Rick Wurster, Charles Schwab Corp. CEO, is planning to introduce spot Bitcoin trading for Schwab clients by April 2026. Rick attributed a 400% traffic increase on Schwab’s crypto website to these plans.

A large part of this decision was dictated by the regulatory environment. As per Rick, Schwab was waiting for a more ‘positive regulatory catalyst’ to offer crypto trading directly to its clients.

Read on to know how this development speaks positively about the overall crypto market. We’ll also suggest some of the best cryptos to buy now to make the most of it.

The Right Regulatory Catalyst

The crypto industry has seen some positive regulatory developments ever since the appointment of Trump as the president.

Be it the formation of a US Bitcoin reserve or doing away with the draconian debanking policies, the changes are now starting to bear fruit.

In fact, the first Bitcoin ETF was approved in January 2025, right alongside Trump’s entry. And now, a bunch of crypto-pegged ETFs are pending approval with the SEC.

Schwab has also entered into a partnership with Trump Media and Technology Group (TMTG) to assist in offering customized ETF and cryptocurrency services for Truth.Fi.

In case you didn’t know, Truth.Fi is an upcoming project that will blend digital assets with traditional banking.

Bitcoin Can Reach $138K

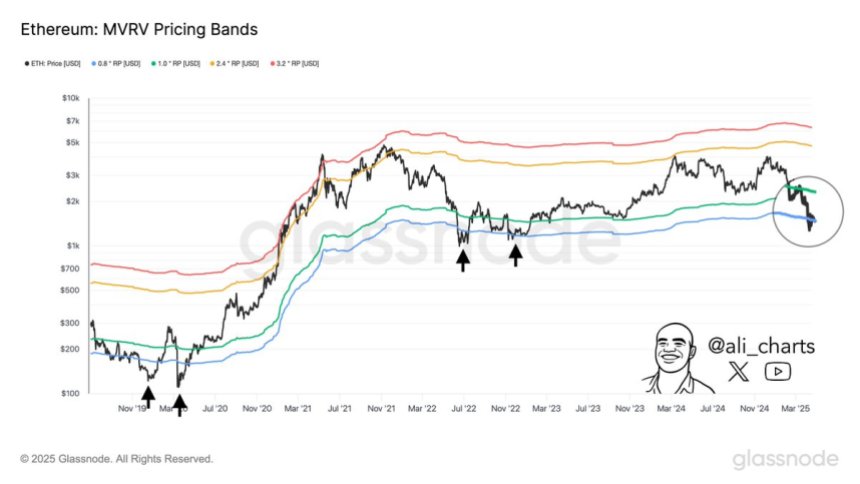

After a sluggish couple of months, Bitcoin looks well-positioned to be the dominating force everyone’s expecting it to be.

In an X post, Timothy Peterson, a network economist, predicted that $BTC may reach as high as $138K in the next three months.

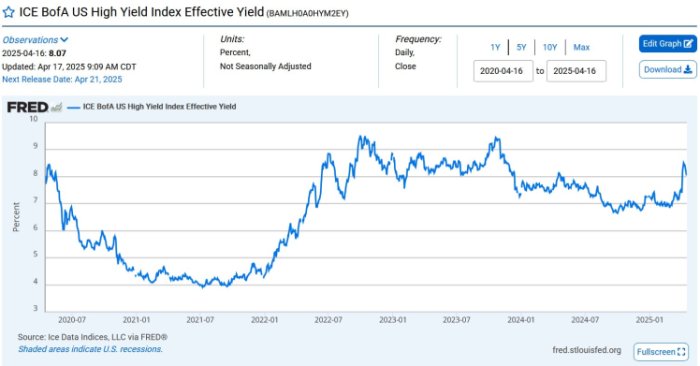

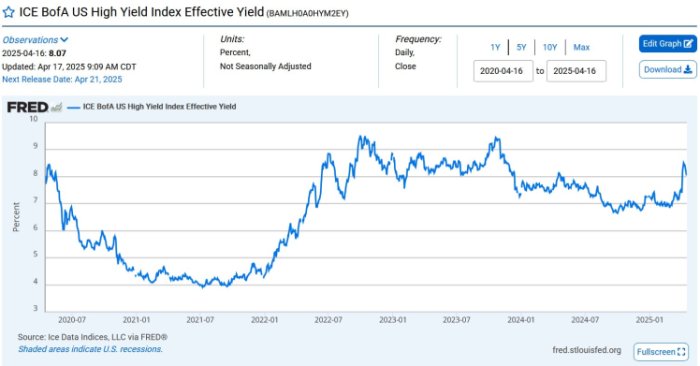

A very important determinant of the prediction is the US High Yield Index Effective Yield, which now sits at 8%. Since 2010, there have been 38 instances when the monthly rate has crossed 8%.

Whenever this has happened, $BTC went up 71% of the time with a median gain of 31%, with the worst-case loss of 16%.

This means that the floor price for $BTC should be around $75K, with $138K being the possible high.

However, this means that Bitcoin would need to deliver around 60% returns from current levels. This wouldn’t be an easy climb given the current choppy macroeconomic conditions and the ongoing trade tariff war.

Then again, with the probability on the bulls’ side, Peterson’s predictions may not be ridiculously wrong after all.

If you’re looking to make the most of the upcoming Bitcoin frenzy, this is probably the best time to accumulate some hot new cryptos, like the following.

1. BTC Bull Token ($BTCBULL) – Best Crypto to Buy If You’re Bullish on Bitcoin

The king cryptocurrency, Bitcoin itself, doesn’t come cheap and would require a huge upfront investment before it could make you any noteworthy profits. BTC Bull Token ($BTCBULL) solves that problem.

It’s the best crypto to invest in if you want to benefit from Bitcoin’s upcoming rally in a cost-effective manner.

As the first-ever and only crypto to offer free $BTC to token holders, BTC Bull Token has been built to follow Bitcoin’s coattails.

It’s worth noting, though, that $BTCBULL’s love for Bitcoin isn’t the reason it could rally alongside it. That will happen because its $BTC giveaways are scheduled to occur every time Bitcoin reaches a new milestone, such as $150K, $200K, and $250K.

Another reason we’ve predicted $BTCBULL to explode to $0.0096 by 2026 is its deflationary approach.

By burning a percentage of the total token supply every time $BTC rises by $25K, the BTC Bull Token developers have ensured the crypto’s demand stays intact and its price follows an upward trajectory.

Luckily for you, BTC Bull Token is currently in presale ($4.8M+ raised), which is why it’s one of the best cheap cryptos to buy now.

One token costs just $0.00247. For more info, here’s a detailed guide on how to buy $BTCBULL.

2. Solaxy ($SOLX) – Top Altcoin Creating the First-Ever Solana Layer-2

Solaxy ($SOLX) is one of the hottest crypto presales on the market right now, and for a very good reason. It’s a token with real utility – Solaxy’s goal is to revamp Solana and restore its past glory.

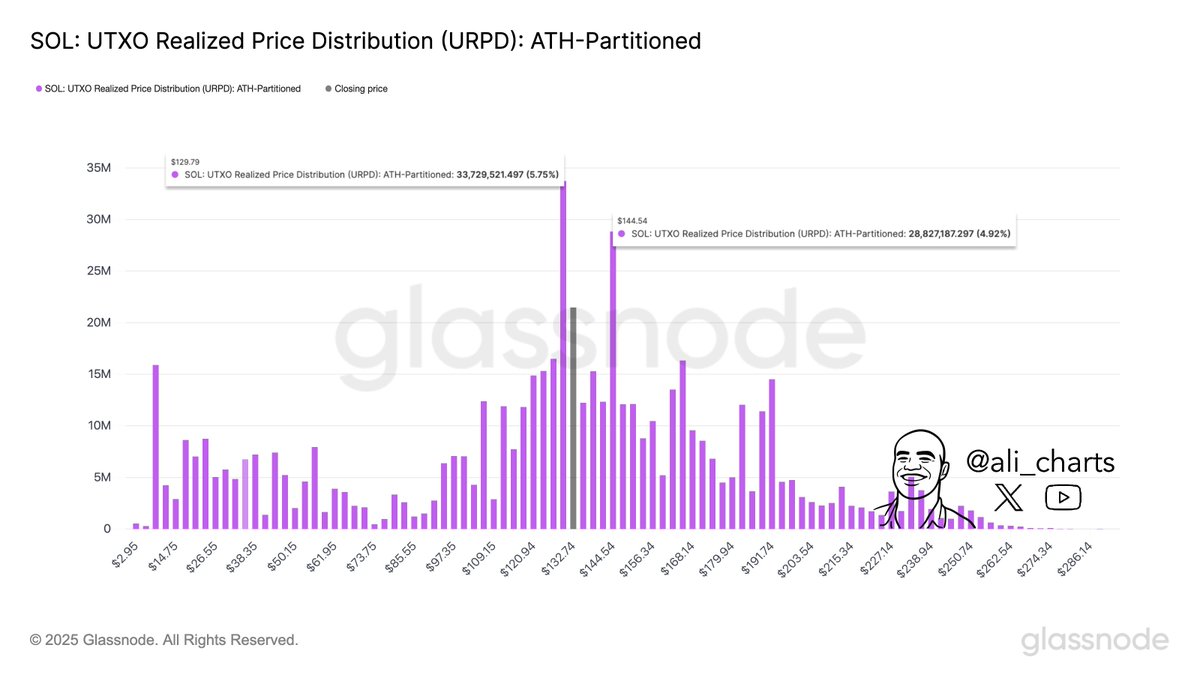

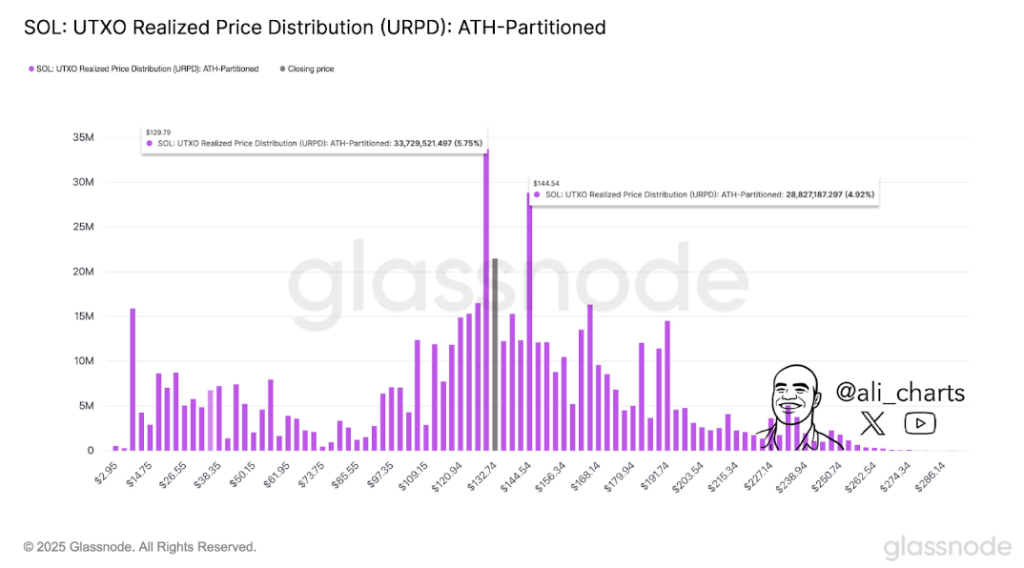

At the time of writing, Solana is struggling to accommodate the increased number of investors on its network, leading to network congestion, failed transactions, and limited scalability.

Solaxy will build the first-ever Layer 2 scaling protocol on Solana. It will reduce the burden on the network’s mainnet by offloading a significant number of its transactions onto a sidechain.

Solaxy plans to do so by utilizing two leading blockchains: Ethereum and Solana. As a multi-chain token, $SOLX will be able to blend Ethereum’s liquidity and Solana’s speed.

The best part? You can join Solaxy’s $30M+ presale by shelling out just $0.0017 per token. Check out our how to buy Solaxy guide for more information.

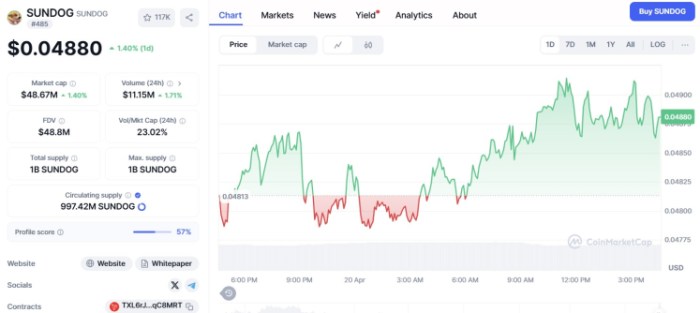

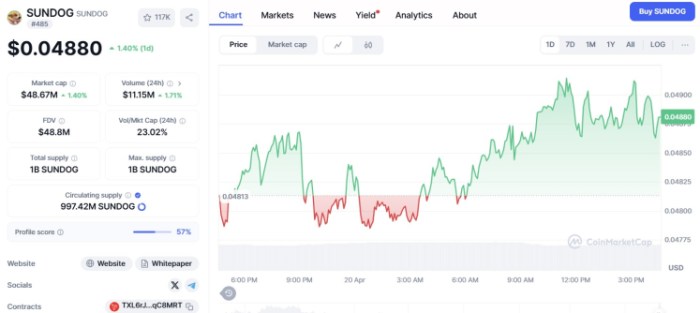

3. SUNDOG ($SUNDOG) – Best Dog Meme Coin on TRON

As the biggest dog-themed meme coin on the TRON network, SUNDOG, though a relatively low-cap coin, deserves to be in the same conversation as $DOGE and $SHIBA.

Built with the ‘serious’ goal of spreading good vibes and joy on the TRON blockchain, SUNDOG is currently one of the top trending cryptos.

It’s up over 15% in the last seven days, and a closer look at its price action suggests that if it continues to hold the break above $0.0490, it could surge past its recent high of $0.05187.

That would result in a gain of over 100%, making SUNDOG’s current price of $0.04863 an excellent entry point for both short- and long-term investors.

Final Thoughts on the Potential of the Best Cryptos

The potential of the best cryptos aside, let’s never forget that this market is subject to high volatility. That’s why you should tread cautiously, irrespective of your level of conviction.

In addition to only investing a small amount, ensure you do your own research before buying cryptos.

As for our articles, they’re solely educational and not financial advice.

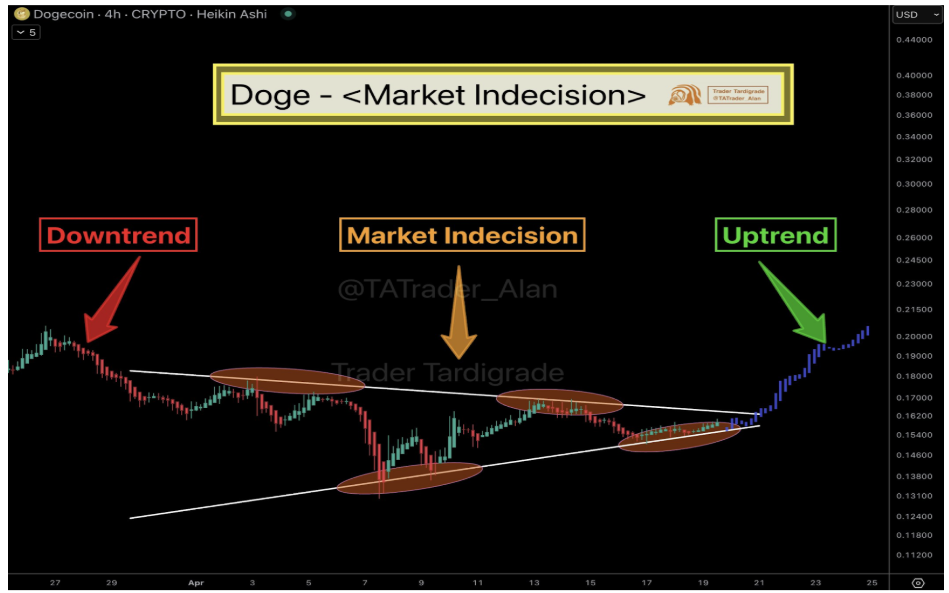

Image From X: Trader Tardigrade

Image From X: Trader Tardigrade