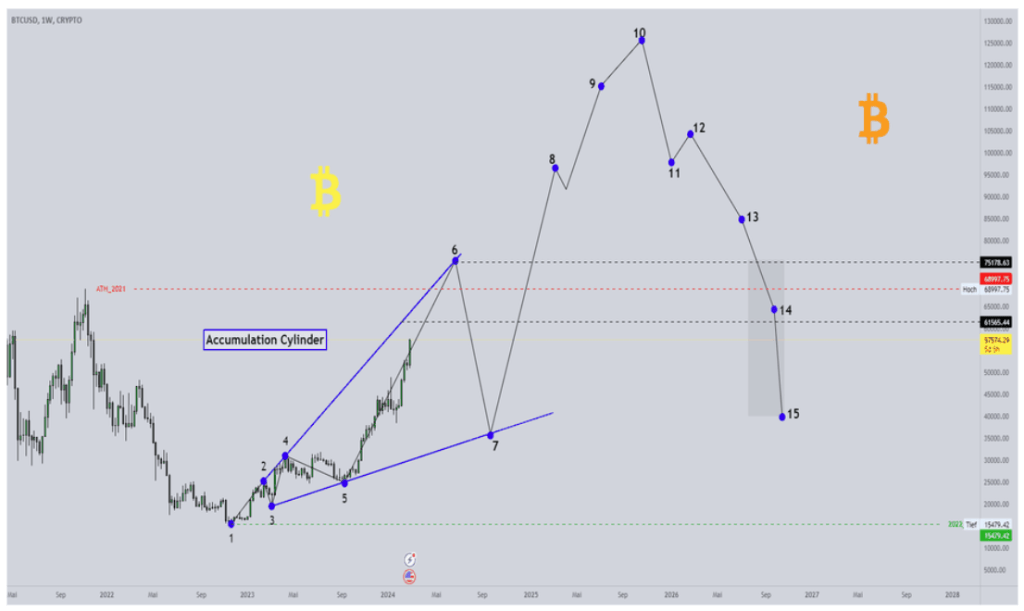

Even better, we’ve noticed a rare bullish signal in Bitcoin. Spoiler alert: it’s one of the strongest (because it’s pretty much worked every single time) technical patterns as far as $BTC is concerned.

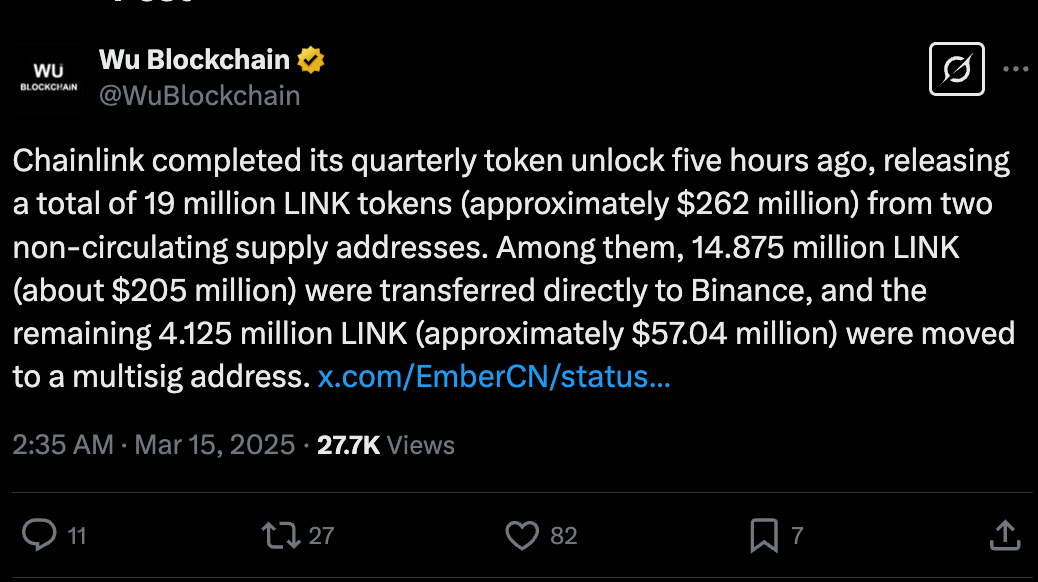

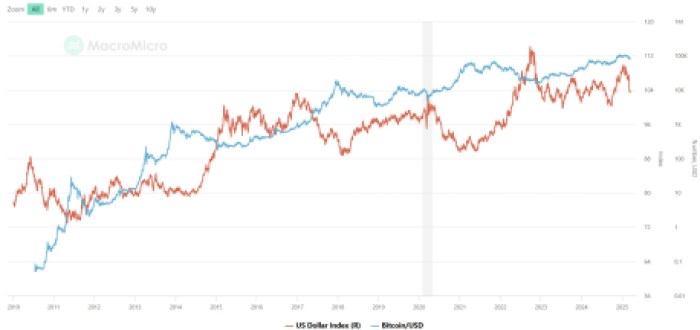

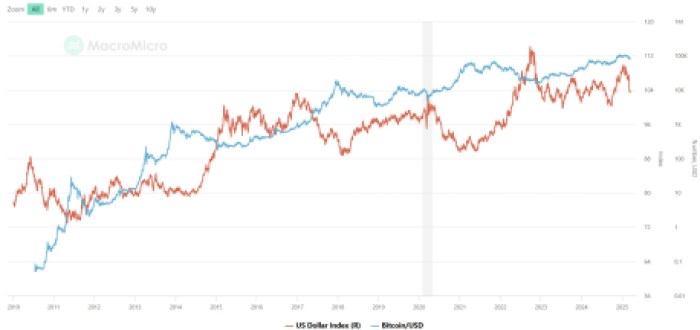

US Dollar Strength Index (DXY) Hints at Bitcoin Reversal

First things first, it’s important to understand that Bitcoin has an inverse correlation with the US Dollar Strength Index (DXY).

Simply put, Bitcoin’s price increases whenever DXY is sloping downwards and vice versa.

The DXY decreased by over 3.4% in a single week recently. Such a rapid fall in the DXY has only occurred thrice before, and each of those instances saw $BTC shed its sluggishness and rally violently to new highs.

To further understand just how prominent this bullish signal is, let’s take an in-depth look at what happened in the past – seeing as in the markets, past action is a strong predictor of future prices.

- In 2015, DXY fell sharply, and Bitcoin climbed by over 200% in just a few months.

- The first few months of 2020 saw the exact same thing unfold, i.e., DXY sloped downwards and BTC sloped upwards simultaneously.

- The latest and greatest instance was during the 2022 bear market recovery, when a decline in DXY was followed by a long-drawn consolidation in $BTC – and then a sharp move upwards.

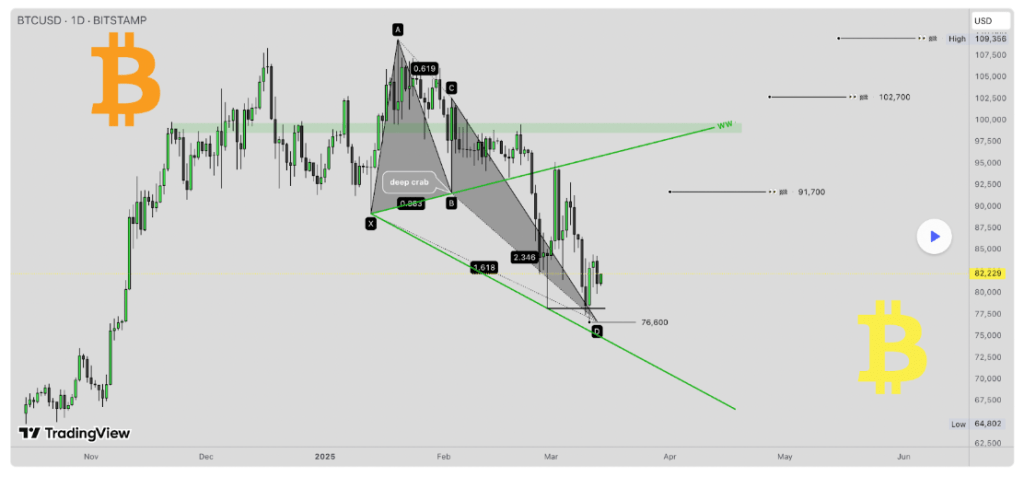

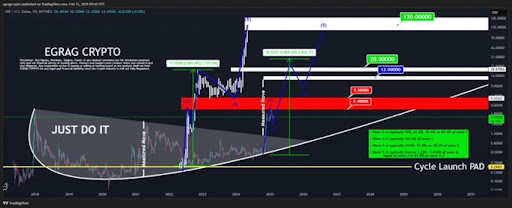

Bitcoin’s Chart Also Screams Bullishness

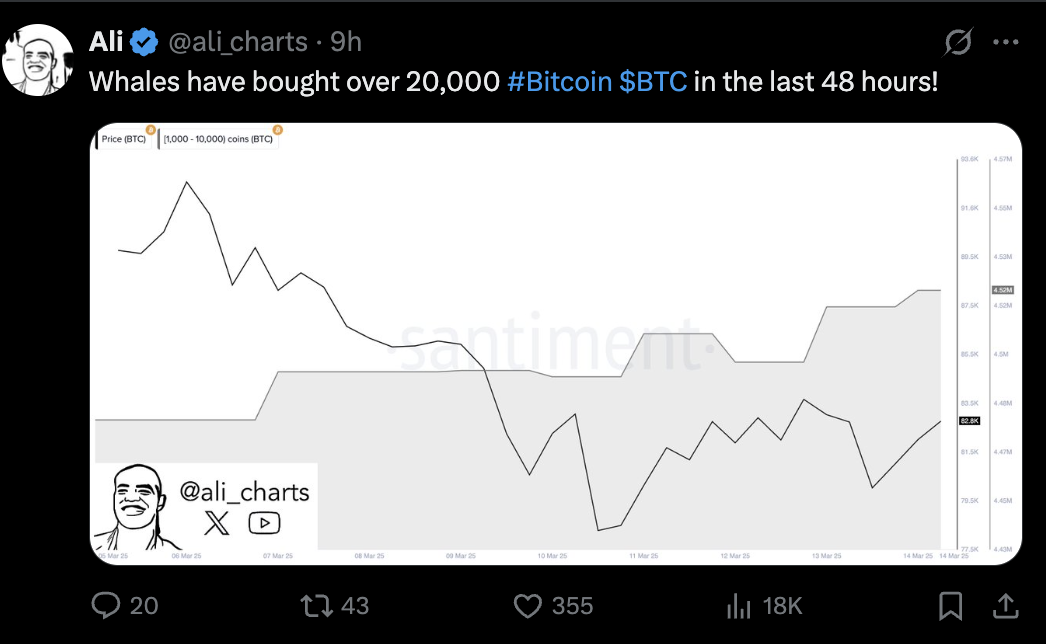

In addition to an inverse relationship with DXY, Bitcoin’s chart is also showing a handful of positive signs.

On the weekly chart, $BTC is taking support on the 50 EMA (Exponential Moving Average). Furthermore, it has formed a pretty neat hammer candle, which is a classic buy signal.

On the 4-hour and 1-hour timeframes, Bitcoin is hovering over the 10 & 20 EMAs, which are both sloping upwards. This is a strong indicator of an upcoming price explosion towards the upside.

If you’re looking to make the most of the forthcoming Bitcoin (and crypto) rally, here are the best new presales to buy. Since these are tokens that haven’t yet been listed, you can grab them for astonishingly cheap prices.

1. BTC Bull Token ($BTCBULL) – Best New Presale to Buy to Get Behind Bitcoin’s Growth

With Bitcoin finally showing some serious intentions to rally upwards, it’s worth backing a project like BTC Bull Token ($BTCBULL).

It is, after all, a meme coin that can help you maximize your earnings from Bitcoin’s growth. Here’s how:

- As a token holder, you’ll receive free $BTC via airdrops. Just make sure you buy and hold $BTCBULL in Best Wallet.

- Secondly, because these $BTC airdrops are slated to take place every time Bitcoin reaches a new milestone ($150K, $200K, $250K, and so on), the price of the $BTCBULL token, too, will rise by leaps and bounds.

Also, given that BTC Bull Token works on meme coin fundamentals, it’s expected to generate better returns than Bitcoin.

Expert BTC Bull Token price predictions suggest the token could reach $0.0084 by the end of 2025.

That’s a nearly 3.5x return on your investment – provided that you get in now when the token is in presale ($3.6M+ raised) and available at some of its lowest ever prices. 1 $BTCBULL is currently selling for just $0.00241.

2. Solaxy ($SOLX) – First-Ever Solana Layer-2 Currently in Presale

Bitcoin might be the biggest cryptocurrency out there, but blockchain networks like Solana have occupied a significant place in the crypto economy, too.

And with Bitcoin to pull the entire crypto market along with it, an altcoin with real utility like Solaxy ($SOLX) is in a pole position to skyrocket.

Solaxy will build the first-ever Layer 2 scaling protocol on Solana. It will provide a much-needed boost to the Solana network, which has recently been struggling with scalability issues and failed transactions.

Essentially, the abundance of meme coin launches in the last few months has overwhelmed Solana, and its mainnet is in dire need of some relief.

Solaxy will do so by processing transactions away from the network’s primary chain, i.e., on a sidechain.

Additionally, since it’s a multi-chain token (works on both Ethereum and Solana), it will leverage Ethereum’s liquidity while providing the same top-notch security and affordability that Solana is known for.

It’s also among the hottest presales of 2025, having already amassed over $26.4M. You can join the hype by shelling out just $0.001664 per token.

Check out our guide on how to buy Solaxy for more info.

3. Bitcoin Pepe ($BPEP) – Fascinating New Project Aiming to Create Bitcoin L2

Bitcoin Pepe calls itself the ‘World’s ONLY Bitcoin Meme ICO.’

Although we still believe BTC Bull Token to be the king of all Bitcoin meme coins, it’s worth noting that $BPEP, unlike $BTCBULL, is actually based on the Bitcoin blockchain.

$BPEP’s aim is simple. It wants to combine Bitcoin’s class-leading liquidity and security with Solana’s speed and low fees and use that to create a meme layer-2 network on Bitcoin.

By becoming a hub for meme coin activities within the Bitcoin ecosystem, Bitcoin Pepe plans to kickstart a new era of DeFi and meme coin trading on the world’s most popular blockchain.

The project, which is currently in its presale, has witnessed significant investor interest.

It has managed to raise a whopping $4.8M so far, and you can currently buy one token for an extremely low price of $0.0281.

Bottom Line

To conclude, Bitcoin has by no means fallen out of favor in the market.

With a rare and extremely strong buy signal in DXY divergence and several other technical analysis confluences in play, the OG crypto is highly likely to start an upmove sooner rather than later.

Although $BTC itself as well as the other top cryptos mentioned in this guide can easily make you a crypto millionaire in 2025, it’s important to not go into overdrive.

That means only investing a sum that’s small enough for you and doing your own research before diving in. Remember, none of the above is a substitute for professional financial advice.