Founders Fund partner Joey Krug claims the Biden-era SEC told crypto founders that settled with them that they could no longer work in the industry.

Cryptocurrency Financial News

Founders Fund partner Joey Krug claims the Biden-era SEC told crypto founders that settled with them that they could no longer work in the industry.

Bitcoin analyst Charles Edwards says a Bitcoin-cycle bottom could be close as negative sentiment continues to build.

Deutsche Telekom operates broadband and mobile networks in more than 50 countries through its subsidiaries, such as T-Mobile, and has a customer base of 252 million.

The Head of Research at CryptoQuant has revealed why it may be too early to call a bottom for Bitcoin, based on the trend in on-chain data.

In a new post on X, CryptoQuant Head of Research Julio Moreno has talked about why Bitcoin may not have reached a bottom yet. “All valuation metrics are in correction territory,” notes the analyst. “It can take more time.”

An indicator that Moreno has cited as an example of this trend is the Market Value to Realized Value (MVRV) Z-Score. This metric basically tells us about how the market cap of the asset compares against its realized cap.

The “realized cap” is an on-chain capitalization model that calculates the total value of the BTC supply by assuming that each token in circulation has its ‘true’ value equal to the spot price at which it was last transacted on the blockchain.

In other words, the realized cap sums up the cost basis of the cryptocurrency’s supply. As such, the model can be interpreted as a measure of the total amount of capital the investors as a whole have put into BTC.

Since the MVRV Z-Score compares the market cap, which represents the value the investors are holding right now, against this initial investment, it tells us about the profit-loss status of the cryptocurrency’s user base.

The MVRV Z-Score is similar to the popular MVRV Ratio, but where it differs from the latter is that it also applies a standard deviation test to pull out the extremes from the data.

Now, here is the chart shared by Moreno that shows the trend in the Bitcoin MVRV Z-Score, as well as its 365-day moving average (MA), over the last few years:

As displayed in the above graph, the Bitcoin MVRV Z-Score has recently witnessed a sharp decline. The reason for this drawdown naturally lies in the crash that the asset’s price has just gone through, which has put many investors into a state of loss.

Despite the plummet, though, the metric remains above the zero mark. Below this level, the overall market enters into a state of loss, so the boundary has historically proven to be an important one for the cryptocurrency.

An important level that the metric has indeed lost, however, is the 365-day MA. As the analyst has highlighted in the chart, past breakdowns of the line have generally led to notable periods of struggle for the Bitcoin price.

It only remains to be seen how long BTC would have to stay under the level this time around, before its price reaches a bottom.

At the time of writing, Bitcoin is floating around $86,300, down more than 11% over the last seven days.

MetaMask, the popular self-custodial crypto wallet for the Ethereum (ETH) network, shared a flurry of announcements on Thursday, aimed at improving its wallet’s user experience.

Part of Metamask’s revamped roadmap includes adding smart contract capabilities to its current wallet. At the moment, MetaMask is an Externally Owned Account (EOA), a type of wallet that is controlled by a public and a private key. One of the main downfalls with EOAs is that it is subject to human error, meaning if you forget your private key, you lose your crypto holdings in that account forever. The other type of wallet that exists on Ethereum are Contract Accounts (CAs), which are controlled by code and have recovery mechanisms in place and security checks for verifying transactions.

In a blog post shared during ETHDenver, the largest North American Ethereum conference, the MetaMask team said “smart-contract-based accounts allow us to solve a number of problems: allowing new powerful uses of the assets you hold, while simultaneously improving security. When the user defines their terms from their own programmable account, we greatly expand how the user expresses their agency in ways that are enforced by their own code.”

One of those new features aimed at making the user experience on MetaMask easier include ERC-5792, which builds on its current feature, smart transactions. Under ERC-5792, or known as batched transactions, users can combine certain steps when it comes to signing off transactions, like “approve + swap” in one click, meaning that they would save time and gas fees by batching those steps together.

Dan Finlay, the co-founder of MetaMask, told CoinDesk that batching transactions “give us all the things you’re going to ask for in order, we’ll present them to the user in a nice, unified way. The user will pay for one gas fee for the series of events and then it’ll just be one block for the whole series of operations.”

The MetaMask team also shared that its MetaMask debit card will be available in select states in the U.S. starting mid-March. The card has been in production for a few months and was initially available just to users in the UK and EU.

It connects to a user’s MetaMask wallet, letting them spend their crypto.

“You can be earning staking rewards or yield on your favorite protocol with your favorite tokens and have those funds available to spend anywhere that Mastercard is accepted with just a tap,” the team wrote in a blogpost.

As part of the theme of making the user-experience easier, the MetaMask team will be adding support for Bitcoin (BTC) and Solana (SOL) in its wallets, meaning users can hold their various crypto assets in one place.

“So these are simultaneously delivering some of the most popular blockchains, but, but they’re also ensuring that we have smoothed out every part of our interface that allows new blockchains to be added seamlessly,” Finlay said in the interview.

Read more: Popular Crypto Wallet MetaMask Rolls Out ‘Smart Transactions’ to Combat Ethereum Front-Running

OpenAI has released a preview version of GPT-4.5, which it claims has a higher EQ and is more creative than previous versions. However, some observers claim the new model is overpriced.

Dogecoin, the industry’s premier meme coin, has consistently led most altcoins in price performance in recent months. However, it faces its toughest challenge amidst falling network activity and a price slump.

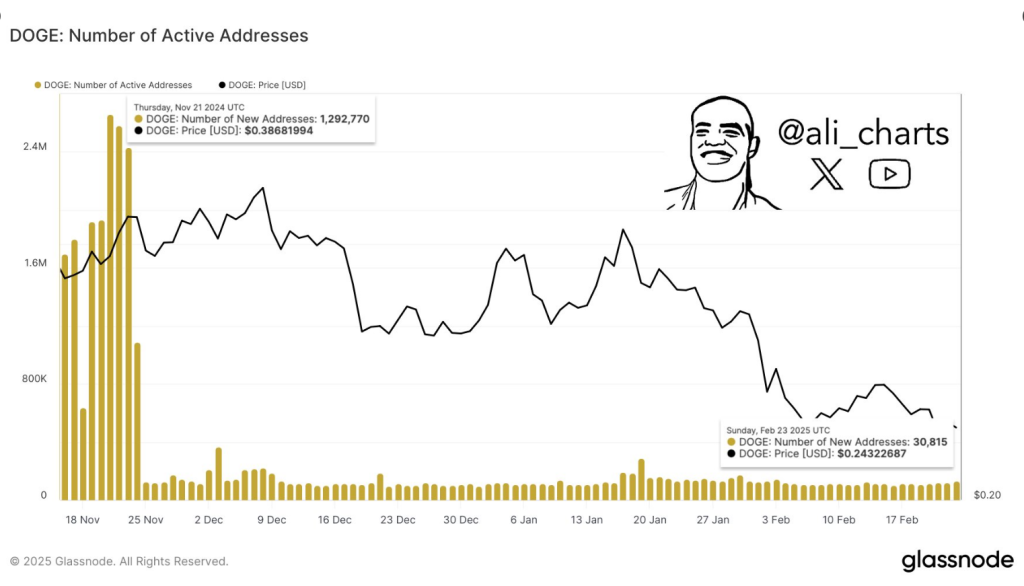

According to an analyst, Dogecoin experienced a massive 95% drop in active addresses on its network, suggesting a considerable decline in activity.

#Dogecoin $DOGE network activity has declined by 95%, dropping from 2.66 million active addresses in November to just 130,282 today! pic.twitter.com/SlH3qTuMP6

— Ali (@ali_charts) February 25, 2025

As Dogecoin’s price starts to recover, its network activity suffered. Crypto expert Ali Martinez notes the decline in the network activity, sharing that the drop in the number of active addresses began three months ago.

According to Martinez, the Dogecoin network registered 1,292,770 new active addresses by November 21st, 2024. The number soon surged to 2.4 million active addresses, but this number immediately dropped. Between December 2024 and February 2025, the number of addresses dropped by around 95%.

Meanwhile, Dogecoin’s price has declined substantially in the last few days, with holders incurring losses. The popular meme coin is currently trading at $0.2077, a slight improvement from its $0.1977 price a few hours ago. Despite DOGE’s minimal gains, it’s still down from last week’s performance.

On February 23rd, it was noted that the network only had 30,815 new addresses, confirming the slide in network activity. The decrease in Dogecoin’s network activity was reflected in its price movement, which dipped from $0.4868 to $0.196. With price dipping and a decline in network activity, many commentators argued it’s a sign of weak demand for Dogecoin.

According to one data, there’s a 2.67% decline in the percentage of long-term Dogecoin investors, which means a less accumulation. Also, there’s a drop of 11.81% in mid-term coin holders, meaning they have already exited their positions.

Finally, the data indicates a 107.45% increase in short-term holders, which suggests an increase in speculative trading. This information shows that Dogecoin traders are more interested in short-term and speculative trading activities than long-term investment.

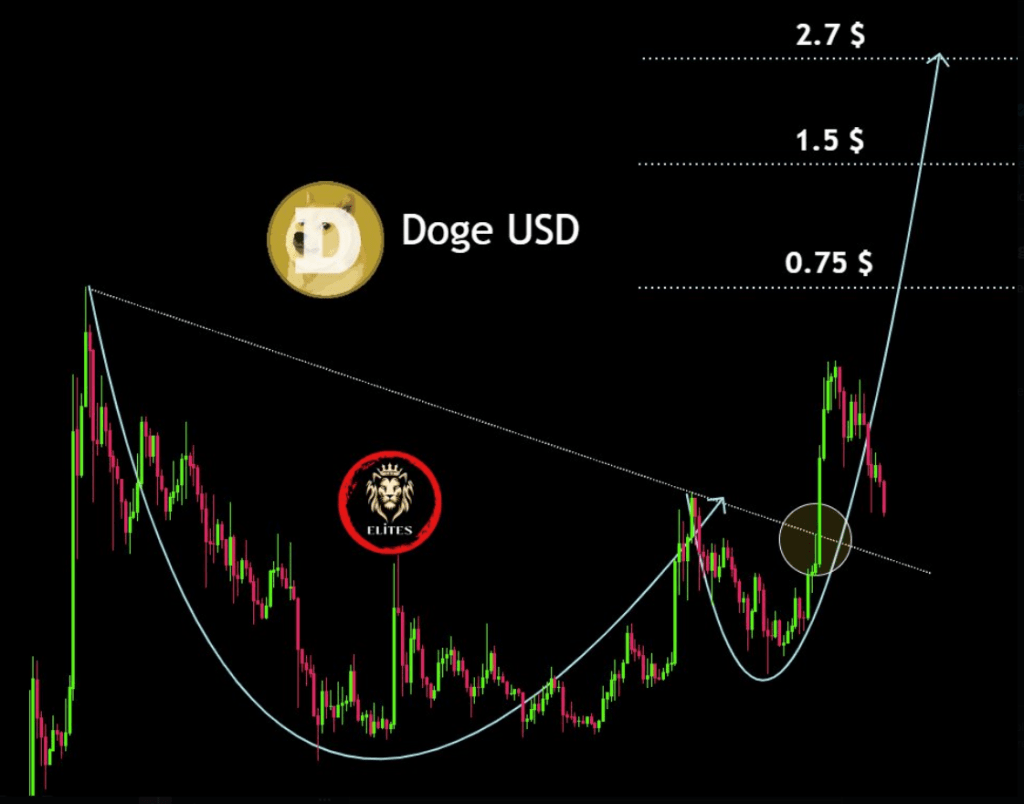

DOGE is starting its big move!

Heading to $5 soon.$DOGE #DOGE #Dogecoin #Memecoin pic.twitter.com/VaztdMxmSn

— @CryptoELlTES (@CryptooELITES) February 25, 2025

DOGE Price Targets

Although Dogecoin’s price is currently down, a few commentators expect a rebound soon. According to CryptoELITES, Dogecoin is up for a rebound, and poised to hit a new higher target.

The analyst offered three price targets for Dogecoin: $0.75, $1.5, and $5.

Featured image from Pexels, chart from TradingView

For decades, your investment portfolio has revolved around a key academic idea that hasn’t held up very well: efficient markets. There’s a direct line from the efficient markets theory of Eugene Fama in the 1960s to modern portfolio theory. It paved the way for index funds, a strategy that has not only weathered market cycles but also become the default for managing pensions and retirement accounts.

As we step into a new era of digital finance, tokenized assets may offer a way to broaden our investment horizons in ways that traditional models have overlooked.

The genesis of modern portfolio theory

Index fund investing didn’t arise by chance. In the early 1970s, amid vigorous debates over market efficiency, Burton Malkiel’s seminal work advocating index funds in 1973 (in his book “A Random Walk Down Wall Street”) was embodied in John Bogle’s launch of the Vanguard S&P 500 fund in 1975.

This cemented a strategy that focused on broad diversification and minimal trading. Astonishingly, passive index-investing has triumphed around the world, even though the theory underpinning it, that investors are always rational, hasn’t held up well.

Behavioral psychologists like Daniel Kahneman and Amos Tversky illuminated the flaws in our decision-making processes. This is highlighted in Daniel Kahneman’s award winning book, “Thinking Fast and Slow.”

In the ensuing decades, economists have reconciled efficient markets and irrational behavior into the concept of “pretty good markets.” Aggregated wisdom in the form of prices trends towards being right, over time, though from day to day and case to case there are significant gaps that investors can exploit. Index funds have held up well because exploiting those opportunities is hard to do consistently or cheaply.

At the same time, the regulatory framework governing institutional investing reinforces this reliance on proven strategies. Fund managers operate under strict fiduciary duties that require them to prioritize client interests and mitigate risk. As a result, they allocate the bulk of their portfolios to assets with long, established track records, typically government bonds and passive equity funds.

In short, the criteria for “acceptable” investments aren’t driven solely by potential returns; they are fundamentally tied to data history, reliability, and transparency. In case you were wondering, that means index funds.

In this environment, venturing into uncharted territory is not taken lightly. New asset classes, no matter how promising, are initially sidelined because they lack the long-term, daily data that makes them viable for inclusion in a fiduciary portfolio. Until now, almost all portfolio theory has been based on U.S. equities and government bonds. Although that universe has expanded over time to include index funds and bonds from other large economies, it still represents only a relatively small portion of the world’s assets. Portfolios are constrained at the intersection of regulations and data. And that’s all going to change.

Tokenization: Expanding the universe of investable assets

Tokenization and on-chain transactions don’t just offer a scalable way to package any kind of asset. They also offer a path to transparent, comparable data on asset values. By representing real-world assets, whether it’s Thai real estate, Nigerian oil leases, or New York taxi medallions as digital tokens on a blockchain, we can begin to generate the kind of daily, market-derived data that has traditionally been reserved for a narrow set of assets.

Consider a simple question: How much Thai real estate should feature in a diversified retirement portfolio? Under current models, the answer is obscured by a lack of reliable, continuous pricing data. But if Thai real estate were tokenized, establishing an on-chain market with daily closing prices, it could eventually be measured against the same metrics used for U.S. equities. In time, this would force a re-examination of the static, index-based approach that has dominated investment strategy for so long.

The implications for global finance

Right now, alternative strategies – as pension fund managers refer to anything that isn’t a stock or bond index – comprise no more than 15–20% of most funds. Changing academic data on investment options would put the other 80% up for grabs.

Imagine a future where a truly diversified portfolio isn’t limited by the confines of traditional equity and debt markets. With tokenization, investors from large institutional funds to individual savers could gain exposure to asset classes and geographic regions previously ignored due to data scarcity or illiquidity. The principles that underpin modern portfolio theory wouldn’t be discarded. Rather, they would be expanded upon to include a broader range of risk and return profiles.

As tokenized assets build track records, fiduciaries, who today favor the predictability of bonds and index funds, might find themselves compelled to recalibrate their strategies. It’s not that the pretty good market hypothesis will be rendered obsolete. Instead, the parameters of what constitutes “efficient” may widen considerably. A richer dataset could lead to better-informed risk assessments and, ultimately, to portfolios that capture a more accurate picture of global value.

A Measured but inevitable shift

This isn’t going to happen overnight. The fastest we’re likely to see changes emerge is about a decade, assuming time to build a wide portfolio of tokenized assets and 5-7 years to build a daily information track record. Once the data is present, however, change could come quickly, thanks to widespread use of artificial intelligence.

One thing that often slows the spread of change is a lack of intellectual bandwidth on the part of fund managers and consumers to adapt to new data. It took about 40 years to move pension fund investors from a 95%+ bonds model in the 1950s to a majority equity index fund model in the 1990s. It took about 30 years for index funds to become the dominant equity investment vehicle after the evidence showed they were the best option.

In a world of AI-driven automated investment tools, the transition might happen a whole lot faster. And with hundreds of trillions of dollars in assets under management, every percentage point change in allocation strategy is a little tsunami of change by itself. We’ll also be hosting a free session on the place digital assets will have in portfolios at the upcoming EY Global Blockchain Summit, 1 -3 April.

A group of big-name crypto and blockchain firms have joined forces to deliver open artificial intelligence (AI) services using combined infrastructure.

The Open Agents Alliance (OAA) consists of NEAR AI, the payments and AI arms of crypto exchange Coinbase and an array of other blockchain and AI projects.

The aim of the alliance is to “ensure secure, open source, economical, and fair AI access,” according to an emailed announcement on Thursday.

The participating organizations will offer combined infrastructure, such as AI agent frameworks, cloud hosting and on/off-ramps to fiat and crypto, to allow developers to build and deploy AI tools.

Crypto and blockchain projects have been attempting to capture the zeitgeist of the proliferation of AI in the last couple of years through initiatives that could introduce greater transparency and fairness through decentralization.

The Securities and Exchange Commission has confirmed memecoins don’t fall under securities laws and don’t have to be registered with the regulator.

In his latest video update, long-time market analyst and self-described “four-year cycle” trader Bob Loukas delivered a breakdown of Bitcoin’s current trajectory. Despite a roughly 22% pullback from its recent all-time high, Loukas asserts that the leading cryptocurrency’s price action remains “nothing we have not seen before.”

Loukas opened his video by acknowledging growing anxiety among traders following Bitcoin’s drop from around $110,000 to the mid-$80,000 range. However, he emphasized that such swings are a natural part of Bitcoin’s characteristic volatility. “As I record this video Bitcoin’s at $87,000, down from an all-time high of around $110,000… which historically, even for this four-year cycle, is basically right on the averages […] a 20% drawdown from a high,” he stated.

While Loukas emphasized that intracycle corrections of this magnitude “should not come necessarily as a major surprise,” he also acknowledged that deeper drops remain possible in the short term. In his assessment, a temporary cascade toward $80,000 or even the mid-$70,000s—which would reflect around a 30% drawdown—cannot be ruled out:

“There’s no reason why this current move couldn’t drop all the way down to the low $80,000s. There’s a more outside chance that it could also fall into the $70,000s—maybe $75,000 or $73,000. That’s still within Bitcoin’s historical volatility range.”

According to Loukas, these corrective moves represent a routine “fear reset.” He contends that late buyers in the previous upswing often capitulate during such pullbacks. However, in the context of Bitcoin’s broader uptrend, he argues these phases have historically paved the way for fresh rallies.

Loukas primarily frames his analysis around a four-year cycle, which he subdivides into shorter “weekly cycles” of roughly six months each. Each weekly cycle, he says, typically ascends for two-thirds of its duration and then declines for the remainder, resetting sentiment. Although the current pullback unsettles many traders, Loukas sees it as consistent with Bitcoin’s longstanding cyclical pattern:

“Unless you believe that the four-year cycle has peaked—which I do not—I see this as one of the normal, oscillating weekly cycle declines. It’s the same E and flow we’ve witnessed so many times.”

Loukas revealed that his first sale target for the model portfolio is around $153,000 per Bitcoin, contingent on where this current decline bottoms. From the mid-$80,000s, his baseline scenario projects a potential 80% upward move during the next multi-week upswing. He emphasized that this number may be revised depending on how low Bitcoin drops during the present correction.

Crucially, Loukas noted that he remains open to the possibility that the top could be in if the next rebound falters in a pattern known as a “failed weekly cycle.” He explained that once Bitcoin establishes a new short-term low—potentially near $80,000 or into the $70,000s—the market’s next test will be its recovery. If that bounce fails to surpass the prior high near $110,000 and subsequently undercuts the newly established low, it would signal deeper downside:

“If we see a sharp countertrend move that rolls over quickly, takes out the new weekly cycle low, that’s extremely concerning. It would indicate a change in trend and possibly that the four-year cycle has already peaked.”

Although Loukas briefly mentioned the altcoin market, he highlighted how this cycle appears to be diverging from past altcoin frenzies. Loukas described a “significant decoupling” of Bitcoin from other digital assets, noting the lack of sustained retail or institutional interest in most alternative tokens: “There isn’t a retail case, there isn’t a retail flow… so many (altcoin) narratives have come and gone… It looks as if the Trump coin was the top of that, which is probably not surprising in hindsight.”

He maintains that Bitcoin, meanwhile, is increasingly being viewed as a distinct, more mature asset class, capturing interest from pension funds, sovereign wealth managers, and institutions well outside the traditional “crypto” sphere.

According to Loukas, Bitcoin’s monthly chart shows no conclusive signs of a cycle top. He remains convinced the market has not fully played out the final leg of its historical four-year bull trend, which, in previous cycles, culminated roughly 35 months after the last bear market low.

For context, he pointed out that the current cycle’s low took shape in late 2022, placing the next potential peak around the fall or early winter of 2025, if it follows established precedent: “We’re in year three of the cycle. Time-wise, if this follows prior four-year structures, we have another leg higher, possibly an aggressive one, heading into late 2025. But no cycle is guaranteed to rhyme perfectly. We stay alert and look for the warning signals of a final top—until then, I see no reason to change the bullish view.”

Despite this bullish perspective, Loukas reiterated that no cycle framework is infallible. He outlined a scenario in which Bitcoin’s weekly cycle might fail—specifically if a new short-term upswing is quickly reversed, setting a lower low. Such a move, he said, could herald a cycle-wide trend change. Still, in his judgment, probabilities favor a continuation of the uptrend:

“Until we have a top in the four-year cycle, I think we have to just grin and bear [the drawdowns] and see it through […] the timing suggests to me that we are experiencing one of these periods where we are in a declining phase into a weekly cycle low before moving higher.”

At press time, BTC traded at $86,562.

The U.S. Securities and Exchange Commission (SEC) is officially washing its hands of memecoins.

The federal securities regulator said that memecoins — which it defined as a “type of crypto asset inspired by internet memes, characters, current events or trends for which the promoter seeks to attract an enthusiastic online community to purchase the memecoin and engage in its trading” — are more like collectibles than securities, according to a staff statement from the SEC’s corporate finance division published on Thursday. Because memecoins have “limited or no use or functionality,” they do not meet the definition of a security under the Howey Test and are therefore outside the SEC’s jurisdiction.

The statement is a formalization of comments made by Commissioner Hester Peirce — the leader of the SEC’s newly-created Crypto Task Force, which has been at the vanguard of the agency’s about-face on crypto regulation since it was formed in January — earlier this month during an interview with Bloomberg TV. In the interview, Peirce said that “many” of the memecoins on the market fall outside the SEC’s jurisdiction.

“If people want to buy a token or product that lacks a clear long-term value proposition, they should feel free but should not be surprised some day if the price drops,” Peirce wrote in her roadmap for crypto regulation published earlier this month. “In this country, people generally have a right to make decisions for themselves, but the counterpart to that wonderful American liberty is the equally wonderful American expectation that people must decide for themselves, not look to Mama Government to tell them what to do or not to do, nor to bail them out when they do something that turns out badly.”

Such legal interpretations from the securities regulator don’t have the weight of formal regulation, but industries overseen by the SEC and other federal regulators tend to follow these kinds of staff statements closely. The infamous Staff Accounting Bulletin No. 121 — guidance known as SAB 121 that was offered by agency accounting staffers — caused turmoil in the crypto sector and the bankers who felt constrained by it until the bulletin was erased by the SEC’s current leadership. In this case, a footnote in the staff memecoin statement points out that it’s “not a rule, regulation, guidance, or statement” approved by the commission.

Though Peirce has made it clear that American investors are responsible for doing their own due diligence on the tokens they buy, the SEC has not ruled out the possibility of stepping in and using its enforcement powers in the case where memecoins are used to evade securities laws.

“Notwithstanding the foregoing, this statement does not extend to the offer and sale of meme coins that are inconsistent with the descriptions set forth above, or products that are labeled “meme coins” in an effort to evade the application of the federal securities laws by disguising a product that otherwise would constitute a security,” the staff statement said. “As noted above, the Division will evaluate the economic realities of the particular transaction.”

Hyperliquid’s $9 billion in volume and profitable mechanisms will make vampire attacks on the network’s liquidity a challenge.

In a recent statement, the US Securities and Exchange Commission (SEC) provided insights into the classification of memecoins within the context of federal securities laws.

This move, a part of the SEC’s attempt to make clear how these regulations apply to different assets, could prove to be a significant victory for these altcoins and the exchange-traded funds (ETFs) that have been filed with the regulator.

According to the SEC’s criteria, a memecoin is generally characterized as a type of cryptocurrency that draws inspiration from internet memes, cultural phenomena, or current events, with promoters aiming to cultivate a vibrant online community that engages in buying and trading these assets.

The SEC’s Division of Corporation Finance delineated that while individual memecoins may exhibit distinct features, they typically share common traits. Their value largely hinges on market demand and speculative trading, akin to collectibles rather than traditional investments.

As such, the agency asserted that memecoins usually lack substantial functionality or practical use beyond entertainment, leading to significant price volatility driven by speculative behavior.

Importantly, the SEC concluded that transactions involving these types of memecoins do not constitute the offer and sale of securities as defined under the federal securities laws.

This means that individuals participating in the sale of meme coins are not required to register their transactions under the Securities Act of 1933, nor do they need to rely on any exemptions from registration.

The SEC’s analysis draws from the definitions of “security” enshrined in federal statutes, which include various financial instruments such as stocks and bonds. Since memecoins do not yield income or confer rights to profits or assets, they do not fit into these established categories.

The SEC evaluated whether memecoins could be classified as investment contracts under the “Howey test,” a legal precedent that determines if an arrangement qualifies as a security based on economic realities.

The key factors examined include whether there is an investment in an enterprise with the expectation of profits derived from the efforts of others.

The SEC found that purchasers of memecoins are not investing in an enterprise, as their funds are not pooled for development by promoters. Instead, the value of memecoins emerges from speculative trading and public sentiment, without any involvement of managerial efforts that could generate profits.

However, the statement made clear that this classification does not apply universally to all memecoins. The SEC will scrutinize any offerings that deviate from the outlined characteristics or that attempt to bypass securities laws under the guise of being meme coins.

Plus, the regulator clarified that while memecoins may not be subject to federal securities regulations, any fraudulent activities associated with their sale could still be pursued under other federal or state laws.

Featured image from DALL-E, chart from TradingView.com

Blockchain and Crypto have a complicated status in China: Beijing says no to crypto but yes to blockchain. It bans trading yet builds infrastructure.

Now, with Hong Kong offering regulated crypto markets, insiders say a loophole is emerging.

If China already allows investors to buy U.S. stocks through its Qualified Domestic Institutional Investor (QDII) program, why not bitcoin? The key, one expert argued on stage at Consensus Hong Kong, is control, and Beijing may have just found a way to keep it.

In China, there are two systems for mainland investors to buy and sell stock outside China. First, there’s QDII, which allows select investors to buy U.S. ETFs using RMB.

Then there’s also the Shanghai-Hong Kong Connect and Shenzhen-Hong Kong Connect, which let Chinese investors buy and sell Hong Kong stocks through mainland securities firms, with all trades settled in RMB.

“The key [with these systems] is that capital never flows freely out of China, and if you apply this same logic to crypto, there’s no reason it couldn’t work the same way,” Yifan He, CEO of Red Date technology, said on stage at Consensus Hong Kong.

He emphasized that the biggest regulatory hurdle isn’t crypto itself, but capital controls, ensuring that funds don’t move freely in and out of China.

These capital controls are in place as they prevent excessive currency fluctuations and capital flight, in order to maintain the stability and value of the RMB. They are also one of the reasons why Hong Kong’s crypto ETFs, with their in-kind redemptions, were not allowed on the mainland.

“What’s the difference between a Hong Kong-regulated stock and a Hong Kong-regulated crypto asset?” He continued. “If they have a system for you to buy and sell in RMB, but never move money outside China, then it’s just another regulated investment product.”

This system would not allow Chinese investors to self-custody their crypto. Instead, purchases would be held by an intermediary, such as a licensed securities firm.

“They buy crypto directly, but it’s not like they’re holding it themselves,” He said. “The security company in the middle actually holds it for you.”

This model aligns with China’s approach to stock and ETF investments.

Just as mainland investors can trade U.S. ETFs through QDII but never take direct custody, they could gain exposure to crypto without owning the underlying assets – no money moves across borders.

For a nation with 200 million retail investors and an economy in need of stimulus, regulated crypto access through Hong Kong’s sandbox might offer Beijing a calculated compromise

Blockchain vs. Crypto

China has long been a proponent of blockchain technology, while taking a cold approach to crypto.

“We don’t allow guns in China, but we can still make steel,” He explained as an analogy. “The technology is not regulated so that you can build all kinds of applications. But when some application triggers regulations, that’s different.”

But based on his conversations with financial regulators, this could be changing.

“I see some signal from financial regulators,” He said. “They’re beginning to talk about Bitcoin, saying we need to pay more attention and do more research on digital assets.”

Could this lead to broader adoption? Two years ago, He would have said ‘zero chance.’

“Now, I’d say there’s more than a 50% chance in three years,” He concluded.

And you can take those odds to Polymarket.

Every successful crypto conference needs a Hackathon to showcase the ideas and projects that will usher in the next wave of Web3 ideas. Consensus Hong Kong—organized by EasyA, the start-up for developers—did just that and brought in hundreds of competitors to highlight the projects that look to take the industry to the next level.

EasyA’s founders Dominic and Phil Kwok set out to create a competition that not only showcases bright ideas but also ensures that the winners actually stick around to build the future of Web3. The participants focus on one piece of tech where they plan to launch their technology, as opposed to different chains.

Read more: EasyA Wants to Attract More Than Just ‘Bounty Hunters’ to Its Hackathons

The two-day events saw some of the world’s best developers compete for a chance to win over $200,000 and showcase their projects to influential VCs and investors.

The participants built their projects within different tracks, including Aptos, Ripple, Polkadot and OriginTrail. Some of the winners included AI-powered portfolio managers on DeX, gaming on the blockchain, payments solutions, social media platforms and NFT platforms.

1st Place: Profitx – ProfitX is an intelligent, AI-powered portfolio manager and trading assistant integrated with Merkle Trade, a decentralized perpetual DEX built on the Aptos blockchain.

2nd Place: HealthDB – Offers a local-first, Aptos-based AI agent that helps users better manage and enrich their health data via a weighted Monte Carlo Tree Search.

3rd Place: Grand Theft Aptos – Grand Theft Aptos is an open-world game that combines AI-driven NPCs and blockchain technology to offer a dynamic, immersive gameplay experience.

4th Place (tie): Ai.apt – Ai.apt is a powerful quant trading Agent that monitors prices, sentiment/news, and on-chain data around the clock, executing and adjusting strategies in real-time to maximize profit.

4th Place (tie): Mixture of Multichain Experts(MoME) – MoME is an LLM and Retrieval-Augmented Generation (RAG)-based platform that automatically parses, verifies, and explains blockchain transactions across multiple networks—Aptos, Ripple, Polkadot, and OriginTrail.

1st Place (tie): Xeno – Offers a tap-to-pay RLUSD (Ripple USD) solution to support global consumers and businesses to eliminate 1-3% card fees with XRP Ledger’s low-cost transactions and NFC convenience.

1st Place (tie): FrameUS – FrameUs creates a solution that gives the fans a platform to donate to the charities of their idols.

2nd Place (tie): Modern Portfolio Theory (MPT) – Guides DeFi investors in balancing risk and reward by helping maximize returns for a specific risk level or minimize risk for a target return by diversifying investments. By combining assets with different risks and correlations, MPT aims to reduce overall portfolio risk and achieve optimal performance.

2nd Place (tie): Playcheck – Offers a secure in-person betting platform to help players make fair, real-time wagers with AI-driven verification and XRP Ledger for secure fund management.

3rd Place: QR RLUSD – Offers a QR code-based payment solution to help merchants and customers execute cross-border transactions instantly with RLUSD stablecoin and Pyth Oracle real-time FX rates.

1st Place: MozaicDot – The project interacts with Polkadot’s AssetHub to enable comprehensive NFT functionality. The platform facilitates the creation, deployment, viewing, buying, and selling of NFTs within the Polkadot ecosystem. By leveraging AssetHub’s infrastructure, users can seamlessly manage their digital assets while benefiting from Polkadot’s security and interoperability features.

2nd place (tie): Nemwork – Develops a blockchain-based AI Pet platform to help crypto enthusiasts manage assets and connect socially with unique NFT pets powered by Polkadot and Aptos.

2nd place (tie): FrameUS – The same project that was the winner in the Ripple track.

1st Place: Mixture of Multichain Experts (MoME) – The same project that was tied for the fourth place in the Aptos track.

1st Place: Pix x Origintrail Telegram Bot – Tech-Noir I-Ching divinations integrated with the Origin Trail KnowledgeGraph will allow users to find interesting patterns across different divinations. How/Why/Does the I-Ching really work? In the future, it will also enable incentivized user-generated content by tracking and tracing authors of highly engaging divination questions and interpretations.

2nd Place Mixture of Multichain Expert (MoME) – The same project that won the Crust network track and tied for fourth place in the Aptos track.

3rd Place Prophet.fun – A platform for users to make prophecies and stake their own money in Natural Language.

The crypto industry has cozied up to the Republican Party during the most recent election cycle but donated heavily to both parties.

The US SEC has filed a voluntary dismissal in its case against Coinbase. The agency has also dropped lawsuits against Consensys, Robinhood, and Gemini in recent days.

Dogecoin is trading at key demand levels after two weeks of massive selling pressure, with bears pushing DOGE down more than 30%. The meme coin sector has been hit the hardest during this market-wide correction, which began in mid-January, and as the market leader, Dogecoin has suffered the most.

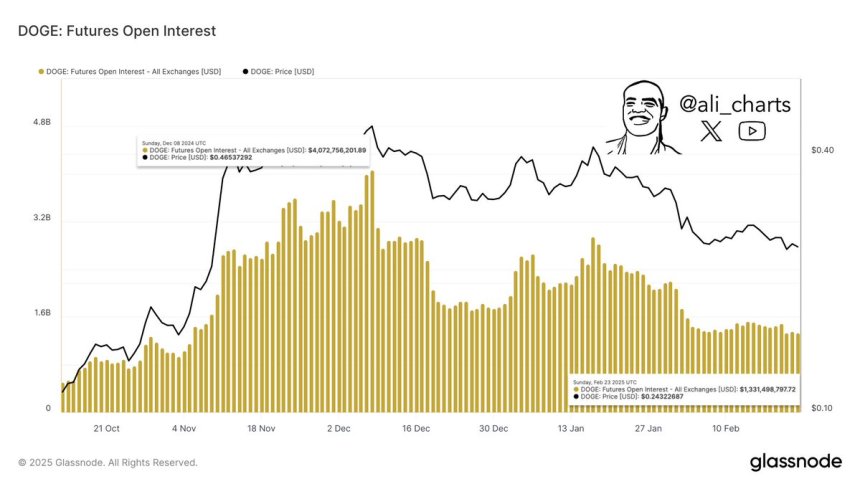

Investors have started to question the sustainability of the meme coin rally, especially as sentiment continues to weaken across the board. Glassnode metrics confirm this downward trend, revealing that Dogecoin’s open interest has dropped by 67% over the past three months.

With DOGE now at a critical level, traders are watching whether bulls can step in to hold support and push prices higher. If buying pressure returns, Dogecoin could start a strong recovery rally, but if the trend continues, further liquidations and losses could follow. The next few days will be crucial as investors assess whether DOGE can recover or extend its decline in this volatile market.

After this week’s market breakdown, Dogecoin has struggled to reclaim key price levels and still faces a serious risk of further declines. The meme coin sector has been one of the hardest-hit areas in the crypto space, with analysts blaming speculative meme coin trading as a key factor behind the broader crypto correction. As sentiment weakens, DOGE and other meme coins continue to lose ground, unable to recover from massive sell-offs.

Top analyst Ali Martinez shared Glassnode data on X revealing that Dogecoin’s open interest has declined by 67% over the past three months. Open interest fell from an all-time high of $4.07 billion to just $1.33 billion today, highlighting that traders have lost interest in DOGE and that speculation has dried up. This data confirms the negative environment surrounding meme coins, and as the market leader, Dogecoin is setting the tone for the entire meme sector, which continues to struggle.

For DOGE to regain momentum, bulls must step in and defend key demand levels. A break below current support could lead to even more selling pressure, while a reclaim of higher resistance levels could signal a potential recovery rally. With open interest and volume declining, Dogecoin remains in a critical position, and the next few weeks will determine whether bulls can take back control or if the downtrend will continue.

Dogecoin (DOGE) is currently trading at $0.21 after weeks of underwhelming price action. Bears remain in control, and momentum continues to push the price into lower levels, making it difficult for bulls to reclaim strength. DOGE has been in a steady downtrend, struggling to gain traction as meme coins face increasing selling pressure across the market.

If bulls want to regain control, DOGE must push above the $0.24 level and hold it as support. Reclaiming this level would signal short-term strength and could trigger a relief rally toward higher resistance zones. However, with market sentiment still bearish, a breakout seems unlikely unless overall conditions improve.

On the downside, if DOGE fails to hold current levels, a drop toward $0.15 could be expected. This level represents a significant psychological and technical support, but losing it would put DOGE in uncharted territory for this cycle. With open interest declining and liquidity drying up, bulls need to step in soon, or the downtrend could accelerate.

The next few days will be crucial as DOGE attempts to stabilize or continues to bleed out. If market conditions remain weak, further downside pressure could push DOGE into even lower demand zones.

Coinbase has been freed from its protracted legal battle with the U.S. Securities and Exchange Commission as the agency agreed to drop the case that’s been among the industry’s core fights in federal court.

Though the SEC’s intention to agree to shut down the legal dispute had already gone public when the U.S. crypto exchange announced the deal last week, the commissioners had to cast a formal vote to ask a federal judge to throw the switch. The dismissal was done in such a way that the regulator can’t change its mind later.

“It’s time for the commission to rectify its approach and develop crypto policy in a more transparent manner,” SEC Acting Chair Mark Uyeda said in a statement. SEC lawyers already filed a motion to dismiss the case

Dropping this main case doesn’t free the SEC from other Coinbase legal matters, including the company’s petition to force the agency to establish crypto rules and Coinbase’s pursuit of internal documents in the exchange’s ongoing work to reveal the regulator’s private deliberations on how to approach digital assets.

But this enforcement case was the top legal concern for the U.S. public company, and it sought to elevate the central legal questions of what makes a crypto security and when (and how) a digital assets exchange should register with the agency. Those fundamental questions still await answers that must now be provided by the U.S. Congress.

Once the SEC’s previous leadership departed — especially the crypto skeptic chair, Gary Gensler — the temporary chair elevated by President Donald Trump, Mark Uyeda, began overhauling the agency’s legal officials and its stance on digital assets. Uyeda named fellow Republican Commissioner Hester Peirce to run the agency’s crypto task force, and both of them were vocal critics of the way Gensler approached the industry.

The digital assets sector didn’t have to wait for the confirmation of Paul Atkins, Trump’s pick to permanently run the agency. Both Uyeda and Peirce served as his counsels when he was a commissioner at the SEC, so they’re widely expected to be on a course he’ll maintain. So far, that course has seen a wave of abandoned crypto investigations and dropped cases, including against Robinhood, Gemini and ConsenSys’s MetaMask, and pauses of matters involving Tron and Binance.

The regulator is no longer maintaining the interpretation of the U.S. Supreme Court’s so-called Howey test that it said had indicated many crypto projects qualified as securities.

The SEC’s changed view on Coinbase, which CoinDesk was first to report on last week, will cause the exchange to shift its Washington focus toward Congress and legislation, Chief Legal Officer Paul Grewal told CoinDesk in a previous interview. The company is among the digital assets businesses that led the creation and deployment of the Fairshake PAC in the 2004 elections, collectively devoting more than $160 million to an effort to elect crypto-friendly candidates to office. Now Coinbase is seeking to get a return on that investment with regulations that it considers favorable.

The Fairshake PAC, which shook up the campaign-finance world with its outsized corporate spending levels, is still at it, dabbling in special elections as it prepares for the 2026 cycle.

Read More: SEC Poised to Drop Coinbase Lawsuit, Marking Big Moment for U.S. Crypto