By Francisco Rodrigues (All times ET unless indicated otherwise)

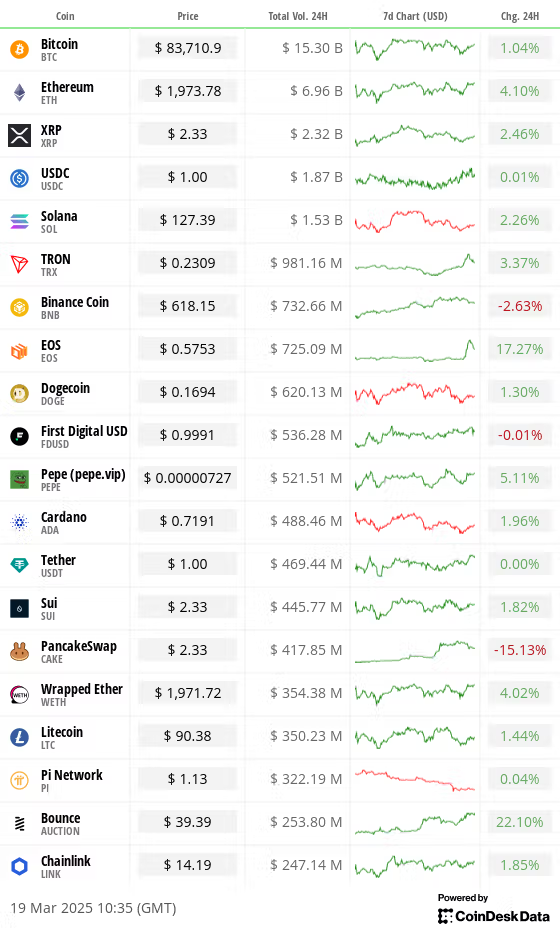

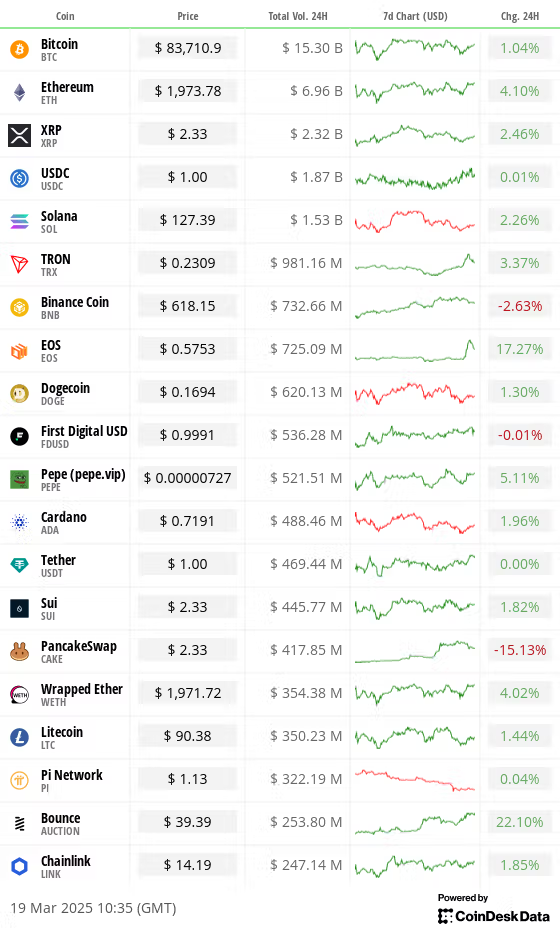

Cryptocurrency prices are seeing a slight recovery from Tuesday’s decline with bitcoin (BTC) gaining 0.5% and the broader CoinDesk 20 Index (CD20) advancing 0.8% in the last 24 hours.

The drop came before the Federal Reserve’s policy decision due later today. Interest rates are forecast to remain unchanged at 4.25%-4.5%, so investors will instead be focused on macro outlook with a potential end to quantitative tightening (QT) in sight.

Since mid-2022, the Fed has been slowly shrinking its balance sheet, which inflated to $9 trillion to support the economy during the COVID era. An earlier-than-expected end to quantitative tightening, which has so far reduced the Fed’s balance sheet to $6.7 trillion, could boost risk assets like bitcoin.

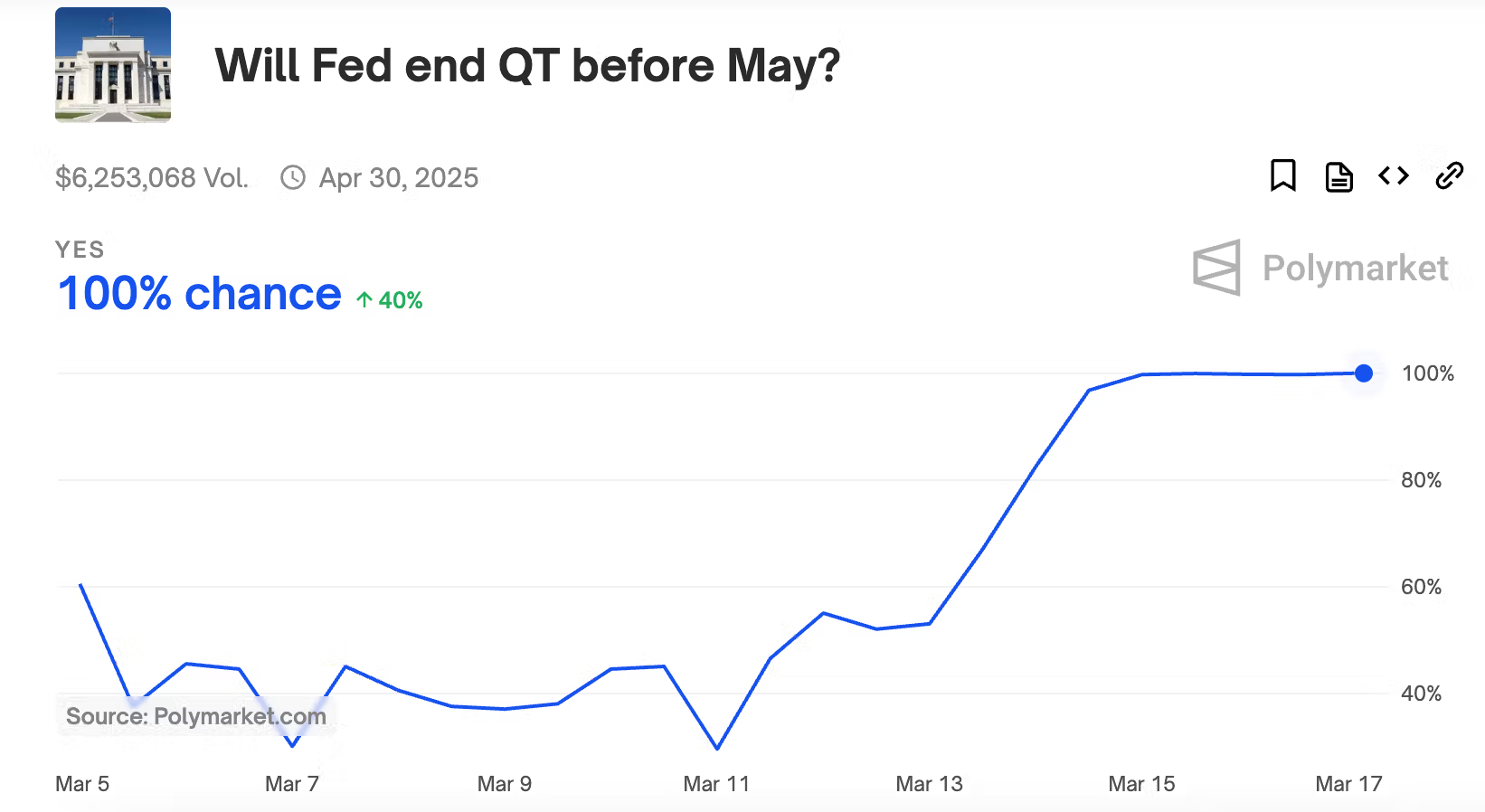

An end to QT would see the Fed stop withdrawing liquidity from the market, potentially weakening the dollar and making crypto assets more attractive. Traders on prediction market Polymarket are essentially certain an end to QT will be announced before May.

Another boost for risk assets came from the Bank of Japan (BOJ), which held its benchmark interest rate unchanged, despite growing inflation in the country. The decision keeps Japanese bond yields steady, limiting the attractiveness of these assets and attracting less capital to traditional markets. Still bitcoin failed to respond.

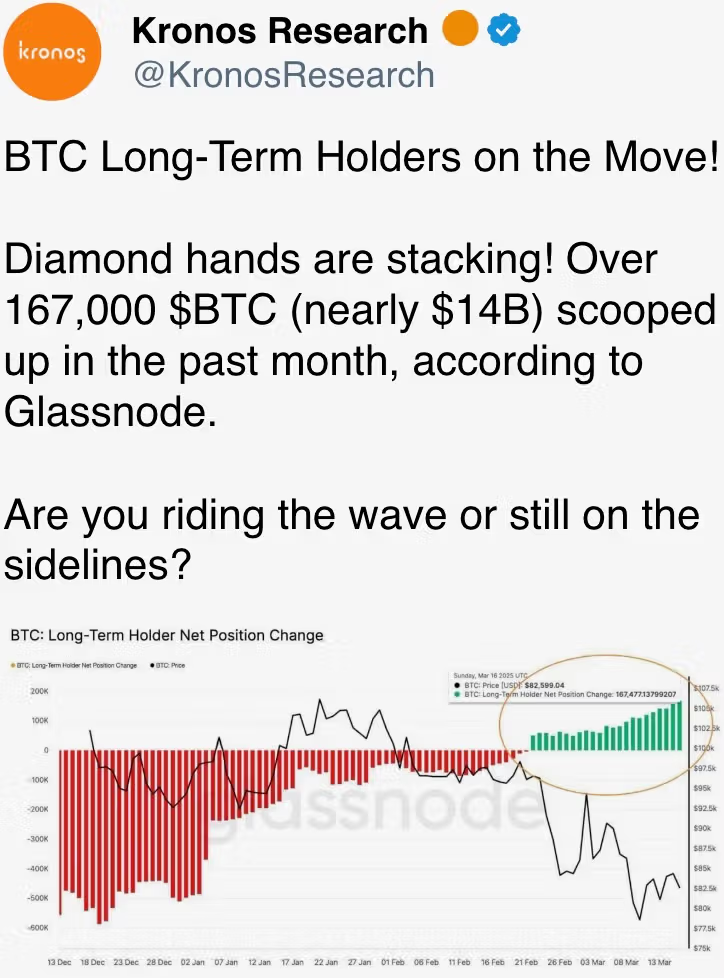

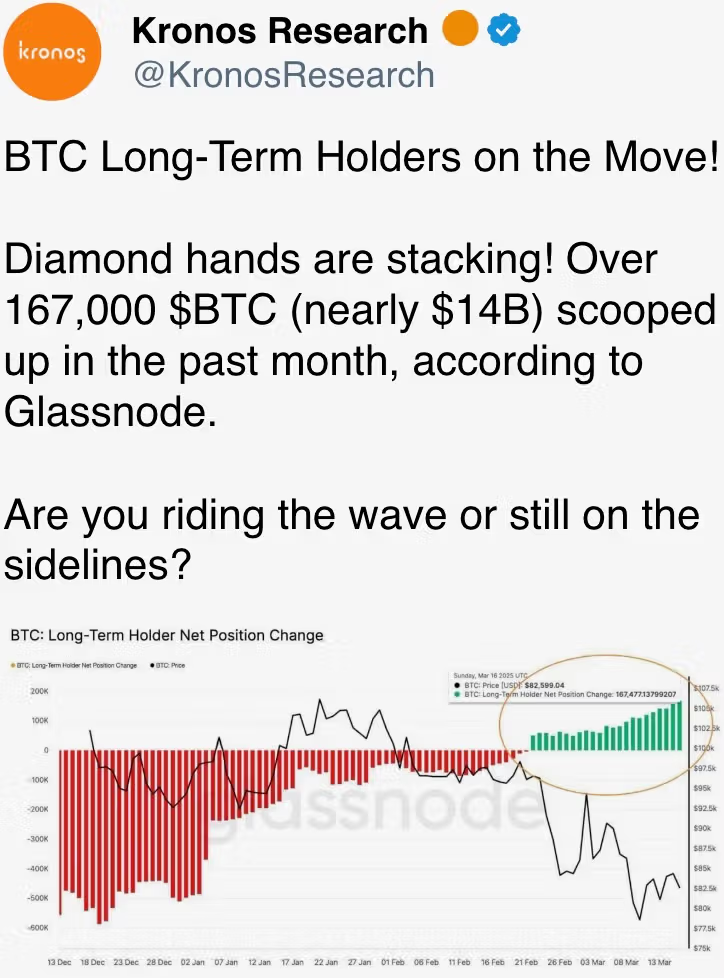

Bitcoin’s appeal as an alternative store of value has been seeing growing recognition. The number of public companies buying bitcoin has more than doubled to 80 from 33 in just two years, according to data from River. Strategy, the largest corporate holder of BTC, has even detailed plans to sell $500 million in preferred stock to buy more.

Yet, growing tariffs threats have reignited inflationary risks as economic growth stagnates. The result could be stagflation, a situation that wouldn’t please market participants. Stay alert!

What to Watch

Crypto:

March 20: Pascal hard fork network upgrade goes live on the BNB Smart Chain (BSC) mainnet.

March 21, 1:00 p.m.: The SEC’s Crypto Task Force hosts a roundtable, open to the public, that will focus on the definition of a security.

March 24 (before market open): Bitcoin miner CleanSpark (CLSK) will join the S&P SmallCap 600 index.

March 24, 11:00 a.m.: Bugis network upgrade goes live on Enjin Matrixchain mainnet.

March 25: The Mimir upgrade goes live on Chromia (CHR) mainnet.

Macro

March 19, 2:00 p.m.: The Federal Reserve announces its interest-rate decision. The FOMC press conference is likely to be live-streamed 30 minutes later.

Fed Funds Interest Rate Est. 4.5% vs. Prev. 4.5%

March 19, 3:00 p.m.: Argentina’s National Institute of Statistics and Census releases GDP data.

Full Year GDP Growth (2024) Prev. -1.6%

GDP Growth Rate QoQ (Q4) Prev. 3.9%

GDP Growth Rate YoY(Q4) Est. 1.7% vs. Prev. -2.1%

March 19, 5:30 p.m.: The Central Bank of Brazil announces its interest-rate decision.

Selic Rate Est. 14.25% vs. Prev. 13.25%

March 20, 3:00 a.m.: The U.K.’s Office for National Statistics releases January employment data.

Unemployment Rate Est. 4.4% vs. Prev. 4.4%

March 20, 8:00 a.m.: The Bank of England announces its interest-rate decision.

Bank Rate Est. 4.5% vs. Prev. 4.5%

March 20, 8:30 a.m.: The U.S. Department of Labor releases employment data for the week ended March 15.

Initial Jobless Claims Est. 224K vs. Prev. 220K

Continuing Jobless Claims Est. 1890K vs. Prev. 1870K

March 20, 3:00 p.m.: Argentina’s National Institute of Statistics and Census releases Q4 employment data.

Unemployment Rate Prev. 6.9%

March 20, 7:30 p.m.: Japan’s Ministry of Internal Affairs & Communications releases February consumer price index (CPI) data.

Core Inflation Rate YoY Est. 2.9% vs. Prev. 3.2%

Inflation Rate MoM Prev. 0.5%

Inflation Rate YoY Prev. 4%

Earnings (Estimates based on FactSet data)

March 27: KULR Technology Group (KULR), post-market, $-0.02

March 28: Galaxy Digital Holdings (GLXY), pre-market, C$0.38

Token Events

Governance votes & calls

Arbitrum DAO is voting on registering the “Sky Custom Gateway contracts” in the “Router contracts” to enable users to bridge USDS and sUSDS through the official Arbitrum Bridge UI.

Frax DAO is voting on introducing the WisdomTree Government Money Market Digital Fund (WTGXX) as an on-chain reserve for Frax USD.

March 21, 11:30 a.m.: Flare to host an X Spaces session on Flare 2.0.

Unlocks

March 21: Immutable (IMX) to unlock 1.39% of circulating supply worth $14.16 million.

March 23: Metars Genesis (MRS) to unlock 11.87% of its circulating supply worth $146.8 million.

March 31: Optimism (OP) to unlock 1.93% of its circulating supply worth $28.22 million.

April 1: Sui (SUI) to unlock 2.03% of its circulating supply worth $150.22 million.

April 3: Wormhole (W) to unlock 47.7% of its circulating supply worth $118.05 million.

April 7: Kaspa (KAS) to unlock 0.59% of its circulating supply worth $12.3 million.

Token Listings

March 19: Hamster Kombat (HMSTR) and DuckChain (DUCK) to be listed on Kraken.

March 31: Binance to delist USDT, FDUSD, TUSD, USDP, DAI, AEUR, UST, USTC, and PAXG.

Conferences

CoinDesk’s Consensus is taking place in Toronto on May 14-16. Use code DAYBOOK and save 15% on passes.

Day 2 of 3: Digital Asset Summit 2025 (New York)

Day 2 of 3: Fintech Americas Miami 2025

Day 1 of 2: Next Block Expo (Warsaw)

March 24-26: Merge Buenos Aires

March 25-26: PAY360 2025 (London)

March 25-27: Mining Disrupt (Fort Lauderdale, Fla.)

March 26: Crypto Assets Conference (Frankfurt)

March 26: DC Blockchain Summit 2025 (Washington)

March 26-28: Real World Crypto Symposium 2025 (Sofia, Bulgaria)

March 27: Building Blocks (Tel Aviv)

March 27: Digital Euro Conference 2025 (Frankfurt)

March 27: WIKI Finance EXPO Hong Kong 2025

March 27-28: Money Motion 2025 (Zagreb, Croatia)

March 28: Solana APEX (Cape Town)

April 2-3: Southeast Asia Blockchain Week 2025 Main Conference (Bangkok)

April 3-6: BitBlockBoom (Dallas)

April 6-9: Hong Kong Web3 Festival

April 8-10: Paris Blockchain Week

April 15-16: BUIDL Asia 2025 (Seoul)

Token Talk

By Shaurya Malwa

More than 590 new tokens were issued on the Tron blockchain-based SunPump today, marking the highest issuance in four months and spurring Tron founder Justin Sun to post “tron meme szn” on X.

Sun later posted that trading fees will be “subsidized,” adding that every memecoin would be “back on Tron.”

SunPump allows instant trading without initial liquidity seeding, fueling the frenzy. It has pocketed $5.74 million in fees in the past 24 hours, reaching levels not seen since August.

Derivatives Positioning

Bitcoin futures open interest (OI) on centralized exchanges has risen above $55 billion, up 32% since Feb. 23, with OI in SOL and ETH futures remaining mostly stagnant. The market is clearly biased toward the leading cryptocurrency.

Positioning in the BTC CME futures, however, remains light, near February lows.

NEAR, TON and TRX are leading growth in perpetual futures open interest in the past 24 hours. NEAR stands out with negative cumulative volume delta, pointing to net selling.

Deribit-listed BTC and ETH options continue to show bias for short and near-dated protective puts.

Market Movements:

BTC is up 1.84% from 4 p.m. ET Tuesday at $83,576.60 (24hrs: +0.88%)

ETH is up 2.04% at $1,945.99 (24hrs: +2.6%)

CoinDesk 20 is up 2.2% at 2,624.87 (24hrs: +1.6%)

Ether CESR Composite Staking Rate is unchanged at 2.96%

BTC funding rate is at 0.0071% (7.74% annualized) on Binance

DXY is down 0.32% at 103.57

Gold is unchanged at $3,030.30/oz

Silver is down 1.24% at $33.70/oz

Nikkei 225 closed -0.25% at 37,751.88

Hang Seng closed +0.12% at 24,771.14

FTSE is down 0.15% at 8,691.31

Euro Stoxx 50 is up 0.15% at 5,493.38

DJIA closed on Tuesday +0.62% at 41,581.31

S&P 500 closed -1.07% at 5,614.66

Nasdaq closed -1.71% at 17,504.12

S&P/TSX Composite Index closed -0.32% at 24,706.07

S&P 40 Latin America closed unchanged at 2,476.87

U.S. 10-year Treasury rate is unchanged at 4.29%

E-mini S&P 500 futures are up 0.23% at 5,682.25

E-mini Nasdaq-100 futures are up 0.32% at 19,764.25

E-mini Dow Jones Industrial Average Index futures are up 0.16% at 42,004.00

Bitcoin Stats:

BTC Dominance: 61.62 (0.27%)

Ethereum to bitcoin ratio: 0.02329 (-0.30%)

Hashrate (seven-day moving average): 773 EH/s

Hashprice (spot): $47.30

Total Fees: 5.13 BTC / $428,677

CME Futures Open Interest: 154,060 BTC

BTC priced in gold: 27.2 oz

BTC vs gold market cap: 7.71%

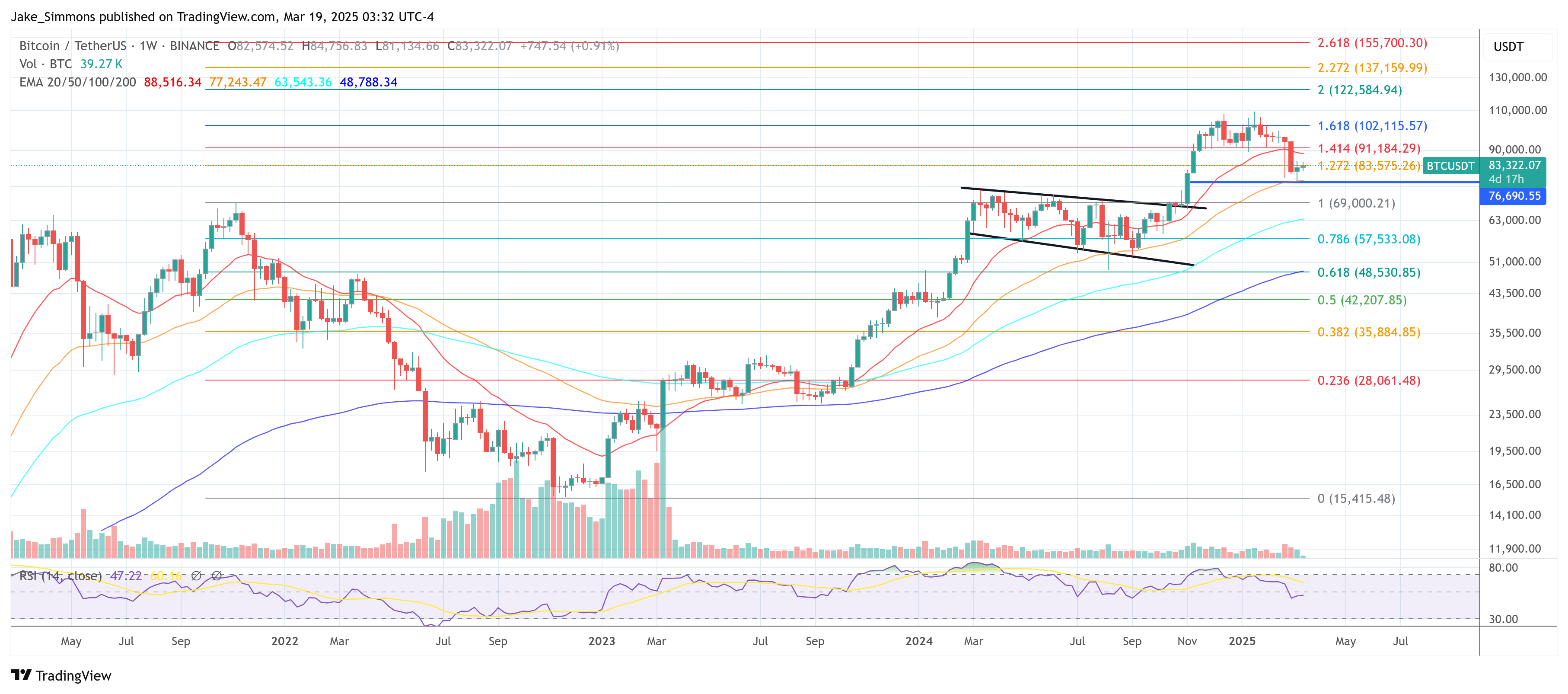

Technical Analysis

BTC’s recent bounce toward the 200-day simple moving average (SMA) is accompanied by a declining trend in daily trading volumes.

The discrepancy raises a question mark on the sustainability of the recovery.

Plus, the 50-day SMA has crossed below the 100-day SMA, a bearish signal that the path of least resistance is to the downside.

Crypto Equities

Strategy (MSTR): closed on Tuesday at $283.19 (-3.77%), up 1.95% at $288.47 in pre-market

Coinbase Global (COIN): closed at $181.14 (-4.14%), up 1.36% at $183.60

Galaxy Digital Holdings (GLXY): closed at C$17.09 (-1.5%)

MARA Holdings (MARA): closed at $12.07 (-6.94%), up 1.74% at $12.28

Riot Platforms (RIOT): closed at $7.40 (-4.64%), up 1.22% at $7.49

Core Scientific (CORZ): closed at $8.02 (-8.45%)

CleanSpark (CLSK): closed at $7.59 (-6.53%), up 1.98% at $7.74

CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $14.25 (-7.29%)

Semler Scientific (SMLR): closed at $35.49 (-1.5%), up 9.33% at $38.80

Exodus Movement (EXOD): closed at $30.26 (-6.46%)

ETF Flows

Spot BTC ETFs:

Daily net flow: $209.1 million

Cumulative net flows: $35.87 billion

Total BTC holdings ~ 1,116 million.

Spot ETH ETFs

Daily net flow: -$52.8 million

Cumulative net flows: $2.47 billion

Total ETH holdings ~ 3.472 million.

Source: Farside Investors

Overnight Flows

Chart of the Day

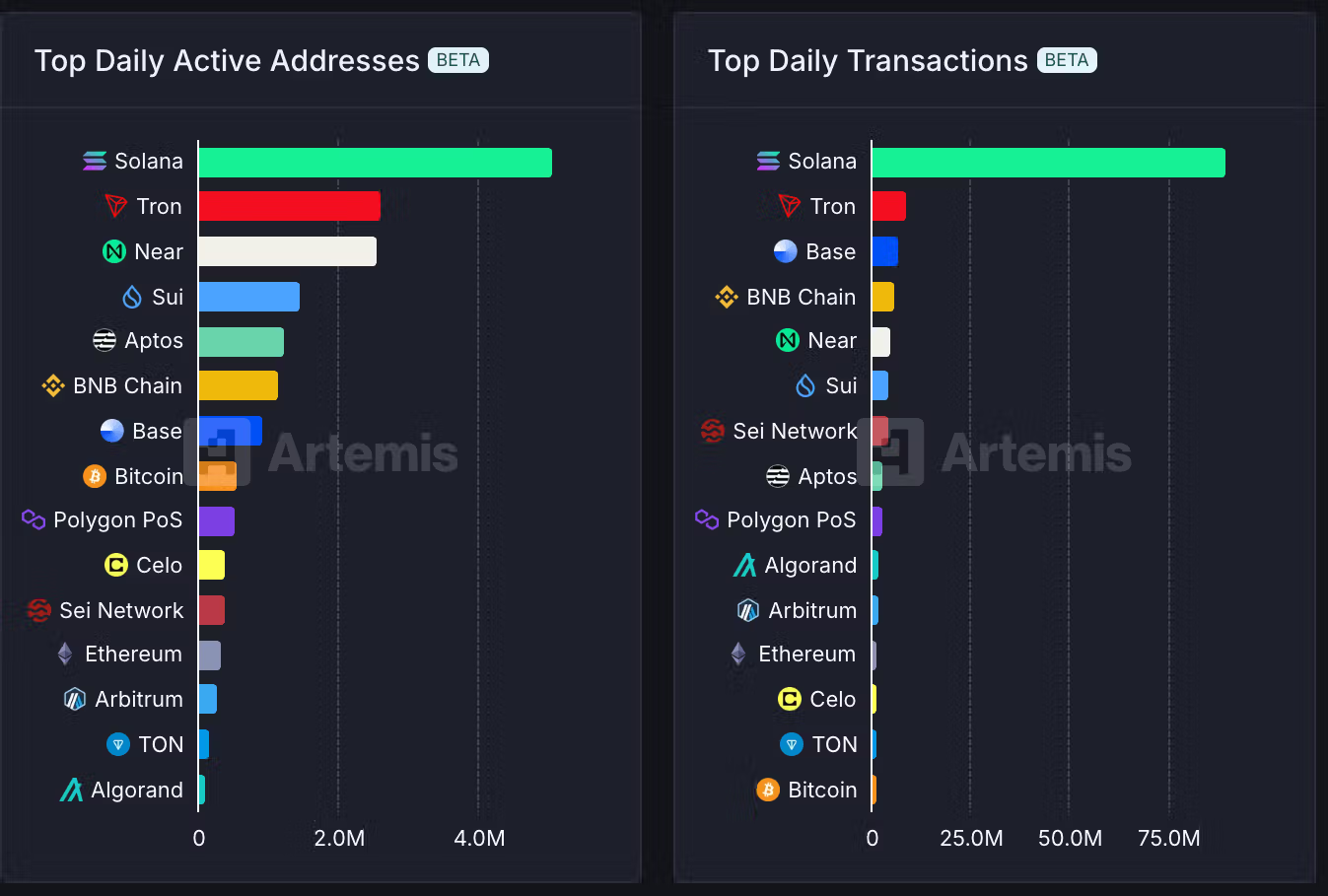

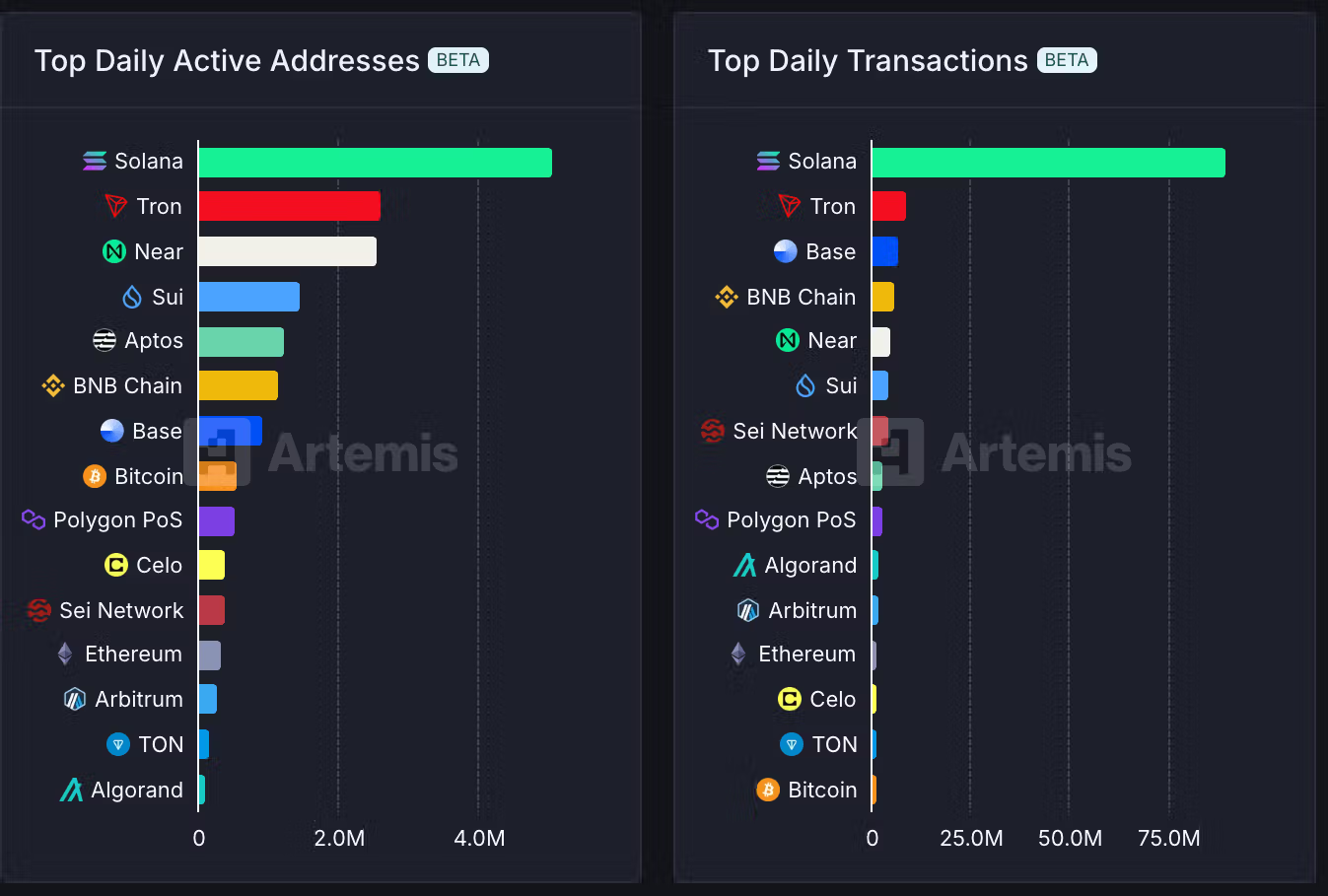

Programmable blockchain Solana leads other platforms with the highest number of daily active addresses and daily transactions despite a slowdown in the memecoin trading frenzy.

The data supports the bull case for the blockchain’s SOL token versus native coins of other smart-contract blockchains.

While You Were Sleeping

Investors Pump $22B Into Short-Term U.S. Debt to Ride Out Market ‘Storm’ (Financial Times): Investors, wary of Donald Trump’s economic policies, are moving into haven assets, with short-term Treasury funds seeing $21.7 billion in net inflows from early January to March 14.

Bank of Japan Keeps Interest Rates Steady, Warns of Trump Tariff Risks (Reuters): The central bank held its benchmark rate at 0.5%, as economists forecast. Governor Kazuo Ueda indicated that future rate policy is likely to reflect the effects of tariffs imposed by the U.S.

Drone Strike Sets Fire to Russia Oil Depot Near Damaged CPC Link (Bloomberg): Despite a proposal discussed Tuesday by Donald Trump and Vladimir Putin to halt attacks on energy infrastructure, a key Russian oil depot was struck by a Ukrainian drone early Wednesday.

Raydium’s RAY Jumps 13% as DEX Reveals Own Token Issuance Platform (CoinDesk): The Solana-powered decentralized exchange Raydium is reportedly planning to launch a platform named LaunchLab to increase revenue and expand its user base.

Untangled Finance Brings Moody’s Credit Scores On-Chain (CoinDesk): The proof of concept system, powered by Polygon’s Amoy testnet, uses zero-knowledge proof technology to securely publish, update and withdraw credit ratings on-chain, protecting proprietary information.

North Dakota Senate Passes Crypto ATM Bill to Create Licensing Regime (CoinDesk): House Bill 1447 requires crypto ATM operators to issue fraud warnings, obtain money transmitter licenses, use blockchain analytics software for fraud detection, submit quarterly reports and appoint a compliance officer.

In the Ether